Analyst Will Sell Everything And Go All-In on Bitcoin at This Price: Details

The past week or so only intensified bitcoin’s otherwise bearish sentiment that began in early October, and the asset plunged to $81,000, which was its lowest level since December.

While some reports indicate that whales have reentered the BTC ecosystem in their most significant buying spree in two years, one popular analyst believes there’s more downside risk for the cryptocurrency.

As such, he outlined his target at which he plans to “sell everything” and go all-in on BTC. And that target, according to Ali Martinez, is $45,163, which is the lowest level on the 3-day chart he posted on X.

Before that, Martinez outlined the next significant support levels for BTC in case its correction continues. The first is situated at around $76,000, followed by $56,200, and $53,000 if the first two give in.

The cryptocurrency decline over the past week was largely attributed to the rising geopolitical tension, this time between Iran and the US, as the latter’s president ordered a large naval fleet to move closer to the Middle Eastern country.

Additionally, the US Federal Reserve paused its interest rate cut policy, which was also believed to be bearish for risk-on assets.

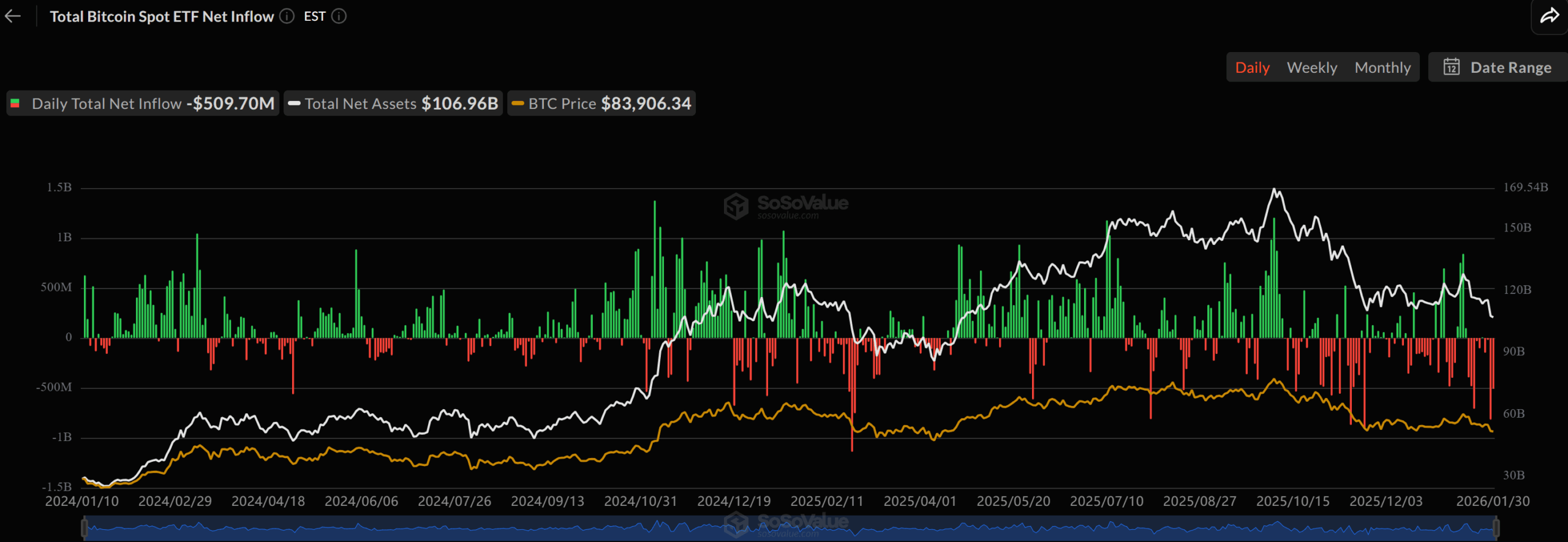

Wall Street investors using the spot BTC ETFs to gain exposure to the asset have seemingly turned away, pulling out roughly $1.5 billion in the past week. Thursday was the worst day in a while, with more than $800 million leaving the funds on that day.

The cumulative net inflows have dropped to $55 billion, which shows a $3 billion decline since mid-January.

Bitcoin ETF Flows. Source: SoSoValue

Bitcoin ETF Flows. Source: SoSoValue

The post Analyst Will Sell Everything And Go All-In on Bitcoin at This Price: Details appeared first on CryptoPotato.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt