Why Digitap ($TAP) Crypto Presale Could Onboard More Users Than Hyperliquid

But as the week unfolds, the old pattern seems to have returned – sharp pushes with no follow-through, resistance cutting every rally short, and a chart that creates noise instead of confidence. The end of this week favors Digitap ($TAP) instead. Its crypto presale pushed past $2.2 million, crossed 95% completion, and continues to accelerate as more users download the live omni-bank app and begin spending with real cards.

Hyperliquid may have started the week in the spotlight, but Digitap is ending it as the best crypto presale with real momentum and a clear path forward.

Hyperliquid’s Chart Holds Traders Back

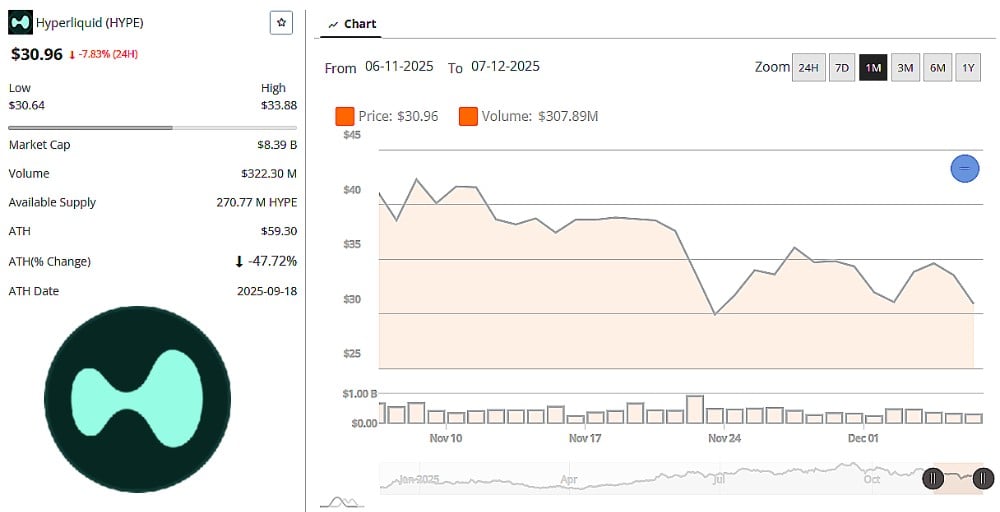

HYPE is showing its first signs of stabilization after several weeks of declines, with the token recently rebounding from the closely watched $31–$33 support region and returning to what many traders view as its accumulation band. The move comes as broader crypto markets remain mixed, yet HYPE continues to draw attention thanks to ongoing ecosystem development and the emergence of clearly defined. As of now, the asset trades around its support line at $30, down nearly 9% over the last day as liquidity begins rotating back into mid-caps.

Hyperliquid has found support at $30 in the last month, but has failed to breakthrough resistance above $42. Price source Brave New Coin HYPE market data.

One of the first notable shifts was highlighted by market commentator Crypto King, who noted that HYPE had “tapped a major support zone” that has repeatedly acted as a market floor across prior cycles. Early higher-low formations on lower timeframes reinforce the view that sentiment may be shifting, and analysts tracking the pattern see a potential path toward liquidity areas at $38 and $45 if volume expands. The defense of support is particularly notable given heightened volatility across altcoins this week.

Another perspective came from Sjuul, who said HYPE is beginning to “show some signs of life” after printing a potential double bottom in the $30–$32 demand zone. Still, the analyst urged caution around the key resistance at $37, a level that rejected price in late November and remains HYPE’s most stubborn short-term barrier. A clean reclaim of this area is seen as necessary before any meaningful bullish continuation takes hold, with potential upside opening toward $42–$45 if momentum accelerates.

Support near $30 holds for now, yet every recovery stalls before a real trend forms. The chart shows brief spikes, fast drops, and no real direction. This signals uncertainty instead of conviction. For buyers lookking for an altcoin to buy with real adoption potential, Hyperliquid’s chart does not offer a long runway. It moves, but it does not onboard. It trades, but it does not build.

Digitap Leads the Best Crypto Presale Category

Digitap enters this cycle with a completely different setup. It is not offering a future idea or a roadmap filled with promises. It is delivering a working product right now. The omni-bank app is already live in the Apple App Store and Google Play Store. Users can download it today, open an account, generate virtual cards, spend across borders, and manage both fiat and crypto inside one smooth platform.

This puts Digitap in a separate class from the usual crypto presales. Most early projects hope to build something later. Digitap built first, then opened the doors. That level of execution explains why more than 137 million tokens have already been sold and why its presale continues to accelerate even as the wider market hesitates.

Source: Digitap

The project’s tiered pricing setup adds a compelling narrative for early buyers in the presale. Stage 1 began at $0.0125, and the current stage’s price of $0.0334 shows how the structured progression has unfolded so far. The next stage is set to rise to $0.0361, leading into a planned listing price of $0.14. Together, these benchmarks highlight the project’s forward-looking launch design and pricing structures favor early investors.

These numbers matter because they show a clear, built-in upward path. Digitap rewards early buyers with structure, confidence, and a defined value curve – something traders rarely get in a new altcoin to buy.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

For anyone searching for the best crypto presale with real adoption already underway, Digitap shows why it leads: a live product, a fast-growing user base, and a price trajectory that strengthens long before the token lists.

A Deflation Engine That Keeps Pushing $TAP Higher

Digitap’s design centers on predictable value. The supply is fixed at 2 billion tokens, with no inflation and no hidden emissions. The platform burns tokens through real usage, not marketing promises. Half of all platform profits go directly to buybacks and burns, which creates permanent scarcity as the user base grows.

The staking system offers up to 124% APR during the crypto presale and rewards long-term holders through a non-inflationary pool. This means growth does not rely on minting new tokens. It relies on actual activity across Digitap’s global payment system.

Hyperliquid does not offer this engine. Its moves depend on traders, not users. Digitap advances through adoption, real spending, and an economy that gains strength as more people join.

This is the kind of structure that turns $TAP into an altcoin to buy for anyone who cares about long-term value instead of short-term swings, and it places Digitap among the strongest crypto to buy picks at this stage.

Digitap Is Ready to Scale — And the Window Is Narrow

Digitap enters this cycle with everything needed for fast expansion: a live money app, Visa-linked cards, offshore account options, and instant multi-currency payments. It behaves like a fintech platform with crypto built into its core, not the other way around. This gives $TAP a path to onboard far more users than Hyperliquid.

The timing also matters. The current presale round is nearly sold out, and the next price increase to $0.0361 is hours away. This creates one of the last early entries before $TAP reaches its launch target. The structure potentially rewards those who act early.

Digitap stands out in a crowded market as a crypto to buy already operating at scale. Hyperliquid trends on charts, but Digitap builds real financial tools that work today. For anyone searching for the best crypto presale before the next cycle turns, Digitap offers the clearest setup and the strongest upside.

Digitap is Live NOW. Learn more about their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Team Launches AI Tools to Boost KYC and Mainnet Migration for Investors