2026-02-11 Wednesday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

Cardano Founder Hoskinson Defends Crypto Vision as ADA Crashes 92% ⋆ ZyCrypto

The post Cardano Founder Hoskinson Defends Crypto Vision as ADA Crashes 92% ⋆ ZyCrypto appeared on BitcoinEthereumNews.com. Advertisement     Cardano founder

Share

Author: BitcoinEthereumNews2026/02/06 23:30

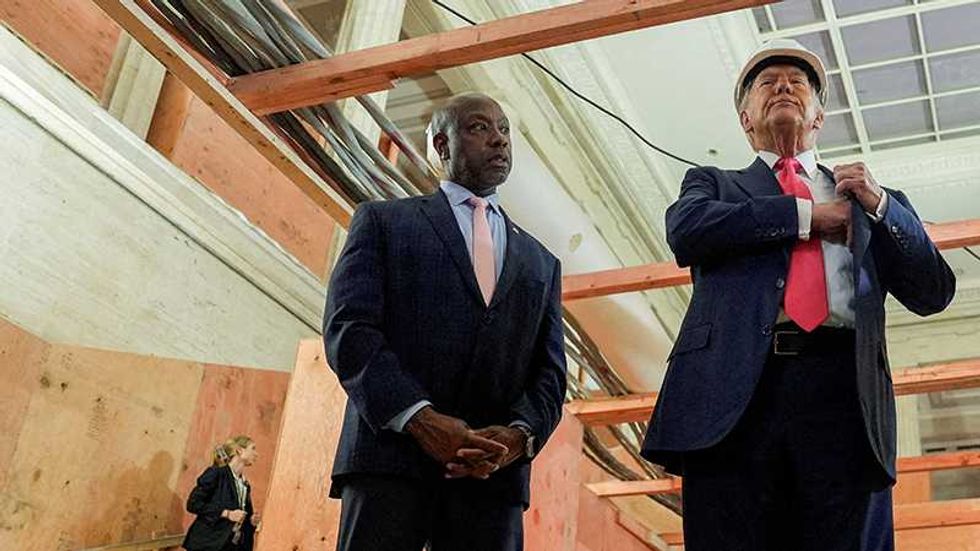

'Most racist thing I’ve seen': Even GOP’s Tim Scott is calling out Trump’s AI Obama post

Long-time Donald Trump loyalist, Sen. Tim Scott (R-S.C.), is questioning the president after he posted a racist meme online about former President Barack Obama

Share

Author: Alternet2026/02/06 23:25

Bithumb Error Sends Bitcoin Crashing 10% After 2,000 BTC Airdrop

The post Bithumb Error Sends Bitcoin Crashing 10% After 2,000 BTC Airdrop appeared on BitcoinEthereumNews.com. South Korea’s cryptocurrency exchange Bithumb faced

Share

Author: BitcoinEthereumNews2026/02/06 23:25

Best Crypto Presales 2026: Analysts Flag Early Projects Worth Tracking

Crypto is kicking off February 2026 with a distinct chill in the air. The tape is doing exactly what it always does during drawdowns: punishing leverage first,

Share

Author: Bitcoinist2026/02/06 23:24

Bitcoin rises past $68,000, extending bounce from Thursday's crash

Markets

Share

Share this article

Copy linkX (Twitter)LinkedInFacebookEmail

Share

Author: Coindesk2026/02/06 23:18

Crypto Market News Today: South Korea Arms Regulators With AI, LINK and SUI Slide, as DeepSnitch AI Gears for Utility-Fueled 1000x in February

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Share

Author: Blockchainreporter2026/02/06 23:15

DeFi protocols avoid shut downs despite near-record activity in latest market capitulation

DeFi activity moved to the highest levels since the October 10-11 crash. The recent market capitulation turned into a DeFi stress test, with most protocols surviving

Share

Author: Coinstats2026/02/06 23:00

Bitcoin Soars: BTC Price Surges Above $68,000, Fueling Bullish Market Sentiment

BitcoinWorld Bitcoin Soars: BTC Price Surges Above $68,000, Fueling Bullish Market Sentiment In a significant move for digital asset markets, Bitcoin (BTC) has

Share

Author: bitcoinworld2026/02/06 23:00

Bernstein: The IREN crash reflects market disappointment over the failure to reach an AI agreement; Bitcoin is no longer a core part of his investment portfolio.

PANews reported on February 6th that, according to The Block, research firm Bernstein analysis indicates that IREN, a Bitcoin mining company transitioning to AI

Share

Author: PANews2026/02/06 22:58