Bitcoin Super Cycle: Why 2026 Could Redefine Bitcoin’s Market Mechanics

Binance co-founder Changpeng Zhao (CZ) and prominent market analysts are confident: the coming years could validate the “Bitcoin Super Cycle,” fundamentally decoupling the asset from its traditional four-year patterns. This potential structural shift suggests that institutional liquidity and regulatory clarity may finally supersede the programmatic impact of supply issuance.

Historically, Bitcoin’s price discovery has been tethered to the Halving Cycle, a recurring event that slashes miner rewards in half every four years. However, the market landscape has evolved significantly following the approval of US spot ETFs and the unprecedented influx of corporate capital. Industry observers argue that rising global liquidity and impending legislative frameworks like the CLARITY Act are now overpowering the supply shock mechanics, setting the stage for a sustained uptrend driven by demand rather than scarcity alone.

DISCOVER: Best Solana Meme Coins in 2026

Is the Halving Cycle Beating a Retreat? A New Idea Of The Bitcoin Super Cycle

This is the current idea: For CZ, the entry of institutional capital at scale signals a departure from retail-driven boom-bust volatility. He suggests the market is maturing and adoption curves are becoming more important than simply reducing new coin issuance.

This view challenges the rigid expectation of a bear market merely because a specific time has passed since the last halving.

Supporting this thesis, macroeconomic data indicate that Bitcoin’s correlation with the global M2 money supply is strong, suggesting that central bank policies are a more potent price driver than internal protocol mechanics.

Analysts like Ali Martinez have pointed to historical patterns suggesting that without a massive catalyst, Bitcoin could still face deep cyclical corrections, potentially retesting lower support levels before any renewed parabolic run.

EXPLORE: Next Crypto to Explode

A New 2026 Crypto Outlook

The potential shift toward a Super Cycle places significant weight on the regulatory and macroeconomic environment expected in the near future. The advancement of the Digital Asset Market Clarity Act, or CLARITY Act, represents a crucial piece of this puzzle. By potentially establishing a clear division of power between the SEC and CFTC, the legislation could offer the jurisdictional certainty needed to unlock trillions in sideline institutional capital, reinforcing the asset class against traditional volatility.

Furthermore, the 2026 Crypto Outlook is complicated by broader monetary factors. With the term of Federal Reserve Chair Jerome Powell expiring in May 2026, uncertainty regarding future interest rate policies could drive investors toward Bitcoin as a hedge against central bank unpredictability. If these regulatory and monetary catalysts align, the market may finally break free from the four-year cycle, entering a period of sustained appreciation characteristic of a mature global reserve asset.

EXPLORE: Upcoming Binance Listing To Watch in 2026

Bitcoin Price Analysis: Super Cycle Loading… Or Just Another Dip?

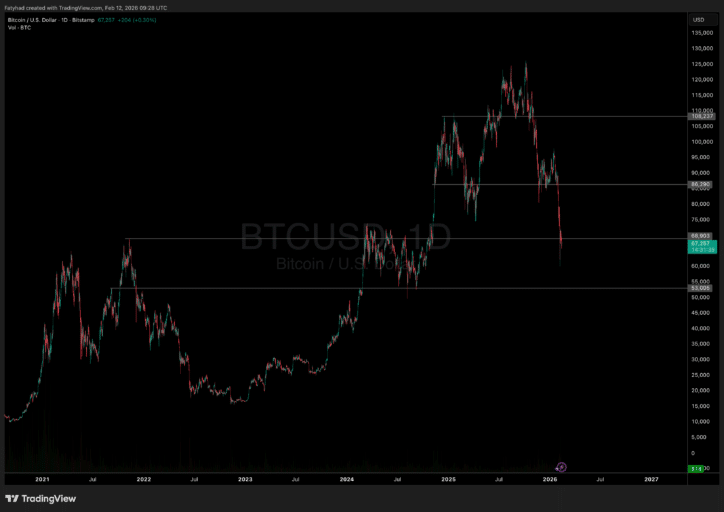

Bitcoin Price Analysis Source: TradingView

Bitcoin hovers around $67,000–$67,500, nursing a brutal 45–50% drawdown from the October 2025 ATH above $126K. Whale dumps (including a fresh $172M stack) and thinning futures OI have fueled the bleed, with price coiling between $60K support and $69K resistance.

On-chain signals scream accumulation, yet ETF outflows and macro caution keep the vibe bearish short-term with potential flush to $60K or lower before any real squeeze.

The market’s failure to surge past $69K so far is proving a harsh counterpunch to CZ’s bold Super Cycle thesis: instead of decoupling into endless upside, BTC remains chained to classic post-peak correction dynamics, with bulls lacking the firepower for a breakout.

For now, it’s sideways.

nextThe post Bitcoin Super Cycle: Why 2026 Could Redefine Bitcoin’s Market Mechanics appeared first on Coinspeaker.

추천 콘텐츠

Top 5 Myths About Supply Chain Digital Transformation (and What the Data Really Says)