Can RTX technology improve Bitcoin price predictions? Here’s what we know

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix gains momentum as traders shift from unclear Bitcoin signals to utility-driven, data-focused projects.

- Remittix draws rising interest as traders seek clearer signals beyond Bitcoin’s shifting liquidity trends.

- The token is gaining traction with its new iOS wallet, expanded beta program, and rapid adoption ahead of key updates.

- Security boosts and confirmed listings on BitMart and LBank push Remittix momentum as funding passes $28m.

Bitcoin price prediction models have always relied on chart structure, liquidity behavior, and investor sentiment, yet the latest market conversations show traders searching for more dependable signals. As analysts track how liquidity zones shift around major price levels, projects focused on real utility and advanced data systems are gaining attention, including Remittix (RTX), which is priced at 0.119 dollars.

While Bitcoin still dominates crypto news and drives broader crypto market activity, investors are combining traditional technical tools with newer blockchain technology to understand potential shifts. This mix of on-chain activity, liquidity trends, and product-driven analytics is at the center of today’s market discussion.

Market structure takes priority in Bitcoin price prediction models

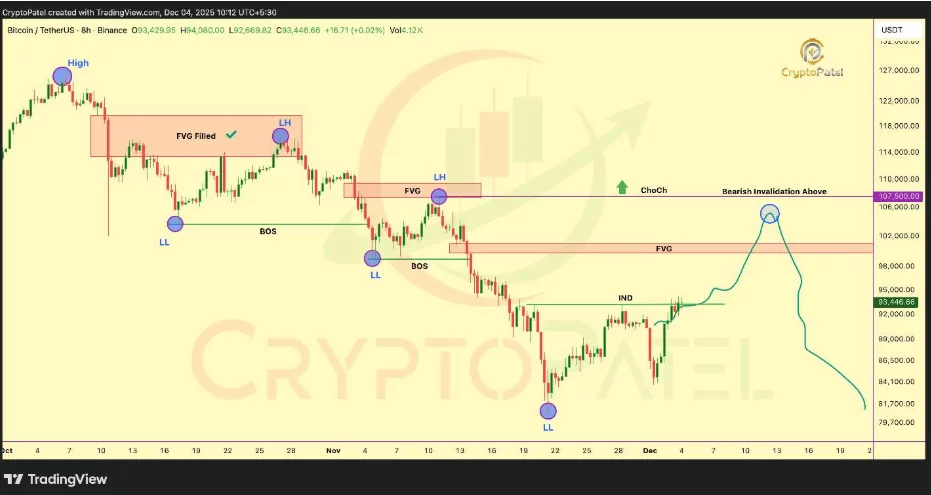

The current figures place Bitcoin at 90,211 dollars, with a market cap of 1.85 trillion dollars and trading volume at 70.35 billion dollars. Analysts following liquidity charts highlighted by Crypto Fortress are pointing to a clear sequence of lower highs and lower lows, which fits a bearish macro bias.

Their analysis, shared through a high-timeframe update, outlines how Bitcoin is currently moving through a premium retracement phase as internal liquidity gets collected. The premium fair-value gap between 99,866 and 101,184 stands out as the next major liquidity draw.

The analyst also noted that bias remains bearish below 107,500 and described a likely pattern where Bitcoin sweeps buy-side liquidity, fills the gap, mitigates the move, then continues lower. This matches the sentiment expressed in this community update linked here through the market post on CoinMarketCap.

These types of signals are often used by traders refining their Bitcoin price prediction frameworks, especially when assessing whether a temporary rebound reflects genuine trend recovery or standard liquidity behavior.

Market sentiment remains mixed as institutional adoption continues rising, blockchain technology keeps expanding and digital assets attract long-term investors. Yet traders agree that volatility is central to Bitcoin Price Prediction strategies in times when liquidity behavior drives more of the short-term outcome.

