Introduction to Ping (PING) Price Analysis

The current market position of Ping (PING) shows significant growth potential as it continues to gain traction since its initial exchange listing in 2025. Currently trading in the $0.04 to $0.08 range on MEXC, Ping (PING) has demonstrated remarkable resilience despite market volatility, with recent price swings of over 35% in a single day and a 782% increase over the past month. While the market cap has fluctuated—reaching as high as $70 million during trading frenzies and currently reflecting a more modest capitalization—Ping (PING) remains one of the most closely watched emerging tokens in the AI-crypto sector.

Understanding both short-term and long-term price movements is crucial for investors looking to maximize returns in the Ping ecosystem, especially given its position at the intersection of artificial intelligence and blockchain technology. Multiple factors influence Ping price predictions, including development progress on the platform's core products, growing user adoption, token unlock schedules, and broader market sentiment toward AI-crypto projects. With a circulating supply of approximately 7.24 million out of a total 7.25 million tokens (over 99% in circulation), the token's supply dynamics create a unique environment for both short- and long-term analysis.

Short-Term Price Prediction Methods and Strategies

Technical analysis tools provide valuable insights for Ping (PING) short-term price forecasting. Traders regularly monitor Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands to identify potential entry and exit points. The formation of higher lows on the daily chart suggests strengthening bullish sentiment, while key support levels have been established at $0.04 and $0.03.

Market sentiment and social indicators play a critical role in Ping (PING)'s short-term price movements, especially given its focus on information aggregation and curation in the crypto space. Social engagement metrics tracked by analytics platforms show increased mentions across major crypto communities, with sentiment analysis indicating predominantly positive discussions around the project's features and trading opportunities. Sophisticated traders use sentiment analysis tools to predict short-term price movements based on community engagement levels.

For short-term trading, many investors employ swing trading strategies, aiming to capture gains from Ping's characteristic 3-5 day price cycles. Day traders focus on volume spikes, which often precede significant price movements, particularly following platform update announcements or new partnership reveals. The most successful traders combine technical analysis with fundamental developments to identify high-probability trading opportunities in the Ping (PING) market.

Long-Term Price Prediction Approaches

Fundamental analysis for Ping (PING) valuation centers on user growth metrics, platform adoption rate, and revenue generation potential of its AI-driven information network. Analysts examining Ping's long-term potential focus on the expanding market for high-quality crypto information, estimated to reach billions in value as the broader cryptocurrency market matures.

On-chain metrics provide critical insights into Ping (PING)'s network growth, with increasing active addresses, growing transaction volumes, and rising staking participation indicating healthy ecosystem development. Particularly noteworthy is the distribution pattern of tokens, which shows declining concentration among large holders, suggesting broader market participation and potential reduced volatility over time.

The project's development roadmap outlines several major milestones that could significantly impact long-term valuation, including expansion of the intelligence platform, integration with major DeFi protocols, and launch of additional creator tools. As the platform progresses through these development phases, analysts expect substantial growth in utility-driven token demand, potentially driving price appreciation independent of general market trends.

Factors Affecting Ping (PING) Value Across Time Horizons

Regulatory developments represent both a risk and opportunity for Ping (PING)'s valuation. As major global economies and emerging markets continue to develop regulatory frameworks for AI and crypto intersections, Ping's proactive compliance approach positions it favorably compared to competitors. The upcoming clarity on tokenized information systems expected from key regulatory bodies could significantly impact price discovery in both short- and long-term horizons.

Macroeconomic factors influencing Ping (PING) include interest rate policies, inflation trends, and broader technology sector performance. During periods of economic uncertainty, Ping's utility as an information curation tool could enhance its appeal as users seek reliable intelligence about market conditions. Historically, projects that solve real information problems have shown greater resilience during bear markets than purely speculative assets.

