Best Crypto to Buy Now: XRP Price Prediction

XRP has delivered one of its most intriguing periods in recent memory, marked by a clear disconnect between strengthening fundamentals and restrained price action.

While the broader crypto market has been under pressure, with Bitcoin falling below $86,000 and Ethereum sliding under $2,900, XRP has continued to quietly build momentum beneath the surface.

Despite trading in a relatively tight range between roughly $1.70 and $1.91 and struggling to reclaim the psychological $2 level, developments around Ripple and XRP suggest that the asset may be laying the groundwork for a much larger move in the years ahead.

This backdrop keeps XRP price prediction centered on gradual accumulation and patience, with $XRP increasingly viewed as a best crypto to buy now candidate for investors looking beyond short-term market noise.

XRP Sees Record ETF Inflows Despite Broader Crypto Outflow

One of the most compelling narratives supporting XRP right now is the surge in institutional participation. Spot XRP exchange-traded products have surpassed $1 billion in total net inflows since launch, recording weeks of consecutive inflows without a single day of net outflows.

This streak stands in stark contrast to Bitcoin and Ethereum ETFs, which collectively experienced billions of dollars in outflows over the same period.

Such consistency signals deliberate, long-term positioning rather than speculative trading, reinforcing the idea that institutional capital is quietly accumulating exposure to XRP even as broader market sentiment remains cautious.

Source – Whale Insider X

Regulatory progress has further strengthened this thesis. U.S. banking regulators have granted conditional approval to several crypto-related firms, including Ripple, to pursue national trust bank charters.

This development is significant because trust banks serve as a bridge between traditional financial institutions and digital asset infrastructure, enabling regulated custody, asset management, and deeper integration with legacy finance.

Rather than remaining on the fringe, XRP and Ripple appear to be embedding themselves directly into the evolving financial system, a move that could have long-term implications for adoption and liquidity.

Source – Cilinix Crypto YouTube Channel

Why XRP Price Remains Range-Bound Despite Institutional Inflows

Still, the question remains: why hasn’t price responded more aggressively? On-chain data offers a clear explanation. Long-dormant XRP supply has begun re-entering circulation, with older holders taking advantage of renewed interest to sell into strength.

This selling pressure has partially offset ETF inflows, keeping price range-bound. Historically, such tension between accumulation and distribution often precedes sharp breakouts once supply overhang diminishes and sentiment flips decisively bullish.

Adding to the speculative upside are emerging discussions around potential mainstream integrations and ambitious long-term projections, including the possibility of XRP significantly closing the gap with Ethereum’s market capitalization by 2026.

While such outcomes are far from guaranteed, the convergence of institutional inflows, regulatory clarity, and infrastructure expansion suggests that XRP’s current consolidation may be less a sign of weakness and more a period of quiet preparation.

If broader market conditions improve and resistance levels give way, XRP could transition rapidly from subdued performance to an aggressive upside phase.

XRP Price Prediction

XRP price prediction remains neutral to cautiously bearish in the short term as the market continues to absorb recent selling pressure. Price action shows XRP trading below the key $1.98–$2 resistance zone, a level that must be reclaimed to shift momentum decisively higher.

Until that happens, the structure favors consolidation rather than an immediate breakout. Strong support is forming in the $1.84–$1.82 range, which has so far limited deeper downside moves.

A failure to hold this area could expose $XRP to a pullback toward the $1.75 region, where buyers previously stepped in. Despite near-term weakness, XRP’s broader structure remains constructive after clearing major cycle highs earlier in the year.

The current $1.80–$1.90 zone is significant, as it acted as resistance before a powerful rally in the past. If market conditions improve and resistance breaks, a move back toward the $3.60 area would represent substantial upside from current levels.

Analysts Highlight Top Crypto to Buy Now as Alternatives to XRP

At present, ETF inflows by themselves are proving insufficient to drive a sustained move higher. As demand cools and on-chain indicators remain mixed, $XRP’s price continues to hover between firm support and gradually increasing selling pressure.

