Understanding Bull and Bear Markets in BLUAI's History

The cryptocurrency market, including Bluwhale AI Token (BLUAI), experiences distinct cyclical patterns known as bull and bear markets. Since its inception, BLUAI has been part of these cycles, offering valuable lessons for traders and investors. A bull market in Bluwhale AI is characterized by sustained price appreciation, often driven by factors such as technological advancements, strategic partnerships, and increased adoption. Conversely, bear markets typically feature extended downtrends, influenced by macroeconomic trends, regulatory changes, and market sentiment.

The psychology behind these cycles often follows a predictable pattern: during bull markets, investor euphoria and FOMO drive BLUAI prices to unsustainable heights, while bear markets are characterized by pessimism, capitulation, and eventually apathy among Bluwhale AI market participants. Given BLUAI's recent listing on MEXC, understanding these patterns is crucial for navigating its market phases effectively.

Major Bull Markets in BLUAI's History

Although Bluwhale AI is relatively new and has not experienced multiple complete market cycles, its listing on MEXC and ongoing airdrop events suggest potential for significant BLUAI price movements. Key catalysts that could trigger price surges include increased adoption of AI and blockchain technologies, strategic partnerships with Bluwhale AI, and favorable regulatory developments.

During potential bull phases, BLUAI might display recognizable price action patterns, such as a series of higher highs and higher lows, increased trading volume during upward moves, and price consolidation periods followed by continued uptrends. Bluwhale AI market sentiment indicators often show extreme greed readings, with social media mentions increasing significantly compared to bear market periods.

Notable Bear Markets and Corrections in BLUAI's Timeline

While Bluwhale AI has not yet experienced a full bear market cycle, understanding the broader cryptocurrency market's behavior during such periods is essential. In general, BLUAI bear markets are marked by decreased trading volume, increased volatility during capitulation phases, and a shift in investor sentiment from denial to fear and eventually apathy.

Recovery patterns after major BLUAI price collapses often begin with prolonged accumulation phases, where prices trade within a narrow range before establishing a solid base. This is typically followed by a gradual increase in Bluwhale AI trading volume and renewed developer activity on the network, eventually leading to a new cycle of price appreciation.

Essential Trading Strategies Across Market Cycles

Successful Bluwhale AI investors employ distinctly different strategies depending on market conditions. During BLUAI bull markets, effective risk management approaches include gradually scaling out of positions as prices rise, taking initial capital off the table after significant gains, and tightening stop-loss levels to protect profits.

In bear markets, Bluwhale AI strategies revolve around defensive positioning with reduced exposure to high-beta assets, strategic accumulation of quality projects at deeply discounted valuations, and generating yield through staking or lending BLUAI to offset price declines. Implementing dollar-cost averaging over extended periods rather than attempting to time the exact bottom is also advisable.

Identifying Transition Points Between Market Cycles

Recognizing the transition between bull and bear markets is among the most valuable skills for BLUAI traders. Key technical indicators that often signal these shifts include the crossing of long-term moving averages, extended periods of declining Bluwhale AI trading volumes despite price increases, and bearish divergences between price and momentum indicators.

Fundamental developments frequently precede BLUAI cycle changes, including changes in monetary policy, shifts in regulatory stance toward cryptocurrencies, and major institutional adoption announcements for Bluwhale AI. Volume analysis provides valuable insights during potential transition periods, with traders watching for declining volume during price advances and climactic volume spikes during sharp BLUAI sell-offs.

Conclusion

The study of Bluwhale AI's market cycles, though limited by its recent listing, reveals the importance of understanding broader cryptocurrency market patterns. The most valuable lessons include the inevitability of both BLUAI bull and bear phases and the critical importance of disciplined strategy across all market conditions. As Bluwhale AI continues to evolve, integrating these insights into trading strategies will be essential for success.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About Sleepless AI

View More

What is 375ai (EAT)? Complete Guide to the World's First Decentralized Edge Data Intelligence Network

What is GAIB? Complete Guide to the AI Infrastructure Economic Layer and GAIB Token

Maximizing Asset Management Efficiency with MEXC's AI Tools

Latest Updates on Sleepless AI

View More

In 2025, Nigerian creators use AI to scale. Yet they fear its flaws.

Why Explainability and Control Will Define the Next Phase of AI in BFSI

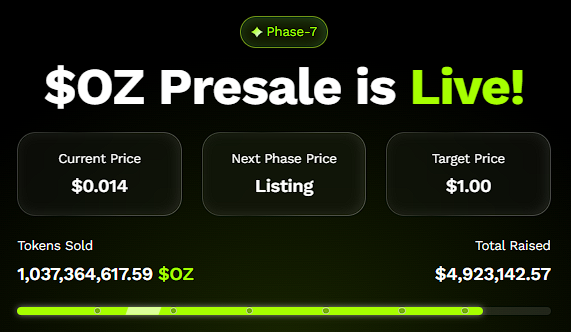

XRP Could Rally Hard in 2025, Yet Ozak AI Forecast Shows a More Aggressive Trajectory

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading