2026-02-13 Friday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

Tether CEO Teases New Local AI Assistant

Tether CEO Paolo Ardoino revealed a first public demo of “QVAC,” an artificial intelligence assistant currently under development by Tether. The preview suggests

Share

Author: Ethnews2026/02/12 23:41

Where to Buy BFS Crypto? Arkham Abandons the CEX Model, North Korean Malware Targets Traders, and DeepSnitch AI’s Moonshot Launch Is About to Come and Go in Early 2026

A fair few headlines have broken on February 11 that, taken together, paint a vivid picture of where crypto is headed and what it still needs to fix. Arkham Exchange

Share

Author: Captainaltcoin2026/02/12 23:30

Standard Chartered's Geoff Kendrick Warns of $50,000 Bitcoin Risk as Bank Cuts 2026 Targets

Geoff Kendrick of Standard Chartered warns Bitcoin could test $50,000 before a recovery. Learn why the bank slashed its 2026 BTC forecast to $100,000 due to ETF

Share

Author: Coinstats2026/02/12 23:27

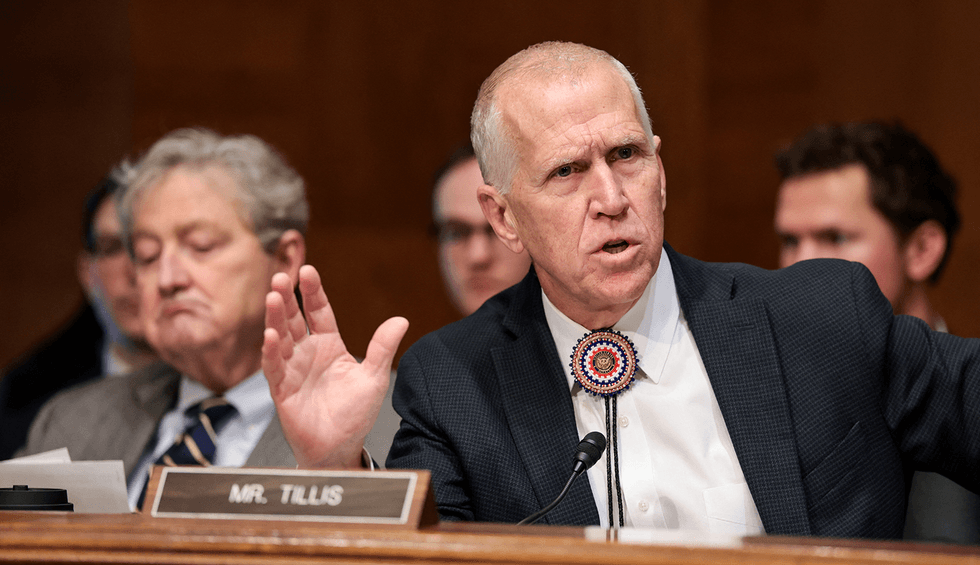

Republicans celebrate Trump DOJ’s failed bid to indict Dems on sedition charges

Numerous Republicans celebrated Donald Trump's latest legal defeat, according to a new report from The Hill, with one senator saying that the case amounted to "

Share

Author: Alternet2026/02/12 23:26

Visionary Insights: Buterin Advocates Digital Governance for Russia’s Political Landscape

Vitalik Buterin, the co-founder of Ethereum, has strongly denounced Russia’s invasion of Ukraine, calling it an act of unwarranted aggression. With the four-year

Share

Author: Coinstats2026/02/12 23:25

White House 'less than thrilled' with Pam Bondi's handling of Epstein matter: CNN reporter

CNN's Kevin Liptak revealed the White House was unimpressed with Attorney General Pam Bondi's fiery performance before the House Judiciary Committee.President Donald

Share

Author: Rawstory2026/02/12 23:19

Vitalik Buterin Condemns Russian Invasion, Urges Blockchain-Based Political Reform

Buterin calls Russia’s invasion a criminal act and urges global support for Ukraine. He proposes decentralized digital governance as a pathway to Russian political

Share

Author: Coinstats2026/02/12 23:18

The Signals That Define Token Health

Most teams check the token price and think they understand what’s going on. They don’t. Price shows the surface. Token health shows the system underneath. A healthy

Share

Author: Techbullion2026/02/12 23:18