In the competitive landscape, Ping (PING) faces challenges from traditional crypto data aggregators, centralized AI recommendation systems, and emerging Web3 information protocols. However, its unique combination of AI capabilities and tokenized incentive mechanisms create significant barriers to entry for potential competitors. The project's strategic partnerships with key crypto media platforms further strengthen its competitive position in the evolving crypto intelligence market.

Conclusion

When approaching Ping (PING) investments, the most effective strategies combine short-term technical analysis with long-term fundamental evaluation. Understanding both timeframes allows investors to make more informed decisions regardless of market conditions. For a complete walkthrough on how to apply these prediction methods and develop your own successful trading strategy, check out our comprehensive Ping Trading Complete Guide: From Getting Started to Hands-On Trading – your essential resource for mastering Ping (PING) trading in any market environment.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Ping

View More

Senate denies holiday leave requests of Discaya, former DPWH officials

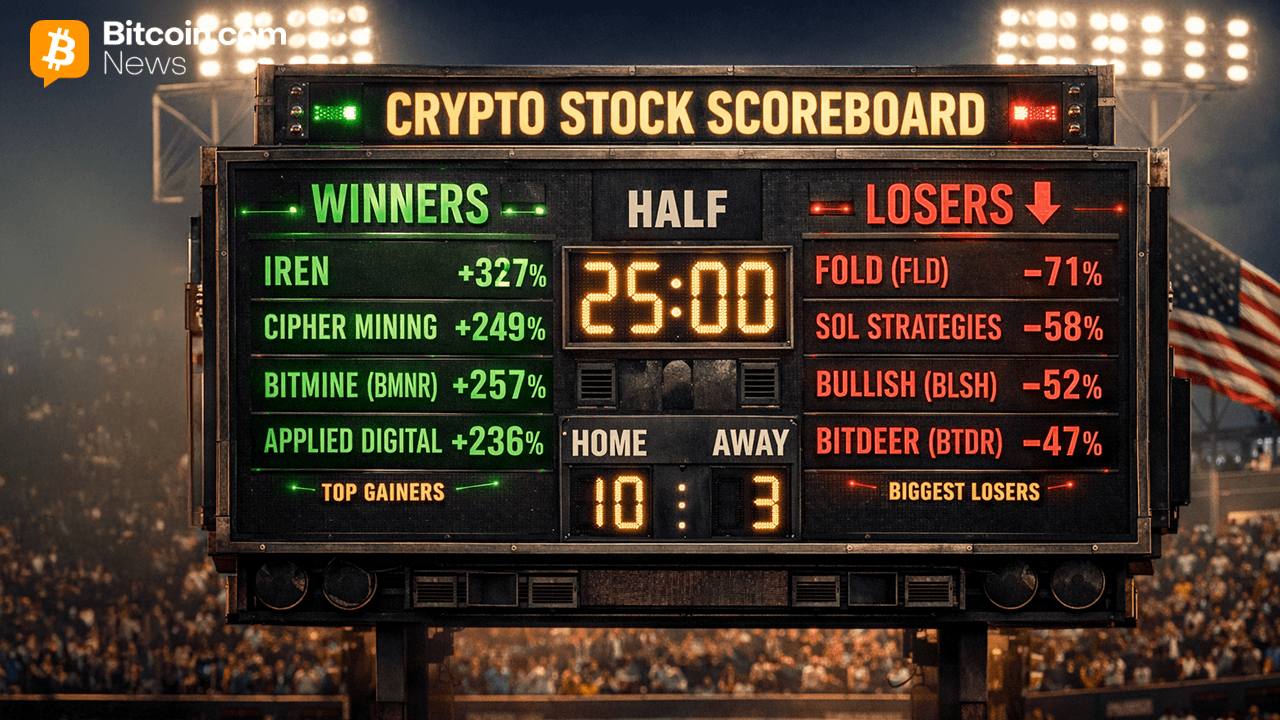

Crypto Stocks in 2025: Eye-Popping Winners, Brutal Losers, and Everything in Between

Senator pushes for heightened vigilance over 2026 budget use

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading