Bitcoin Price Drops 50% From Peak as Futures Demand Slumps

Key Insights

- Bitcoin futures open interest fell to yearly lows.

- Realized losses ranked among largest capitulations.

- Options markets priced elevated downside risk.

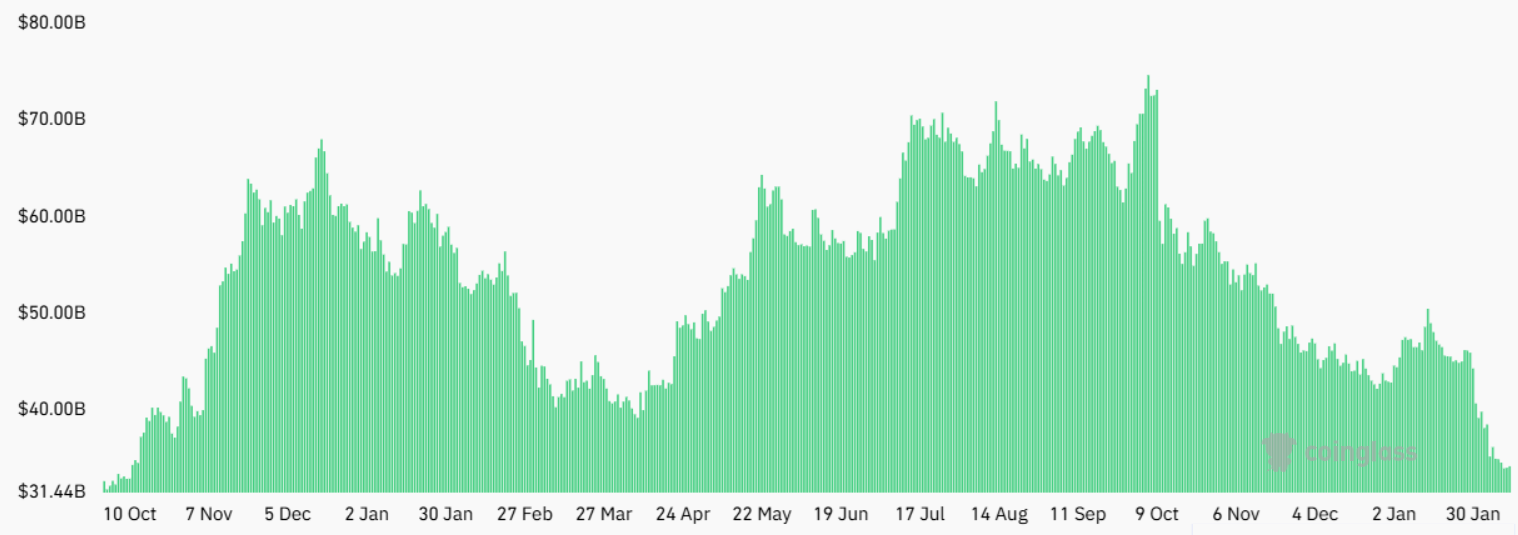

Bitcoin price slid to $66,592 this week after failing to sustain levels above $72,000. At the same time, aggregate futures positioning dropped to its lowest point since November 2024.

CoinGlass data showed leveraged exposure shrank sharply, reflecting caution across derivatives markets. The retreat unfolded as macro uncertainty deepened and traders reassessed risk.

The broader context framed the BTC price pullback as part of a larger repricing cycle. Since peaking above $126,000 in October, the asset had trended lower for roughly four months.

Market participants debated whether institutional demand had waned or merely shifted toward lower-leverage structures.

Bitcoin Price Pressure Reflected in Futures Contraction

CoinGlass records showed that the aggregate Bitcoin futures open interest fell to $34 billion on Thursday. It marked a 28% contraction over the past thirty days.

Measured in Bitcoin terms, however, positioning held near 502,450 BTC. This suggests leverage demand had not collapsed outright. This shift occurred because forced liquidations accelerated during the selloff.

Bitcoin Futures Open Interest Chart | Source: Coinglass

Bitcoin Futures Open Interest Chart | Source: Coinglass

Derivatives tracking revealed $5.2 billion in liquidations across two weeks, reflecting aggressive unwinds of overleveraged bets. That reaction mirrored broader caution in risk markets, even as gold reclaimed the $5,000 threshold and the S&P 500 hovered 1% below its all-time high.

Investors struggled to identify a clear catalyst for the recent downturn. United States Labor Department data showed the economy added 181,000 jobs in 2025, below prior estimates.

Officials argued that slower population growth reduced the required job creation. Markets interpreted the data as a sign that the Federal Reserve might ease policy earlier. This typically supports equities. However, it also complicates the Bitcoin price momentum.

