The Fed nominee's approach and historic job revisions have unsettled cryptocurrency markets, especially Bitcoin. Major downward adjustments in job statistics challengeThe Fed nominee's approach and historic job revisions have unsettled cryptocurrency markets, especially Bitcoin. Major downward adjustments in job statistics challenge

Fed Chair Nominee Warsh Sparks Volatility in Bitcoin as Employment Data Fuel Uncertainty

The Fed nominee's approach and historic job revisions have unsettled cryptocurrency markets, especially Bitcoin. Major downward adjustments in job statistics challenge perceptions of a strong U.S.

Continue Reading:Fed Chair Nominee Warsh Sparks Volatility in Bitcoin as Employment Data Fuel Uncertainty

The post Fed Chair Nominee Warsh Sparks Volatility in Bitcoin as Employment Data Fuel Uncertainty appeared first on COINTURK NEWS.

면책 조항: 본 사이트에 재게시된 글들은 공개 플랫폼에서 가져온 것으로 정보 제공 목적으로만 제공됩니다. 이는 반드시 MEXC의 견해를 반영하는 것은 아닙니다. 모든 권리는 원저자에게 있습니다. 제3자의 권리를 침해하는 콘텐츠가 있다고 판단될 경우, service@support.mexc.com으로 연락하여 삭제 요청을 해주시기 바랍니다. MEXC는 콘텐츠의 정확성, 완전성 또는 시의적절성에 대해 어떠한 보증도 하지 않으며, 제공된 정보에 기반하여 취해진 어떠한 조치에 대해서도 책임을 지지 않습니다. 본 콘텐츠는 금융, 법률 또는 기타 전문적인 조언을 구성하지 않으며, MEXC의 추천이나 보증으로 간주되어서는 안 됩니다.

추천 콘텐츠

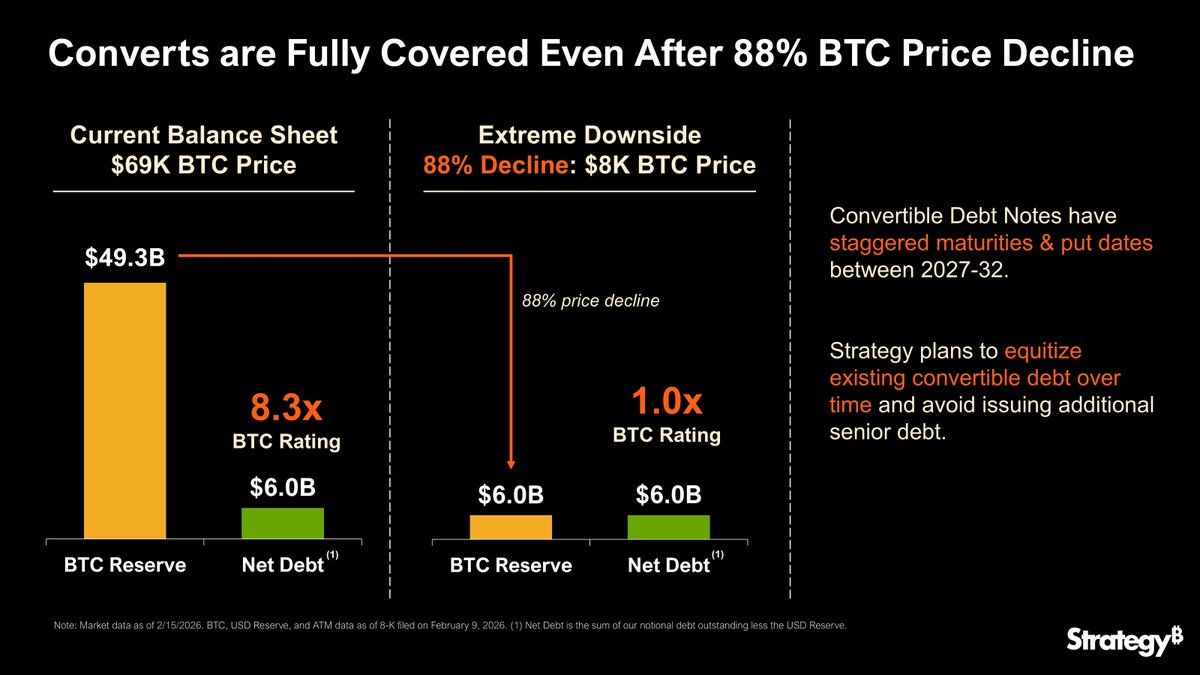

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

Strategy (MicroStrategy) today asserted it can fully cover its $6 billion debt even if Bitcoin falls 88% to $8,000. However, the bigger question is what happens

공유하기

Coinstats2026/02/16 04:08

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more

공유하기

Coinstats2025/09/18 06:02

Positive Pay: Strengthening Business Security Against Check Fraud

In today’s fast-paced financial environment, businesses face increasing risks related to check fraud and unauthorized transactions. As digital payments grow, traditional

공유하기

Techbullion2026/02/16 06:16