Museums of the Middle East: the one glaring omission

At the Cotton Museum in Cairo, a dusty brutalist edifice in Dokki on the west bank of the Nile, one learns of the origins of Egypt’s many fibre varieties since 1818. A helpful chart gives the relationship between Menoufi G36 (1940) and Giza 30 (1939) and shows how Sakha 3 (1926) and Sakha 4 (1929) combined to produce Giza 28.

Long-staple and extra-long-staple cotton were planted in Egypt under the British. The ginned crop was shipped to Manchester for workers there to turn it into sheets and shirts and pillow cases. Cotton is arguably the crop on which modern Egypt was built.

Today the building, part of the Egypt Agricultural Museum and complete with Frida Kahlo-esque friezes of model toiling workers, is all but unvisited.

Despite this, the Arab world is belatedly catching on to the importance of museums as a draw for tourists – more so perhaps than shopping malls.

In the UAE the Zayed National Museum and the Natural History Museum have joined the Louvre on Saadiyat Island. In Al Ain, Abu Dhabi’s second city, the delayed museum has now opened.

In Saudi Arabia we await an announcement of an exhibition site to house the Salvator Mundi, thought to be in Riyadh.

In Jeddah a series of mansions in Al Balad, Jeddah’s old town and a Unesco world heritage site, is being restored. The four-storey 19th century Bayt Nassif in the Yemen neighbourhood named after an eponymous merchant family is the most grandiose. Its staircase was reputedly sufficient to allow camels to carry loads to the roof.

In the south the National Museum in Muscat is worth visiting for the building alone while there are great models of ships – very important to the Arabian Gulf – and of the sultanate’s myriad castles. The Bahrain National Museum in Manama is also wonderful. See the Dilmun funerary mounds.

But it is arguably Egypt that has the most to show off. The Egyptian Agricultural Museum is the second oldest such exhibition in the world.

Much of the complex, centred on a khedival princess’s palace (more Kahlo-esq friezes, mangy carpets and rusty rifles), was designed in the 1950s at the height of the Nasserite pan-Arab movement. The visitor can take in the museum of China-Egypt friendship and another on the Syria-Egypt condominium. Remember the United Arab Republic? It did not end well.

The main exhibition hall features a camel’s stomach and (beautiful) models of the Assiut, Naga Hammadi and Esna barrages on the Nile.

To the north in Alexandria, the Graeco-Roman Museum, smallish and digestible, is recommended. I visited as a truculent 20-something. It is much better now.

Another gem is the Constantine Cavafy Museum on what was Rue Lepsis, off a now pedestrianised Rue Nabi Daniel, maintained by the Onassis Foundation. The Greek poet who inspired EM Forster and Lawrence Durrell is much celebrated today because of The Gods Abandon Anthony, Waiting For The Barbarians and Ithaca. Here is Cavafy’s correspondence with Forster and the final drafts of some of the poems handwritten in Greek.

In Beirut, visit the National Museum for the mummies and mosaics but also make sure to pass by the cafe. Behind perspex is preserved a bullet-pocked door which marked this spot as one of the most contested in the civil war. The Museum crossing was infamous as a major and dangerous point on the Green Line. Heroic curators encased exhibits in concrete to protect them from trigger-happy gunmen who occupied the building.

What lessons can be learned? Tentatively, I would suggest that smaller is more beautiful.

Of the big museums, the Abu Dhabi Louvre works well. The building itself is large and awe-inspiring but the exhibits, carefully chosen, do not overwhelm. They are sufficient to educate. And there is a turtle sanctuary.

In Cairo, the Grand Egyptian Museum on the Giza plateau is an architectural achievement but it is huge and indigestible. Ramses II gets everywhere – as he did in life and death. And what happens when it rains? The vault of the main concourse is open to the skies.

Egypt has a problem in that its archaeological heritage is so rich that it is difficult to think of how to display all that there is.

Elsewhere, the Sursock in Beirut is, like its colleagues in Muscat and Manama, worth it for the building alone but it probably cannot handle a liner load of tourists.

Further reading:

- US architects to revive ancient Sumerian court in Iraq

- Underwater marine museum bids sought by Abu Dhabi

- Egypt banks on new museum to meet 2030 tourism target

And there is a laggard here. In Dubai, the Museum of the Future is packed and has to be booked days in advance, such is demand. The old Dubai Museum is being refurbished. But the Gulf commercial capital lacks at least one more big display.

