2026-01-16 Friday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

USD/CAD picks up from 1.3940 lows ahead of US and Canadian data

The post USD/CAD picks up from 1.3940 lows ahead of US and Canadian data appeared on BitcoinEthereumNews.com. The US Dollar is showing moderate gains against its Canadian counterpart on Thursday, trading at 1.3970 after bouncing from five-week lows near 1.3940. From a wider perspective, however, the immediate trend remains bearish, amid the BoC-Fed monetary policy divergence, after depreciating more than 1% in less than two weeks. The US labour market remains in focus on Thursday, following an unexpected 32K net loss of jobs in November, as reported by the ADP Employment Change. These figures contrast with the 5K increase anticipated by the market consensus and signal a significant deterioration, compared to October’s upwardly revised 47K increase. On Thursday, the US Challenger Job Cuts reported 71,321K layoffs in November, down from the 153,074K reported in September. The market is now focusing on the weekly Jobless claims, due at 13:30 GMT, which are expected to show that first-time applications for unemployment benefits increased to 220K in the last week of November from 216K in the previous one. In Canada, the IVEY Purchasing Managers’ Index is forecast to show an improvement to 53.6 in November’s business activity, from the 52.4 reading seen in October. These figures come after the strong Q3 Gross Domestic Product (GDP) data released last week, which, if confirmed, will support the view that the Bank of Canada (BoC) will keep interest rates on hold in December. The US Federal Reserve (Fed), on the contrary, is widely expected to cut rates after its December 10 meeting. The CME Group’s Fed Watch Tool shows an 89% chance of a 25 basis points rate cut next week and between two and three further cuts next year. This keeps the US Dollar on its back foot against most of its peers. Economic Indicator Initial Jobless Claims The Initial Jobless Claims released by the US Department of Labor is a measure…

Share

Author: BitcoinEthereumNews2025/12/04 21:39

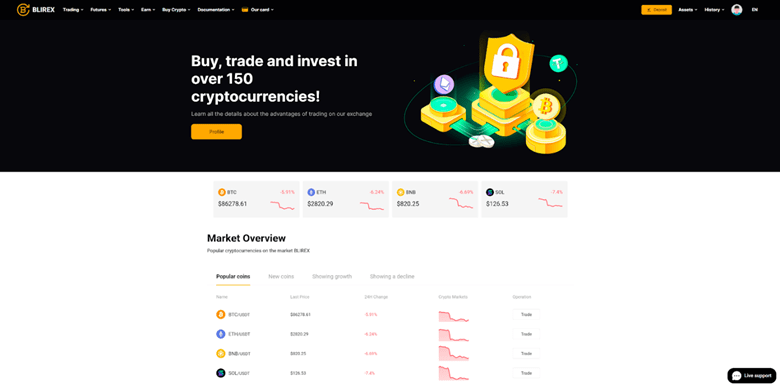

The Trusted Cryptocurrency Exchange of Successful Trading in 2025

The post The Trusted Cryptocurrency Exchange of Successful Trading in 2025 appeared on BitcoinEthereumNews.com. In the cryptocurrency market, where security, trust, and regulatory compliance are paramount, Blirex.com has established itself as a leading exchange with a strong global reputation. Having operated without interruptions for over 10 years, Blirex is recognized for its institutional-level security, regulatory transparency, and advanced trading technology. Millions of traders, from beginners to professional investors, trust Blirex for its seamless user experience, deep liquidity, and a high level of customer support. The platform has received thousands of positive reviews, reinforcing its position as one of the most reliable exchanges in the industry. Global Recognition and Regulatory Compliance Blirex.com holds multiple financial licenses, allowing it to operate legally across various jurisdictions. This ensures that all trading activities adhere to international KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, making it a preferred platform for both retail and institutional investors. The exchange has earned a top-tier ranking among cryptocurrency trading platforms, frequently being listed as one of the most trusted exchanges in industry reports. Unlike many unregulated or newly established exchanges, Blirex provides traders with the assurance of a legally compliant and well-managed platform. 10+ Years of Stability and Trust in the Market While many cryptocurrency exchanges face regulatory scrutiny, liquidity issues, or security breaches, Blirex has remained operational for over a decade, proving its long-term commitment to security, efficiency, and transparency. The exchange has consistently provided a seamless trading experience, never experiencing major operational downtime, hacks, or liquidity crises. This long-standing track record of reliability has made Blirex a go-to exchange for millions of users worldwide. Deep Liquidity and Fast Order Execution Blirex boasts one of the deepest liquidity pools in the industry, ensuring that traders can execute orders with minimal slippage and instant execution speeds. This is particularly beneficial for: High-frequency traders and scalpers, who rely on rapid trade execution.…

Share

Author: BitcoinEthereumNews2025/12/04 21:32

MicroStrategy News: 27% of Stategy’s BTC Now Off-Chain, Bullish Signal or Liquidity Risk?