Bitcoin Price Faces Capitulation as Losses Deepen

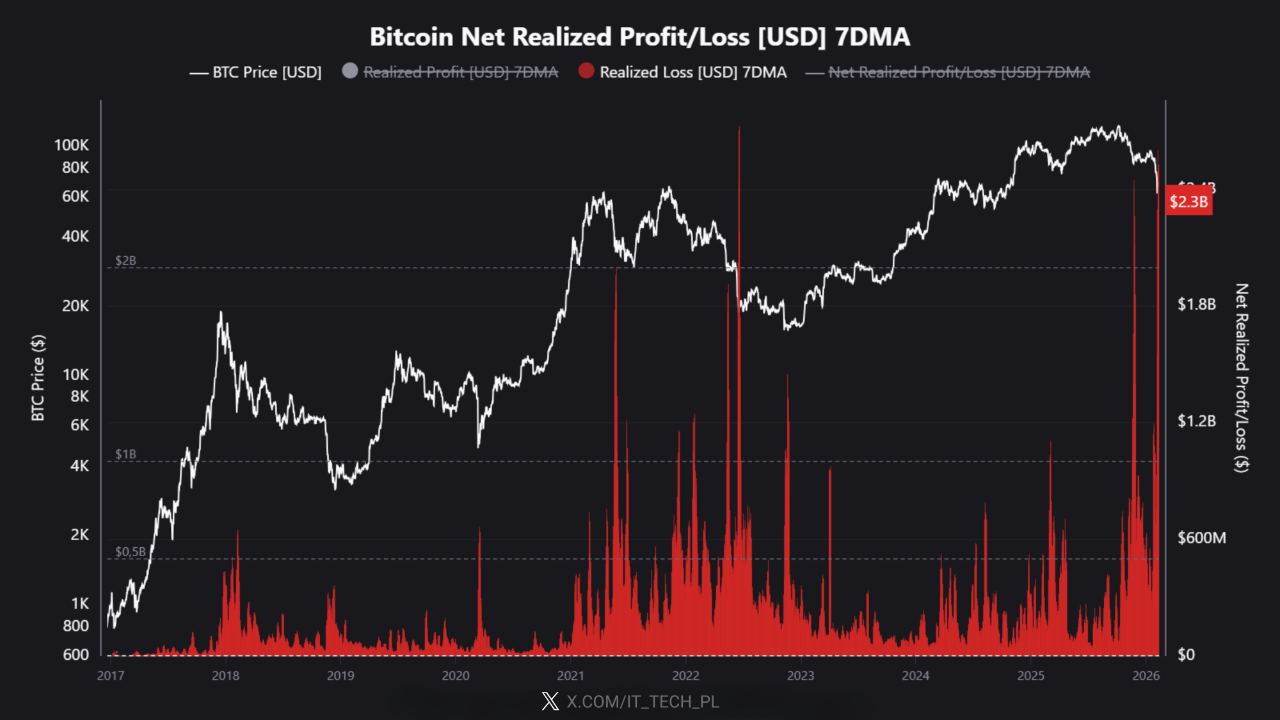

CryptoQuant’s IT Tech analysis shows realized net losses hit $2.3 billion on a seven-day average. The losses rank among the top three to five capitulation events ever recorded. Investors endured one of the most severe downturns in crypto history.

The report compared the drawdown to the 2021 crash and the 2022 Luna and FTX collapse. Only a handful of periods matched this magnitude of realized pain.

bitcoin net realized profit/loss (usd) 7MA. Source: CryptoQuant

bitcoin net realized profit/loss (usd) 7MA. Source: CryptoQuant

BTC price had declined nearly 50% from its October high during the retracement. IT Tech noted that prior loss spikes often preceded rebounds, yet warned relief rallies can emerge within prolonged bear phases.

That caution reflected uncertainty about whether the washout had fully exhausted sellers.

CryptoQuant metrics also placed the realized Bitcoin price near $55,000, a level historically linked to bear market troughs. Past cycles saw the asset trade between 24% and 30% below the realized price before stabilizing.

The firm observed that once the BTC price reached that area, it typically moved sideways before recovery resumed. Options data reinforced defensive positioning.

Laevitas metrics showed the annualized funding rate stayed below the neutral 12% threshold for four consecutive months. This indicates restrained bullish leverage.

Deribit’s 30-day delta skew climbed to 22%, far outside the normal minus 6% to plus 6% band. It signals heavy demand for protective puts.

Institutional Flows And Undervaluation Signals

Despite weak derivatives sentiment, United States-listed Bitcoin exchange-traded funds recorded an average daily trading volume of $5.4 billion. That activity challenged narratives of evaporating institutional interest. Spot flows did not collapse, even as futures participation cooled.

LVRG Research director Nick Ruck stated that the capitulation reflected short-term holder panic amid macro headwinds. He argued that oversold conditions often precede recovery phases.

He stressed that a true bottom needs confirmation from sustained institutional accumulation. Moving ahead, he added that miner stabilization is also essential for lasting recovery.

Crypto Dan’s on-chain commentary added another dimension. He observed that the Market Value to Realized Value ratio hovered around 1.1, approaching the undervaluation threshold near 1.

In prior cycles, readings below 1 marked long-term accumulation zones. However, he noted the recent bull phase lacked an extended overvaluation spike. This implied the current decline could follow a different trajectory.

The bitcoin price, therefore, sat at a technical crossroads shaped by leverage compression, realized losses, and cautious institutional behavior.

Derivatives traders reduced risk exposure, while on-chain metrics approached historically attractive levels. Equity markets remained resilient, creating a decoupling dynamic that unsettled participants.

A sustained break below that threshold would shift focus toward deeper historical support bands identified by realized price metrics.

Immediate attention now centers on the $60,000 support zone. If the Bitcoin price stabilizes above that region, traders may reassess downside risks and funding dynamics.

The post Bitcoin Price Drops 50% From Peak as Futures Demand Slumps appeared first on The Market Periodical.

추천 콘텐츠

Scaramucci Drops Bombshell Claim Trump Coins Drained Crypto Liquidity and Sparked the Bear Market

X wil crypto trading aanbieden aan 600 miljoen gebruikers