My recommendation would be an oil and gas museum. This is unlikely to be popular with the environmental lobby but oil and now gas have been as central to the Gulf as, say, coal was to South Wales or Pennsylvania. To disregard the contribution is wrong.

Children need to understand the difference between sour and sweet crude, between associated and non-associated gas, and what water reinjection looks like. A lower-carbon future can be adumbrated and the threat of methane made more clear. You heard it here first.

You May Also Like

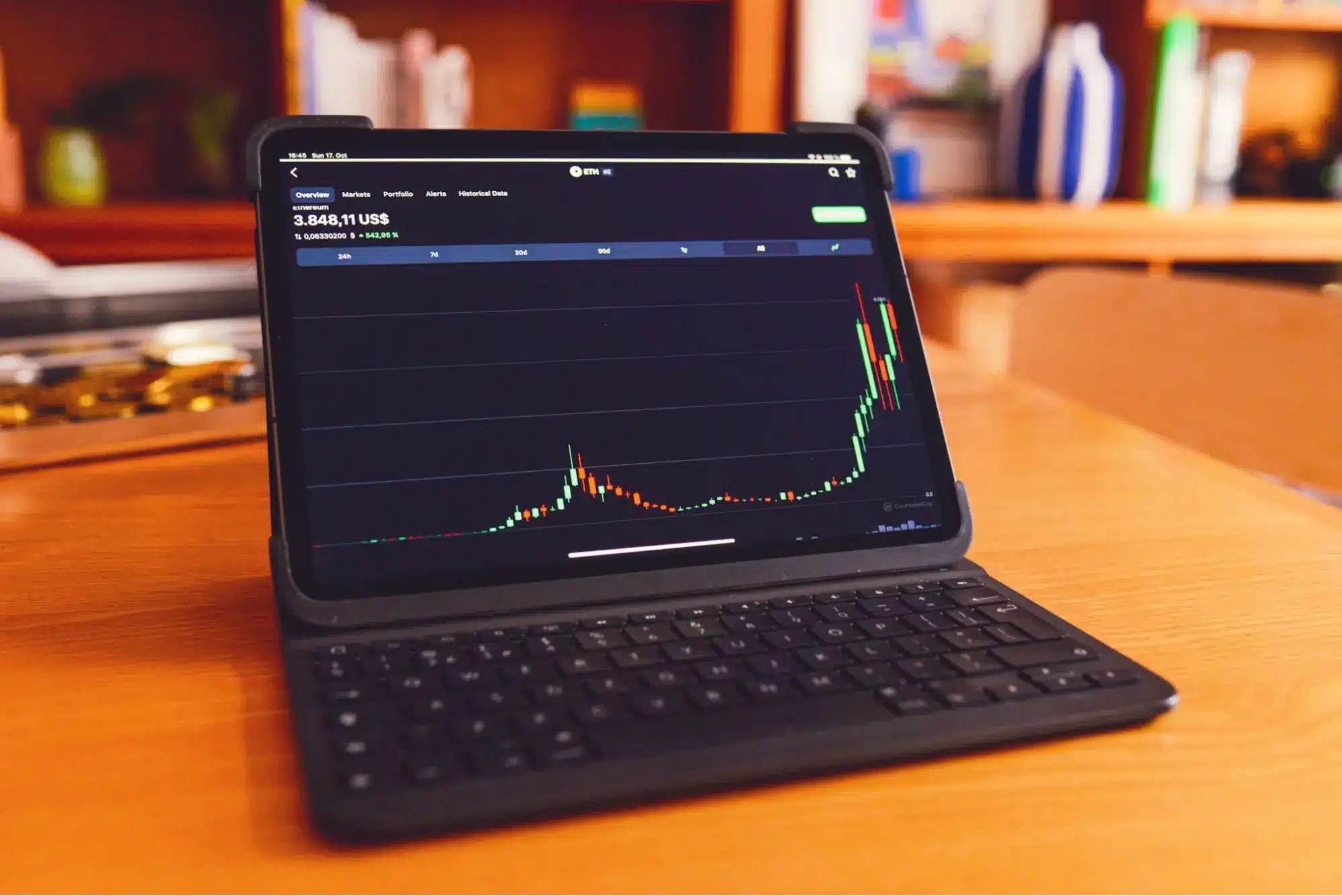

MakinaFi suffered an attack that resulted in the loss of approximately 1299 ETH, with some funds being preemptively processed by MEV.

Magic Eden co-founder sees 'speculation supercycle' ahead