Bitcoin Plummets from $90K as Fed Rate Cut Odds Drop

Market Dynamics and the Impact on Bitcoin

Recent market developments indicate a shift in investor sentiment toward safer assets amid rising demand for US Treasurys and signs of economic slowdown. Bitcoin has struggled to sustain its price above $92,000, reflecting broader risk aversion and shifting investment patterns. While some commentators blame market manipulation or concerns over the artificial intelligence sector, the overarching trend suggests a cautious stance among investors fueled by macroeconomic factors.

The broader equity markets, exemplified by the S&P 500, remain close to their all-time highs, yet Bitcoin’s price remains approximately 30% below its October peak of $126,200. This disparity underscores a growing preference for traditional safe havens, with gold reasserting itself as the preferred hedge during economic uncertainty.

Despite Bitcoin’s decentralized appeal and long-term prospects, macroeconomic factors continue to exert downward pressure. A key factor has been the Federal Reserve’s reduction of its balance sheet throughout 2025, aimed at draining liquidity from financial markets. However, this trend has reversed in December amid signs of a deteriorating labor market and weakening consumer confidence, thereby restraining risk assets like Bitcoin.

Recent indicators have highlighted a slowdown, with major retailers such as Target, Macy’s, and Nike reducing earnings forecasts or sales projections, raising concerns over consumer spending and economic growth. The uncertainty has led to increased demand for US Treasurys, with the 10-year yield stabilizing at 4.15%, signaling heightened risk aversion among traders.

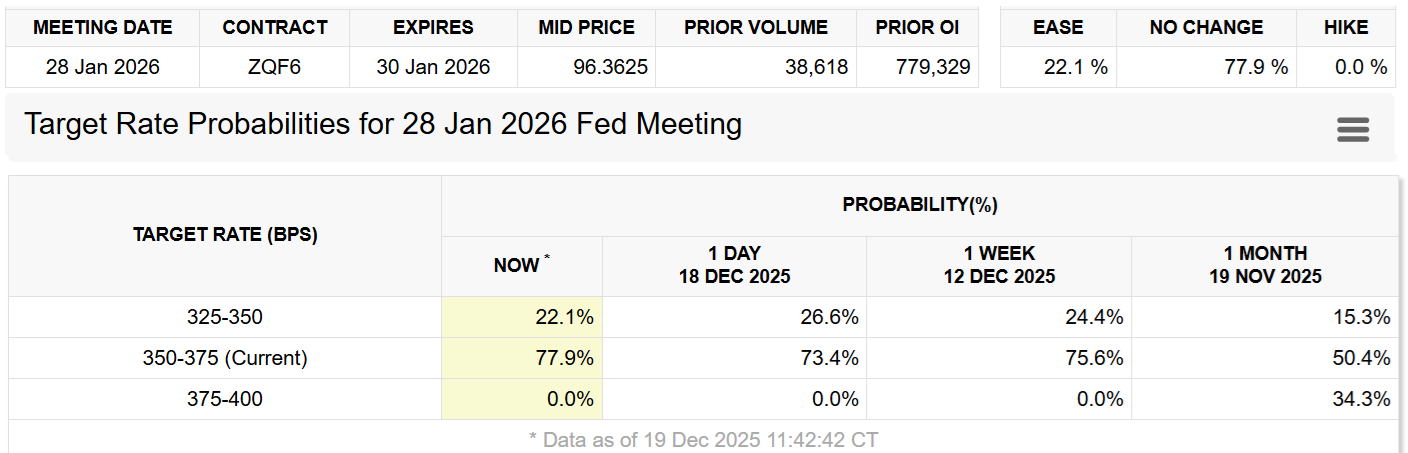

The CME FedWatch Tool reflects this cautious outlook, with the likelihood of a rate cut at the upcoming Federal Open Market Committee meeting on January 28 dropping slightly to 22%. Meanwhile, Bitcoin’s correlation with traditional markets has diminished, yet risks remain, particularly from systemic issues such as Japan’s rising bond yields, which have touched levels not seen since 1999, amid its decade-long negative interest rate policy and currency depreciation efforts.

Fed target rate probabilities for Jan. 2026 FOMC

Fed target rate probabilities for Jan. 2026 FOMC

Overall, Bitcoin’s inability to break through the $90,000 barrier in the current environment highlights ongoing macroeconomic headwinds. As global growth concerns persist and the US labor market remains subdued, Bitcoin’s role as a hedge appears diminished in the near term, reflecting broader investor risk sentiment and monetary policy uncertainties.

This article was originally published as Bitcoin Plummets from $90K as Fed Rate Cut Odds Drop on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

추천 콘텐츠

NY Fed President Highlights CPI Distortion After Shutdown

CME Group to launch options on XRP and SOL futures