Bitcoin Or Ethereum To $62,000? Fundstrat Releases Contrasting 2026 Predictions

Tom Lee, chairman of BitMine and managing partner at Fundstrat, has been a vocal optimist when it comes to the cryptocurrency market, especially for Bitcoin and Ethereum. Most recently, Fundstrat’s managing partner revived his $62,000 target call for the Ethereum price in 2026.

However, it appears that Lee and his investment firm do not align in terms of their market expectations for the coming year. Fundstrat seems to be looking at a more bearish setup for most of the large-cap digital assets, including Bitcoin, Ethereum, and Solana, in 2026.

$60,000 Is The Target, But Not For Ethereum

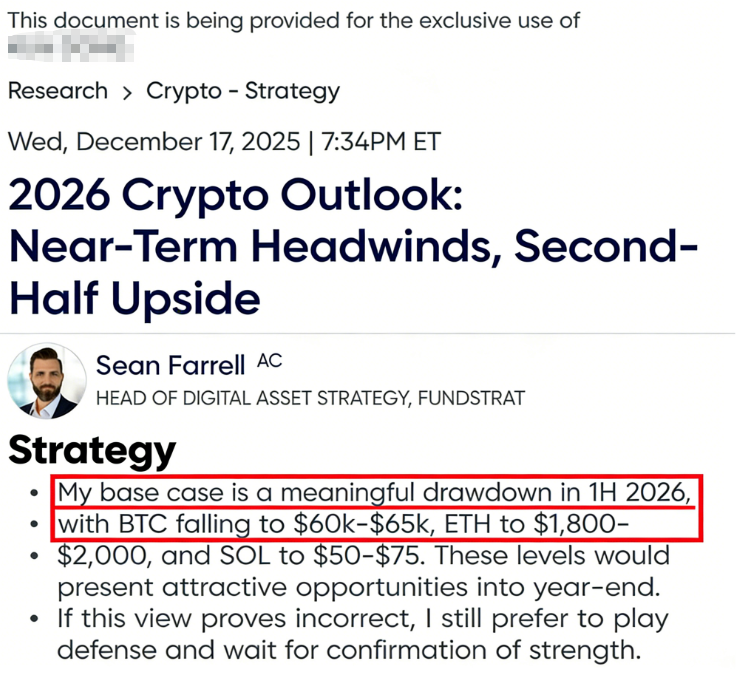

According to screenshots posted on social media platform X, Fundstrat released a 2026 crypto strategy report, warning internal clients of potential market headwinds in early 2026. The report’s title, however, also suggested that Bitcoin, Ethereum, and Solana could enjoy significant growth in the second half of next year.

Sean Farrell, Fundstrat’s head of digital asset strategy, projected significant drawdowns for the crypto market in the first half of 2026. The research set the target for the Bitcoin price between $60,000 to $65,000, the Ethereum price within $1,800 – $2,000, and the Solana price around $50 – $75.

Farrell wrote in the report:

This circulating report stands in contrast to the predictions of Tom Lee, who is the chief investment officer (CIO) at Fundstrat. Speaking to attendees at the Binance Blockchain Week earlier this month, Lee stated that the price could run up to as much as $62,000 as Ethereum becomes the core infrastructure for tokenized finance.

In September, at the Korea Blockchain Week, Lee said that the price of Bitcoin could reach as high as $250,000 by year-end, while Ethereum’s value could climb toward $12,000. The rationale for this projection revolved around macro tailwinds and growing institutional interest in crypto assets.

Now, while the Fundstrat internal document has yet to be authenticated by Bitcoinist as of press time, Colin Wu-led outlet Wu Blockchain verified that this document was indeed distributed to internal clients.

Bitcoin And Ethereum Price At A Glance

As of this writing, Bitcoin, the world’s largest cryptocurrency by market cap, is valued at around $88,180, reflecting no significant movement in the past 24 hours. Meanwhile, the price of ETH stands at around $2,980.

추천 콘텐츠

Will the Fed’s Big Rate Decision Ignite the Next Leg of the Crypto Rally?

XRP Healthcare® Secures Global Trademark Protection at the Intersection of Healthcare Services and XRP-Powered Payments