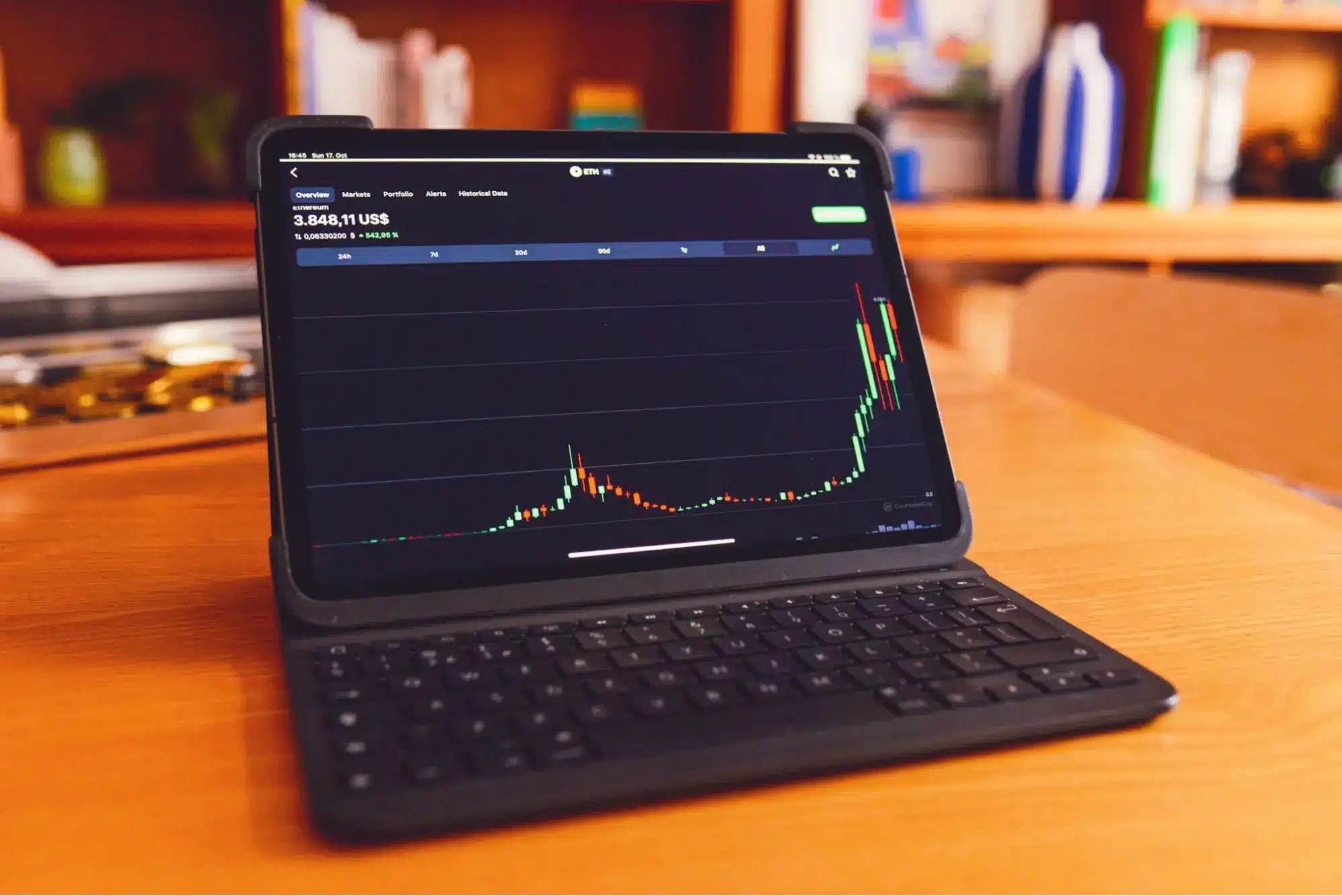

Ethereum (ETH) Price Analysis: $3,400 Upside vs $3,000 Support

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is the driving force behind the decentralized finance (DeFi), non-fungible token (NFT), and Layer 2 Network ecosystems.

At present, ETH is consolidating after the recent market flush that took out all of the excess leverage. At press time, Ethereum is trading at $3,218.74 with a decline of 3.42% over the past 24 hours.

Chart Shows Key Resistance and Early Momentum Recovery

In the daily chart from TradingView, rather than moving more into a confirmed bullish trend, we remain below the 200-day Moving Average (MA), which indicates caution for the medium term. In addition, the 50-day MA represents resistance at this point in time (or near-term) for ETH in addition to a horizontal supply level ranging from $3,230-$3,300.

If ETH continues to break this area and sustain a breakout above these areas, then a continuation on the bullish side of the chart can occur. Both momentum indicators are curling up and starting to show early signs of recovery, but we are still not at the point where we can confirm a bullish outcome.

Also Read: Ethereum (ETH) Shows Potential Upside with Key Levels Toward $3,700 Target

Liquidation Data Points to $3,400 as Upside Pressure Zone

Market analyst Ted Pillows has provided liquidation estimates on his recent update on X, showing that if ETH trades up to $3,400, approximately $3.48 billion of the current short interest stands to be liquidated.

On the downside, if ETH drops to $3,000, approximately $2.5 billion of long positions will be liquidated. The recent flush of the ETH ledger shows how this disparity in positions can create greater potential price magnetism for upside liquidity zones in the short term.

In conclusion, ETH is presently between two highly liquid areas of price, thus this next breakout will likely be highly impactful. As long as the price holds above $3,000, there continues to be the potential for bullish case scenarios.

However, should ETH get near $3,400, this situation may be accelerated due to increased short position liquidations. Trade volume and confirmation signals should be closely observed as price volatility continues to develop.

Also Read: Ethereum Bullish Structure Holds, Eyes $3,500 Breakout

You May Also Like

MakinaFi suffered an attack that resulted in the loss of approximately 1299 ETH, with some funds being preemptively processed by MEV.

Magic Eden co-founder sees 'speculation supercycle' ahead