Why broader technology matters for bitcoin forecast models

Many market watchers now combine classic technical structures with solutions coming from newer crypto projects. Interest is growing around tools that enhance transparency, reduce guesswork and offer clearer real-time data.

While these solutions do not directly control Bitcoin’s movement, they influence how traders refine positions across centralized exchanges and decentralized finance environments. This trend also supports increasing demand for projects with working products, sustainability goals and real-world use cases in the crypto market.

Remittix (RTX), priced at 0.119 dollars per token, remains one of the projects gaining the most traction in this regard. The interest is driven both by its payment-focused utility and by the reliability signals coming from its security framework.

Many crypto investors now look at projects like this when searching for the top crypto to buy now or a new altcoin to watch, especially when those projects contribute to the broader improvement of blockchain infrastructure.

Remittix gains momentum as real utility expands

Remittix continues gaining strength after raising more than 28.4 million dollars in private funding, with over 692.8 million tokens sold. One of the biggest updates is the release of the Remittix Wallet on the Apple App Store, giving users access to fast asset transfers and a clean interface.

The beta testing program was expanded again, with weekly top-ten purchasers gaining entry as long as they use iOS devices. The aim is to accelerate feedback and enhance usability, especially ahead of the December update for the crypto-to-fiat payment feature. A beta demonstration can be viewed through this official video shared by the Remittix team.

Security trust levels also increased following the full CertiK audit and the verification of the Remittix team, documented on the CertiK page and the KYC verification page. Remittix is ranked number one among pre-launch tokens on CertiK, which has strengthened confidence across the crypto market.

With future listings confirmed for BitMart and LBank once the project completes its milestones, and with a large referral program that pays 15% in USDT every 24 hours, ecosystem growth continues accelerating. Remittix also announced a 250,000 dollar giveaway as engagement rises ahead of the 30 million milestone.

Key drivers pushing RTX forward

- Expanding wallet beta testing program

- Fully verified team through CertiK with top ranking

- Multi-exchange listing rollout after funding milestones

- Growing interest from crypto investors seeking real utility

The signal behind the shift

The latest liquidity signals suggest that Bitcoin’s next major move hinges on how price reacts near the premium FVG, and this shapes most Bitcoin price prediction models for the week. As traders watch these zones, the rise of technology-driven crypto projects like Remittix shows how the industry is shifting toward solutions that offer reliability and clear use cases.

With rising utility, strong security validation and growing adoption, Remittix remains one of the strongest candidates for crypto investors evaluating the best long-term crypto investment while market volatility keeps Bitcoin in focus.

To learn more about Remittix, visit the official website, socials, and the $250,000 Giveaway.

Frequently Asked Questions

1. Will Bitcoin rise from its current range?

Bitcoin’s next move depends on how price reacts near the premium fair-value gap highlighted by recent liquidity analysis. Traders are watching the 99,866 to 101,184 zone, as reactions in that area often shape short-term trend direction and influence Bitcoin Price Prediction models.

2. What affects Bitcoin’s price movement the most right now?

Liquidity levels, order-flow patterns and broader market sentiment are key factors. High-timeframe lower highs and lower lows continue to guide the current structure, while shifts in trading volume and institutional activity also play a role.

3. Can Bitcoin reach a new high this year?

It depends on whether the market can break above major invalidation levels highlighted by analysts. Until the 107,500 region is reclaimed decisively, most traders consider the macro bias to lean bearish based on current structure.

4. Why are many traders following fair-value gaps and liquidity zones?

These zones often mark areas where price gathers orders before expanding, making them useful in Bitcoin Price Prediction frameworks. They help traders understand potential turning points instead of relying solely on sentiment.

5. Is Remittix a good project to watch during market volatility?

Many investors are watching RTX because it offers real utility in payments, a verified team, strong security validation on CertiK and an active product rollout. Its current price of 0.119 dollars and ongoing development make it a popular choice among users seeking crypto projects with long-term potential.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

The Next Bitcoin Story Of 2025