Dow Jones Index gains steam ahead of key earnings, US inflation, and NFP data

The Dow Jones Index continued its strong bull run, reaching a new all-time high on Tuesday, as investors waited for the upcoming corporate earnings and key macro data.

- The Dow Jones Index continued its strong bull run ahead of the upcoming earnings.

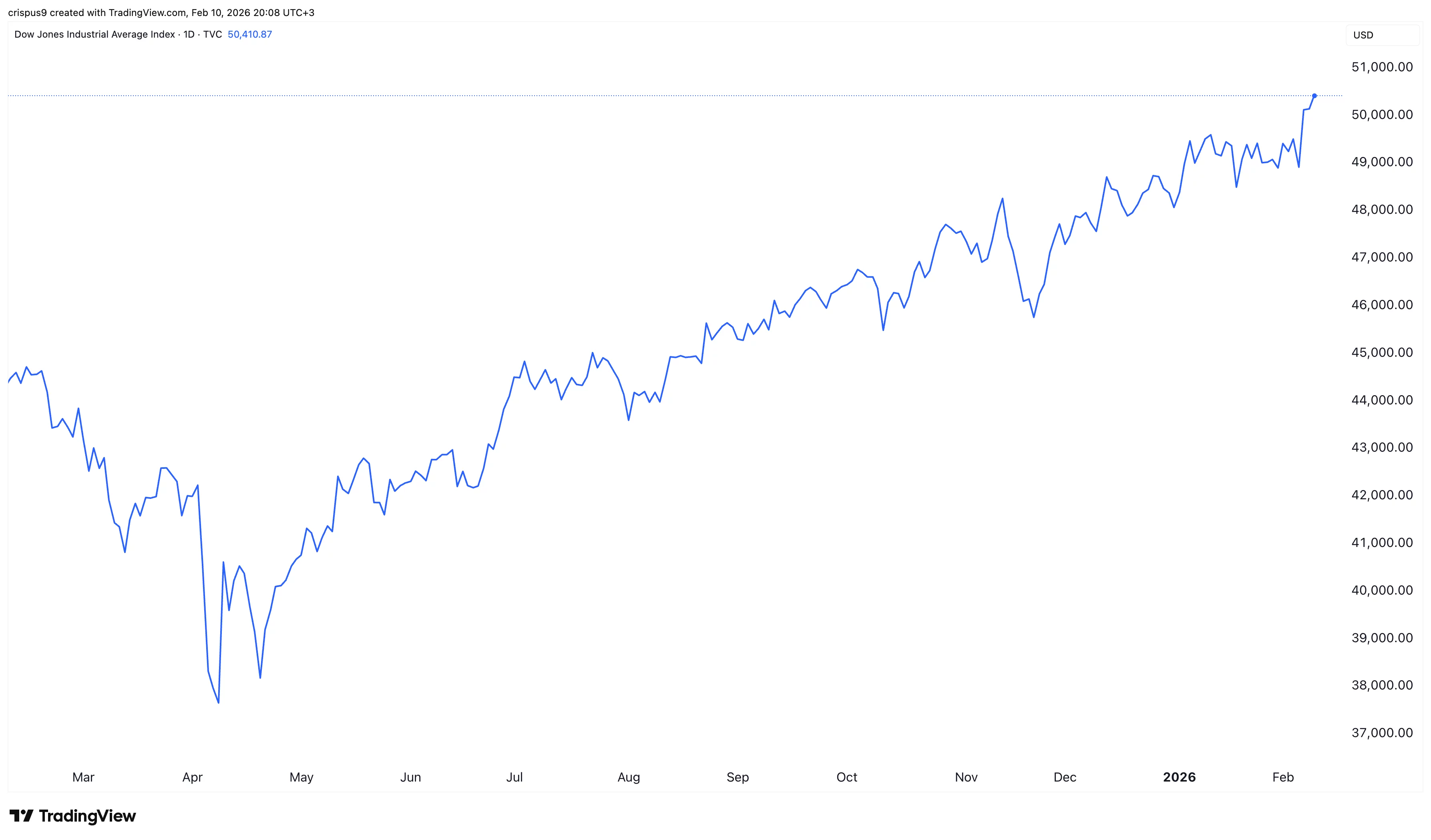

- It has jumped by 37% from its lowest level in April last year.

- The US will publish key macro data on Wednesday and Friday.

Dow Jones, which tracks 30 diverse companies, reached a record high of $50,520, three days after it crossed the important $50,000 milestone. Other blue-chip indices like the S&P 500 and the Nasdaq 100 continued their uptrend.

Dow Jones Index rallies

The Dow Jones has done well in the ongoing earnings season. Data compiled by FactSet show that most American companies have reported strong financial results, with 76% of S&P 500 companies reporting a positive surprise.

The blended earnings growth of all S&P 500 Index companies that have reported is 13%. If this is the final number, it will be the fifth consecutive quarter of double-digit growth.

Dom key companies in the Dow Jones will publish their numbers this week. The most notable ones will be Cisco and McDonald’s. Other notable companies to watch this week will be Applied Materials, Arista Networks, T-Mobile, Shopify, and Ford.

Dow Jones Index chart | Source: TradingView

Dow Jones Index chart | Source: TradingView

US stocks to react to key macro data

The Dow Jones Index will also react to upcoming U.S. macroeconomic data.

The first will be the delayed U.S. non-farm payrolls report, which comes out on Wednesday. Economists polled by Reuters expect the upcoming report to show that the economy created 70,000 jobs in January, higher than the 50k it created in December. The unemployment rate is expected to remain at 4.4%.

These numbers come as some major American companies have recently announced layoffs. Amazon is shedding over 16,000 layoffs on top of the 15,000 it announced last year.

Other top companies, including UPS, Dow Inc., Verizon, Citigroup, and Salesforce, have announced large layoffs. According to Challenger & Gray, companies announced over 108k layoffs.

The most important data will come out on Friday when the United States will publish the latest consumer inflation report. Economists expect the data to show that inflation softened a bit in January, with the headline CPI falling to 2.5%.

A lower inflation figure than expected will be highly bullish for the Dow Jones as it will lead to higher odds of Federal Reserve interest rate cuts this year.

추천 콘텐츠

RWAs Are Defining the Next Phase of Crypto Adoption—Chainlink Co-founder

Silver Price Forecast: XAG/USD Dips to $82.50 Amid Critical Profit-Taking, US Retail Sales Data Looms Large