This environment has pushed some market participants to explore alternatives such as crypto presales. Below are two emerging projects that analysts have already highlighted among the best crypto to buy now.

Maxi Doge (MAXI)

Maxi Doge has been gaining traction in the meme coin space despite a generally fearful market throughout 2025. The coin, positioned as a pure meme coin, has seen steady activity with 55 buyers over the last 24 hours, which is notable during periods of low retail interest.

Its presale has already surpassed $4.3 million. Market conditions, including volatility and extended fear cycles, have created opportunities for selective accumulation in the dog-themed coin sector.

Source – Alessandro De Crypto YouTube Channel

Historically, similar coins have rebounded strongly after dips, often outpacing larger counterparts like Dogecoin. Maxi Doge benefits from this pattern and the overall resurgence of interest in meme coins as sentiment improves.

Analysts note that the coin’s simple approach and timing during the market’s bottoming phase may position it for meaningful gains in the months ahead. To take part in the $MAXI token presale, visit maxidogetoken.com.

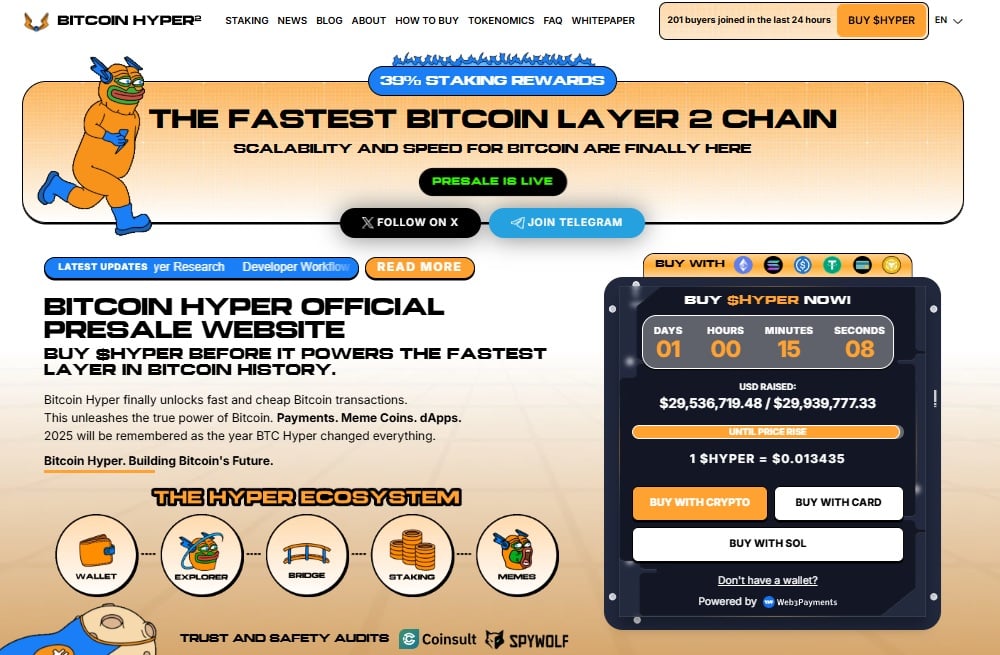

Bitcoin Hyper (HYPER)

Bitcoin has recently experienced a notable pullback from its all-time highs near $126,000 down to around $87,000, creating widespread fear despite being a relatively modest decline.

This drop highlights the market’s sensitivity, but it also underscores the growing interest in solutions that enhance Bitcoin’s utility, such as layer 2 networks like Bitcoin Hyper which already raised nearly $30 million.

By allowing near-instant transactions while maintaining the security of the Bitcoin blockchain, these networks aim to address Bitcoin’s slow transaction times and limited everyday usability. Such developments are influencing market sentiment and helping diversify options for investors.

For those seeking alternatives or broader exposure, Bitcoin Hyper and similar projects are increasingly discussed as part of the best crypto to buy now for potential growth. This combination of innovation and strategic investment could reshape Bitcoin’s practical value.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.