XRP Price Plunges 3.5% As Santiment Says Soaring FUD May Spark A Rally

The XRP price plunged 3.5% over the past 24 hours to trade at $2.09 as of 2:34 a.m. EST on trading volume that plunged 4% to $3.2 billion.

This comes as social media intelligence platform Santiment says that social sentiment data shows that XRP is experiencing “the most fear, uncertainty, and doubt (FUD) since October.”

XRP is the worst performing top 10 crypto in the last 24 hours and is now down 42% from its July 2025 all-time high (ATH) of $3.65.

Despite a 7% drop in the past month, XRP is showing signs of a recovery after surging 9% in the last 2 weeks. Can the Ripple token head higher?

XRP Price Poised For A Sustained Recovery

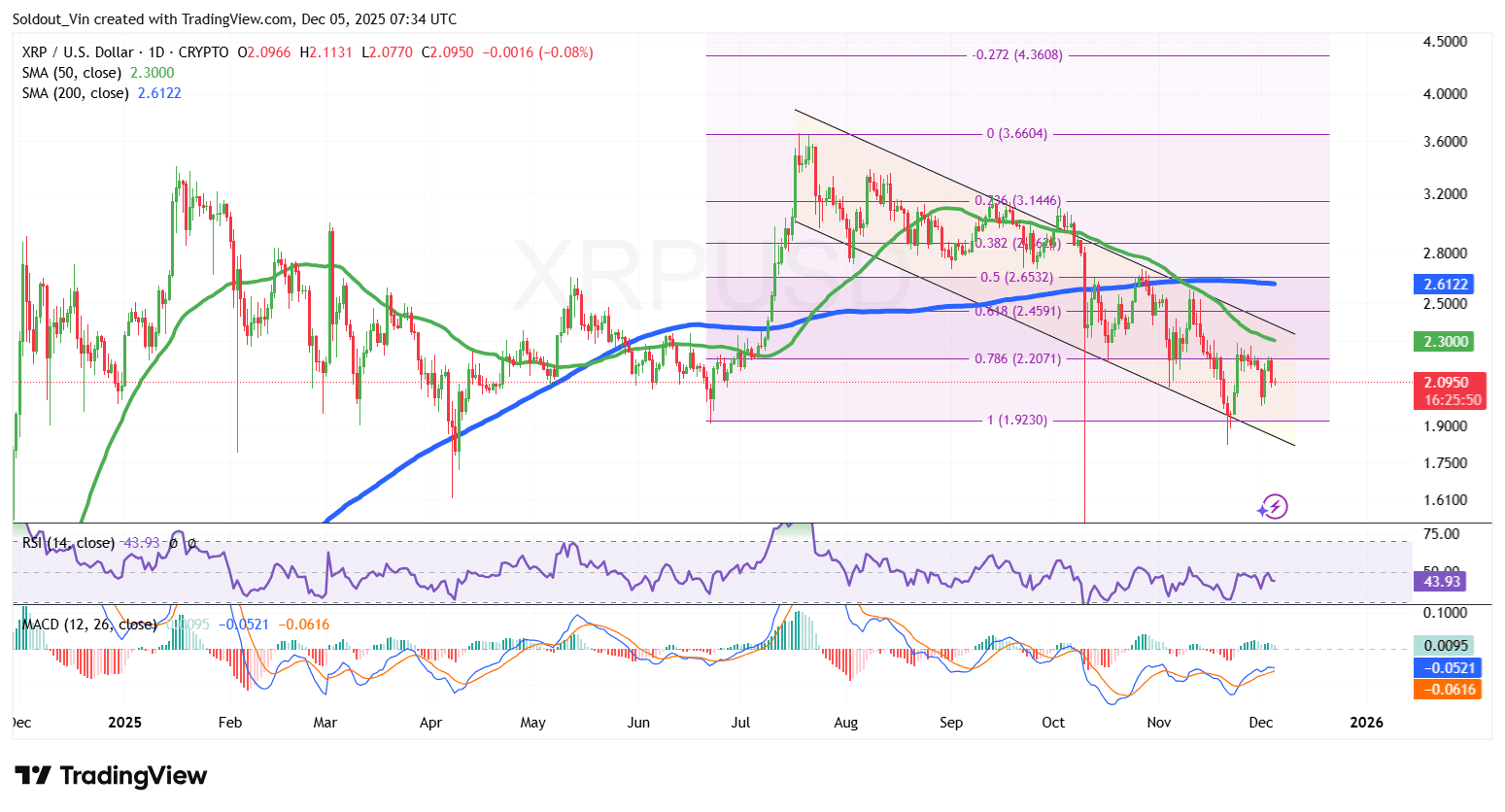

The XRP price saw a strong rally in July, surging to the upper region of the Fibonacci extension zone before losing bullish momentum near the $3.14–$3.66 resistance zone. This rejection marked the beginning of a downtrend as bears stepped in to secure profits.

As sellers took control, XRP broke beneath both its 50-day and 200-day Simple Moving Averages (SMAs). This drop was further fueled by a bearish trend structure forming below the 200-day SMA around the $2.60 region, shifting market sentiment into a firm plunge.

This bearish breakdown ultimately drove XRP toward the lower boundary of the falling channel, with the token approaching the $1.92–$2.00 support area aligned with the 1.0 Fibonacci retracement level.

However, this key demand zone allowed buyers to re-enter the market. The price of XRP has since recovered into the mid-range of the channel, now trading around the $2.09–$2.20 region as it slowly pushes toward the 50-day SMA near $2.30.

The Relative Strength Index (RSI) is also showing signs of bullish intent. After approaching the oversold region in late November, RSI has bounced and is now hovering around the 44 area, moving steadily back toward the neutral 50-level, despite its consolidation around this zone.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator supports these early recovery signals. The blue MACD line has crossed above the orange signal line, and green histogram bars are beginning to print as bearish momentum cools, a clear signal of a potential shift despite the recent downtrend.

XRP/USD Chart Analysis Source: TradingView

XRP/USD Chart Analysis Source: TradingView

Ripple Token Poised For A Recovery Toward Key Resistances

Based on the XRP/USD price analysis, XRP appears positioned for a possible relief rally, with a potential move toward the 0.382 Fib level near $2.82 or the 0.236 Fib region around $3.14, representing a 30–35% upside from current levels.

XRP has repeatedly respected the lower boundary of its falling channel pattern, and the latest bounce suggests that momentum may be shifting.

A sustained rebound could allow the Ripple token price to climb higher into the highlighted supply zone between $2.80 and $3.10.

The first resistance level is at the 50-day SMA ($2.30), followed by the 200-day SMA ($2.61–$2.62), both levels that are acting as crucial barriers.

Conversely, if the price of XRP is rejected around the 50-day SMA, the token could still continue to trade inside the falling channel. In this bearish scenario, XRP could retrace back toward the key demand zone near $2.00–$1.92 if buying momentum fades.

Related News:

You May Also Like

Index Falls 1.5% as Nearly All Constituents Decline

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise