Shiba Inu Whale With 16.4% Of Total Supply Breaks Multi-Year Silence

A long-dormant Shiba Inu wallet that on-chain watchers have tracked since the meme coin’s early days just pinged the market again — this time by sending a chunky clip of SHIB to an exchange.

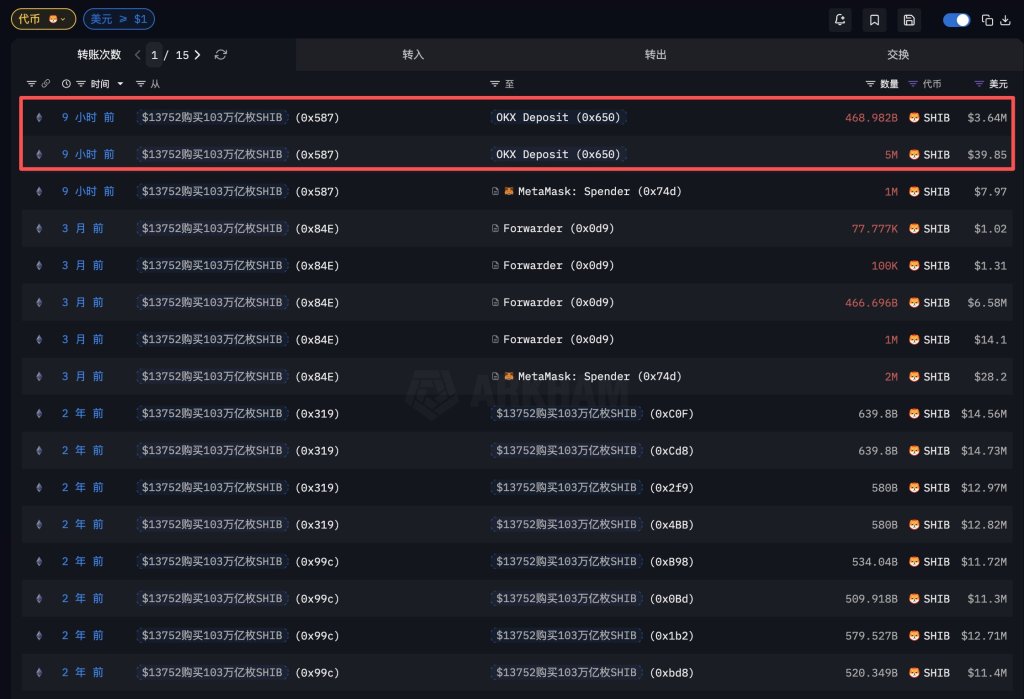

According to posts from on-chain analyst 余烬 (@EmberCN), the address moved roughly 469 billion SHIB (about $3.64 million) into OKX roughly nine hours before the post hit X on Dec. 18, 2025.

Mega Whale Stuns Shiba Inu Community

In 2020, the “top whale” who bought 1.03 trillion $SHIB (17.4% of the total supply) using only 37.8 ETH ($13.7K), transferred 469 billion SHIB ($3.64 million) into #OKX 9 hours ago,” EmberCN wrote.

That “top whale” label is doing a lot of work here. The wallet is known for an almost absurd entry: buying roughly 103 trillion SHIB back in 2020 for just 37.8 ETH. Then the 2021 mania happened. At the cycle peak, that stake would have been worth around $9.1 billion. And the whale, famously, didn’t cash most of it.

EmberCN says the address still controls about 96.684 trillion SHIB, or roughly 16.4% of total supply, valued around $722–$726 million depending on the price snapshot used. “At the 2021 price peak, his 1.03 trillion SHIB was worth $9.1 billion. He has not sold the vast majority of these coins yet, and currently still holds up to 96.684 trillion SHIB (16.4% of the total supply), worth $726 million,” @EmberCN explained.

The reason traders care about “to OKX” is obvious: deposits to exchanges can be a prelude to selling, collateralizing, or rotating into something else. Still, a deposit is not a sale. Overall, it’s unclear whether the SHIB has been dumped yet.

Zoom out and it’s not the first time the wallet has stirred. EmberCN previously flagged activity in July 2023, describing transfers of 1.5 trillion SHIB split across three addresses (500 billion each) after a long dormant stretch.

On July 12, already alerted the Shiba Inu community when he posted: “After being dormant for 610 days, he made another move: 4 hours ago, he transferred 1.5 trillion SHIB to 3 addresses, with 500 billion SHIB ($3.75M) to each address. He bought 1.03 quadrillion $SHIB, and only sold 1.9 trillion SHIB ($18.79M) in 2021 at a price of 0.0000098. The remaining 1.01 quadrillion (17.2% of the total SHIB supply) is distributed across 17 addresses and held to this day, with a current total value of $760 million.”

So, is this “the” sell signal? Maybe. Maybe not. But when an entity sitting on 16.4% of supply starts routing size toward an exchange again, the market tends to stop scrolling.

At press time, SHIB was down 3.9% over the past 24 hours, more or less tracking the broader market wide pullback in the same window. On the chart, it’s not pretty: the current weekly candle has broken below a key support zone around $0.00000790.

That puts the Oct. 10 low at $0.00000680 back in play as the next obvious downside check. If that level gives way, traders will likely start eyeing the June 2023 low near $0.00000543 as the next major reference point.

You May Also Like

BUIDL VIETNAM 2023 is coming back stronger than ever to HCMC this June 2023

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam