A Crypto Trader Flipped His BNB Into Ozak AI — Three Weeks Later, He’s Sitting on 120% Gains While BNB Slipped 5%

As market volatility reshapes investor tactics, sentiment is shifting toward innovative crypto ventures, with Ozak AI ($OZ) beating some known assets. A recent trader’s decision to convert his BNB holdings into Ozak AI is making waves in the crypto community; the investor has seen a 120% increase in just three weeks, while BNB has fallen 5%, reinforcing the growing narrative that AI-blockchain convergence is fueling the next wave of market opportunities.

Ozak AI Presale Sees Rapid Growth and Rising Investor Interest

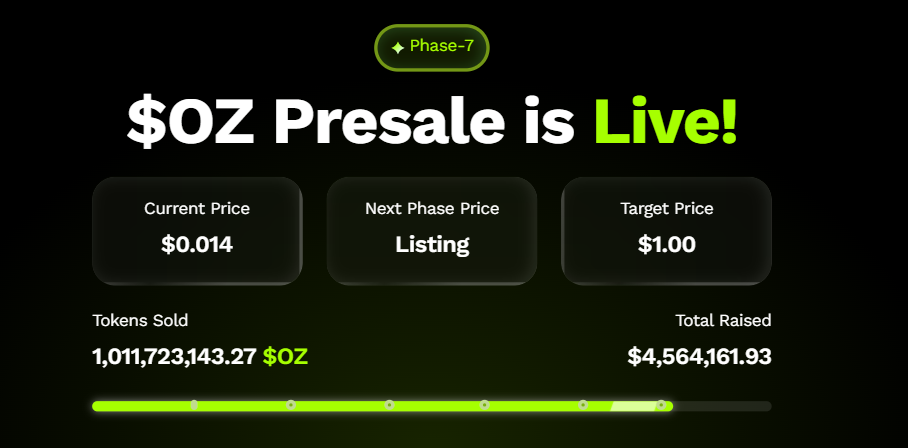

$OZ unveiled its presale earlier this year, starting with a price of $0.001 at Phase 1, then increasing in each subsequent phase as investor demand rises. Currently, it is in Phase 7, and each token is selling at $0.014, representing an impressive 1,300% increase from Phase 1. The next phase is expected to list at $1.

Also, the funds of the Ozak AI are raising daily, now it stands at $4.5 million after selling over 1 billion tokens. Ozak AI also launched its official Dune Analytics Presale Dashboard to track on-chain sales data, strengthening its transparency.

With this strong presale momentum and openness, the new investors could possibly get more than 7000% returns when it hits $1 and 99,900% returns from the initial price.

Trader’s Bold Switch from BNB to Ozak AI Pays Off Big

One trader’s timely move to switch from BNB to $OZ has been a notable success story of the current presale season. During Phase 4, when Ozak AI was valued at $0.005 per token, the trader reportedly swapped only $200 of BNB, acquiring 40,000 tokens.

Now, Ozak AI is in Phase 7 at $0.014; the same holding has risen to $560, representing a remarkable 180% return, well exceeding expectations. In comparison, BNB has fallen by roughly 5% during the same time period, demonstrating how early investment in new AI-driven crypto ventures such as Ozak AI can outperform even established ones .

What Makes Ozak AI Stand Out in the AI-Crypto Space

Ozak AI distinguishes itself through a four-stage, decentralized financial intelligence architecture built upon the DePIN framework, ensuring a community-owned network. This process begins with Ozak Streaming Network (OSN) providing real-time data, which is then securely stored in Ozak Data Vaults.

The core innovation lies with The Neuron, the platform’s AI, which performs complex analysis and generates prediction outputs, providing these outputs to users via the Eon interface.

Furthermore, $OZ token holders have exclusive access to AI agents, data feeds, governance rights, and staking chances, rounding out a distinctive, decentralized, and user-centric financial intelligence environment.

Also, Ozak AI has forged various agreements to boost its ecosystem and accelerate its future growth. On that point, a recent one is with Meganet, which involves employing decentralized edge computing to obtain real-time data with minimal latency.