The post MicroStrategy News: 27% of Stategy’s BTC Now Off-Chain, Bullish Signal or Liquidity Risk? appeared on BitcoinEthereumNews.com. Key Insights: According to latest MicroStrategy news, the firm transferred another 11,642 BTC worth $1 billion to Fidelity, bringing its total moved to 177,351 BTC. Around 27% of these holdings are now in Fidelity’s omnibus custody, making them no longer traceable on-chain. The shift raises questions about reduced visible supply, institutional consolidation, and potential impacts on Bitcoin’s price dynamics. The latest bitcoin custody reshuffle of MicroStrategy has alarmed investors: roughly a quarter of the company’s massive BTC holdings now sit in opaque, off-chain custody. Arkham Intelligence reported on Nov. 26, 2025 that MicroStrategy (Nasdaq: MSTR) moved nearly 60,000 coins from Coinbase into Fidelity’s omnibus vault. With some 427,000 BTC now tracked under a generic “Fidelity Custody” account, roughly 27% of MicroStrategy bitcoin holdings can no longer be directly seen on the blockchain.. The on-chain analytics firm Arkham notes that Fidelity’s omnibus system mixes many clients’ Bitcoin under a single address. In practical terms, any large sale out of Fidelity could be booked as an internal transfer – escaping the usual on-chain sale signals. In fact, crypto research outlet DropsTab recently highlighted that “Strategy moved 165,709 BTC into Fidelity’s omnibus pool — the perfect place to sell quietly.” By blending MicroStrategy’s coins with other holders’, Arkham warns that subsequent off-chain trades (for example via OTC desks inside Fidelity) would leave little on-chain footprint. In other words, about one-quarter of the $10–12 billion Bitcoin treasury could be unloaded stealthily if the company chose to do so. MicroStrategy (MSTR) Stock in Focus These developments come as MSTR stock trades near its lows of the year. After soaring in mid-2025 alongside bitcoin’s rally, MicroStrategy (MSTR) stock price has since collapsed. As of Dec. 4, 2025, the stock closed around $188.39, down roughly 60% from its September peak near $457. Bitcoin itself is near $92,000 (about…

Share

Author: BitcoinEthereumNews2025/12/04 21:30

iRobot Corporation (IRBT) Stock Soars 74% on White House Robotics Initiative

TLDR iRobot shares rocketed 74% Wednesday after reports emerged that the Trump administration will issue an executive order supporting U.S. robotics companies The potential government backing includes subsidies, tax breaks, and research funding to help American firms compete with Chinese robotics manufacturers Despite the rally, iRobot stock is still down 56% in 2024 and the [...] The post iRobot Corporation (IRBT) Stock Soars 74% on White House Robotics Initiative appeared first on Blockonomi.

Share

Author: Blockonomi2025/12/04 21:20

UiPath (PATH) Stock Rises 10% on Q3 Earnings Beat and Profitability

TLDR UiPath beat Q3 expectations with $0.16 EPS versus $0.15 estimated and revenue of $411.1 million versus $392 million expected. The automation company achieved its first GAAP profitable quarter with $13 million operating income and $1.52 billion in cash reserves. Annual recurring revenue reached $1.78 billion, up 11% year-over-year, with $59 million in net new [...] The post UiPath (PATH) Stock Rises 10% on Q3 Earnings Beat and Profitability appeared first on Blockonomi.

Share

Author: Blockonomi2025/12/04 21:16

Matrixport withdrew 1,000 BTC from Binance, worth $93.09 million.

PANews reported on December 4 that, according to Lookonchain, Matrixport has just withdrawn 1,000 BTC (worth $93.09 million) from Binance.

Share

Author: PANews2025/12/04 21:09

VeChain Bridge Allows ETH, USDT, USDC Transfers to Arbitrum

The post VeChain Bridge Allows ETH, USDT, USDC Transfers to Arbitrum appeared on BitcoinEthereumNews.com. Bhushan is a FinTech enthusiast and possesses a strong aptitude for understanding financial markets. His interest in economics and finance has drawn his attention to the emerging Blockchain Technology and Cryptocurrency markets. He holds a Bachelor of Technology in Electrical, Electronics, and Communications Engineering. He is continually engaged in a learning process, keeping himself motivated by sharing his acquired knowledge. In his free time, he enjoys reading thriller fiction novels and occasionally explores his culinary skills. Full Profile Source: https://www.crypto-news-flash.com/vechain-transfer-eth-usdt-to-arbitrum/?utm_source=rss&utm_medium=rss&utm_campaign=vechain-transfer-eth-usdt-to-arbitrum

Share

Author: BitcoinEthereumNews2025/12/04 21:04

PIF owns minority stake in Aston Martin F1 team

Saudi Arabia’s Public Investment Fund (PIF) reportedly owns a minority stake in the Aston Martin Formula 1 team. The fund’s holding totals almost 8 percent, Bloomberg reported, citing data from the UK’s Companies House registry. Although Aston Martin announced Canadian billionaire Lawrence Stroll’s stake divestment, PIF’s investment was not previously disclosed, the report said. PIF also owns a […]

Share

Author: Agbi2025/12/04 21:03

Snowflake (SNOW) Stock: Strong Quarter Can’t Save Shares From 8% Plunge

TLDR Snowflake beat Q3 expectations with 35 cents EPS and $1.21 billion revenue but shares tumbled 8-9% after hours. Fourth-quarter product revenue forecast of $1.195-$1.2 billion exceeded estimates but disappointed investors seeking 30%+ growth. The company signed a $200 million deal with Anthropic to bring Claude AI models to 12,600+ customers. Remaining performance obligations surged [...] The post Snowflake (SNOW) Stock: Strong Quarter Can’t Save Shares From 8% Plunge appeared first on Blockonomi.

Share

Author: Blockonomi2025/12/04 20:53

Why Strategy’s Massive Bitcoin Holdings Remain Secure Despite MSCI Delisting Fears

The post Why Strategy’s Massive Bitcoin Holdings Remain Secure Despite MSCI Delisting Fears appeared on BitcoinEthereumNews.com. Revealed: Why Strategy’s Massive Bitcoin Holdings Remain Secure Despite MSCI Delisting Fears Skip to content Home Crypto News Revealed: Why Strategy’s Massive Bitcoin Holdings Remain Secure Despite MSCI Delisting Fears Source: https://bitcoinworld.co.in/strategy-bitcoin-holdings-msci-index/

Share

Author: BitcoinEthereumNews2025/12/04 20:47