Bitcoin Price Tops $87k On Softer US CPI As BoJ Hikes Rates To 30-Year High, Yen Slides

The Bitcoin price rose more than 1% in the past 24 hours to trade at $87,803 as of 2:45 a.m. EST on trading volume that rose 24% to $61.9 billion.

BTC topped the $87k level after the Bureau of Labor Statistics reported that the US Consumer Price Index (CPI) for November rose 2.7% from a year earlier, below consensus expectations of 3.1%

That bolstered hopes that the Federal Reserve will have more scope to deliver additional interest rate cuts in 2026.

Core CPI also undershot forecasts, increasing 2.6% versus estimates of 3%.

Bank Of Japan Hikes Rates To 30-Year High, Yen Slides

But there was negative news from Asia, where the Bank of Japan (BOJ) announced a 25-basis-point interest rate hike to 0.75%, its highest since 1995.

The decision passed unanimously in a 9-0 vote, made after a two-day policy meeting. The hike aligned with market expectations.

BOJ Governor Kazuo Ueda cited growing confidence in the economic outlook as a key reason behind the hike.

It was Japan’s second rate hike this year, following a 25-bps hike in January, with policymakers signaling further increases to come.

Despite the hike, the yen slid to around 156 against the dollar, with markets have already fully factored in the rate hike.

Bitcoin Price Shows Signs Of Bullish Reversal

The BTC price traded above the $108,000 support level from July to October, a move that allowed the asset to touch its all-time high (ATH) around $126,230.

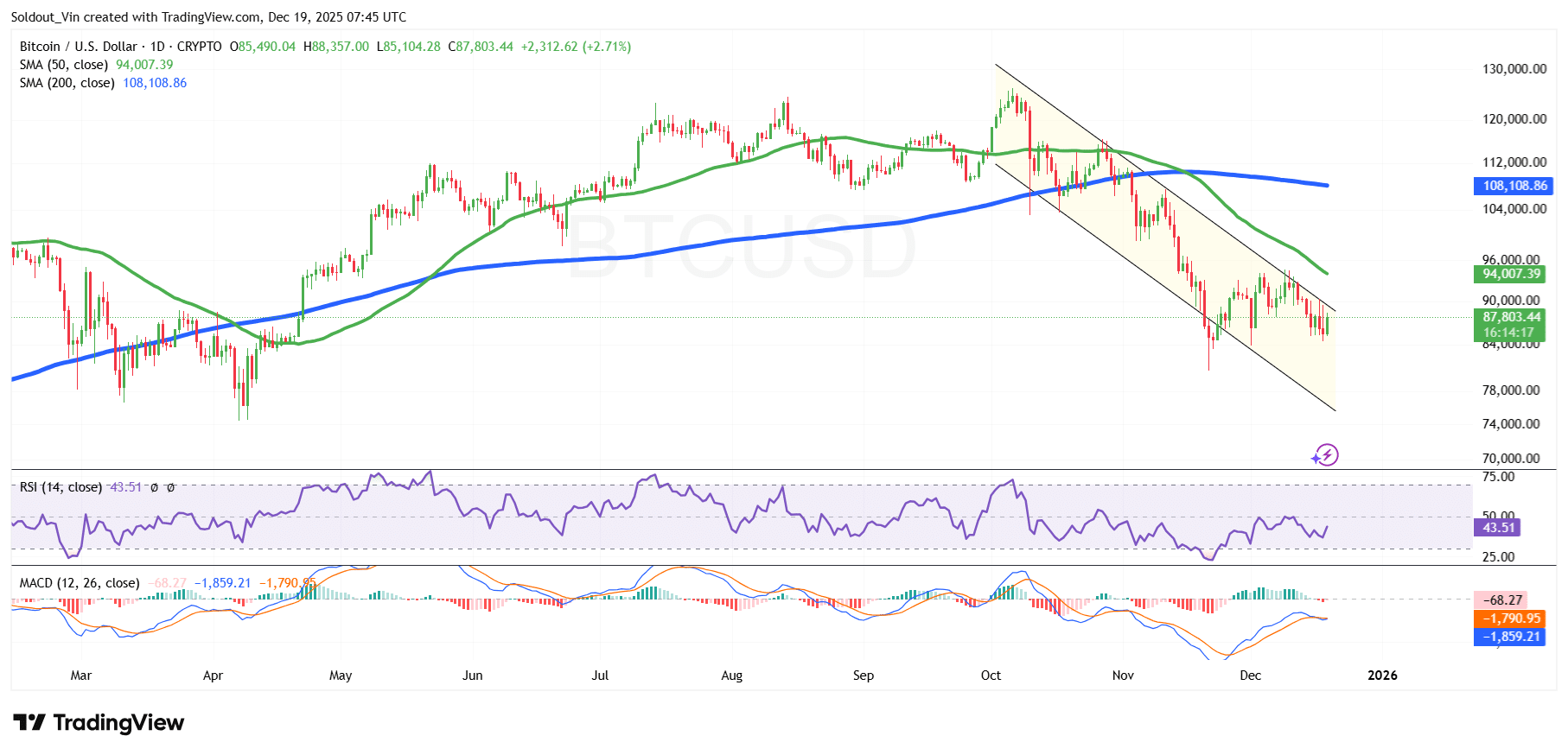

However, the Bitcoin price then went through a correction within a falling channel pattern to the lower boundary around the $84,000 support area. This area has allowed the price of BTC to consolidate within the upper boundary, with $94,000 acting as a barrier on the upside.

The bearish stance has pushed BTC to trade below both the 50-day and 200-day Simple Moving Averages (SMAs). This trend has been fueled by the SMAs forming a death cross around $111,035.

Meanwhile, the Relative Strength Index (RSI) is showing signs of a rebound, currently at 43 and climbing, an indication that buyers are regaining some control.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Price Prediction

According to the BTC/USD chart analysis on the daily timeframe, the BTC price is nearing a breakout above the falling channel pattern as it aims for a bullish trend reversal in the long term.

If the price of BTC climbs above the channel, the next target could be around the SMAs, first at $94,007 (50-day SMA) and $108,108 (200-day SMA).

However, the Moving Average Convergence Divergence (MACD) has turned negative, with the orange signal line crossing above the blue MACD line. The red bars on the histogram are also starting to form below the zero line, a signal of negative momentum.

If the BTC price bears act on the negative momentum, the price could drop back to the lower boundary of the channel and form support around $78,000.

Related News:

추천 콘텐츠

Fed Decides On Interest Rates Today—Here’s What To Watch For

Kalshi BNB Deposits: A Game-Changer for Crypto Prediction Markets