Conclusion

As Ozak AI continues to surpass expectations, instances like this trader’s flipping strategy, yielding over 120% gains, highlight the project’s growing impact on the market. With its presale nearing completion and an exchange listing on the horizon, Ozak AI is rapidly emerging as one of the most notable AI-crypto projects, outperforming several established assets.a

For more information about Ozak AI, visit the links below,

- Website: https://ozak.ai/

- Twitter/X: https://x.com/OzakAGI

- Telegram: https://t.me/OzakAGI

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

US Prosecutors Seek 12-Year Prison for Do Kwon Over Terra Collapse

Highlights: US prosecutors requested a 12-year prison sentence for Do Kwon after the Terra collapse. Terraform’s $40 billion downfall caused huge losses and sparked a long downturn in crypto markets. Do Kwon will face sentencing on December 11 and must give up $19 million in earnings. US prosecutors have asked a judge to give Do Kwon, Terraform Labs co-founder, a 12-year prison sentence for his role in the remarkable $40 billion collapse of the Terra and Luna tokens. The request also seeks to finalize taking away Kwon’s criminal earnings. The court filing came in New York’s Southern District on Thursday. This is about four months after Kwon admitted guilt on two charges: wire fraud and conspiracy to defraud. Prosecutors said Kwon caused more losses than Samuel Bankman-Fried, Alexander Mashinsky, and Karl Sebastian Greenwood combined. U.S. prosecutors have asked a New York federal judge to sentence Terraform Labs co-founder Do Kwon to 12 years in prison, calling his role in the 2022 TerraUSD collapse a “colossal” fraud that triggered broader crypto-market failures, including the downfall of FTX. Sentencing is… — Wu Blockchain (@WuBlockchain) December 5, 2025 Terraform Collapse Shakes Crypto Market Authorities explained that Terraform’s collapse affected the entire crypto market. They said it helped trigger what is now called the ‘Crypto Winter.’ The filing stressed that Kwon’s conduct harmed many investors and the broader crypto world. On Thursday, prosecutors said Kwon must give up just over $19 million. They added that they will not ask for any additional restitution. They said: “The cost and time associated with calculating each investor-victim’s loss, determining whether the victim has already been compensated through the pending bankruptcy, and then paying out a percentage of the victim’s losses, will delay payment and diminish the amount of money ultimately paid to victims.” Authorities will sentence Do Kwon on December 11. They charged him in March 2023 with multiple crimes, including securities fraud, market manipulation, money laundering, and wire fraud. All connections are tied to his role at Terraform. After Terra fell in 2022, authorities lost track of Kwon until they arrested him in Montenegro on unrelated charges and sent him to the U.S. Do Kwon’s Legal Case and Sentencing In April last year, a jury ruled that both Terraform and Kwon committed civil fraud. They found the company and its co-founder misled investors about how the business operated and its finances. Jay Clayton, U.S. Attorney for the Southern District of New York, submitted the sentencing request in November. TERRA STATEMENT: “We are very disappointed with the verdict, which we do not believe is supported by the evidence. We continue to maintain that the SEC does not have the legal authority to bring this case at all, and we are carefully weighing our options and next steps.” — Zack Guzmán (@zGuz) April 5, 2024 The news of Kwon’s sentencing caused Terraform’s token, LUNA, to jump over 40% in one day, from $0.07 to $0.10. Still, this rise remains small compared to its all-time high of more than $19, which the ecosystem reached before collapsing in May 2022. In a November court filing, Do Kwon’s lawyers asked for a maximum five-year sentence. They argued for a shorter term partly because he could face up to 40 years in prison in South Korea, where prosecutors are also pursuing a case against him. The legal team added that even if Kwon serves time in the U.S., he would not be released freely. He would be moved from prison to an immigration detention center and then sent to Seoul to face pretrial detention for his South Korea charges. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Cashing In On University Patents Means Giving Up On Our Innovation Future