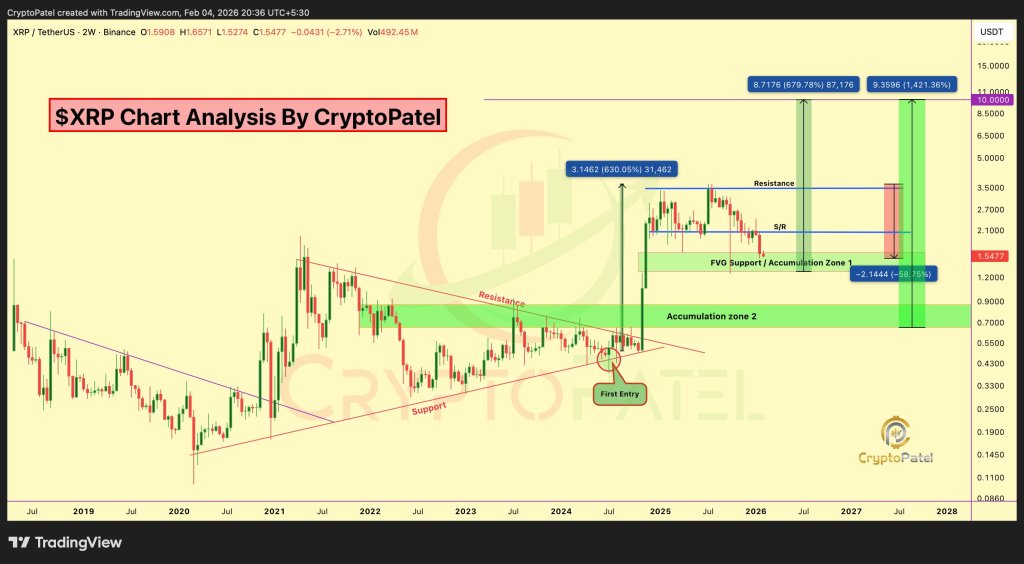

Is The XRP Bottom In? Traders Pin The Floor Between $1.20 And $1.00

XRP is down 58% from its all-time high, and two popular chart-focused accounts on X are framing the drawdown as a potential accumulation window rather than a trend break.

How Low Will XRP Price Go?

Crypto Patel (@CryptoPatel) told followers on Feb. 4 that XRP/USD has “entered our first accumulation zone at $1.50–$1.30.” In his post, he urged staggered entries rather than trying to time a single bottom. “Start buying slowly at these levels, no rush, just steady accumulation,” he wrote, positioning the move as capital-preservation after what he described as an earlier call highlighting a “bottom accumulation zone.”

On the risk side, Patel tied his next decision point to the $1.30 level, suggesting a deeper set of bids if that floor breaks. “If XRP breaks below $1.30, place your entry bids between $0.90–$0.70,” he wrote. “But here’s the thing — if price hits that zone, it could be the best long-term accumulation opportunity for maximum profits.”

He added that his “long-term target remains $10,” arguing that entry discipline matters more than headline targets: “Buying at $3 or $2? Not ideal in my view. If the target is $10, why not aim for entries at $1.50–$1 during hard dips for much bigger returns?”

Patel also leaned on his prior public call as evidence of a repeatable framework. He said he shared an XRP setup at $0.50 in the last bear market and that XRP later rallied to $3.66, which he characterized as “over 600% profit.”

XRP Bottom In March?

A separate post from Charting Guy framed the selloff less as a new regime and more as a familiar cycle structure. “XRP repeating 2021, bottom in march roughly around $1.20 imo,” he wrote, adding: “maybe wick to $1 to scare the hoes. The bear market is almost over.” When asked directly by another user—“Bear market ends in march?”—Charting Guy replied: “yep.”

In Charting Guy’s weekly XRP/USD chart, the roadmap is framed around a rising multi-year trendline and a Fibonacci ladder drawn across the move, with several of those Fib levels clustering right where he expects a March low.

On the retracement side, the chart labels the key downside bands at roughly 0.618 ($0.915) and 0.702 ($1.2149), with additional levels below at 0.5 ($0.615) and 0.382 ($0.413). Charting Guy’s “bottom in March roughly around $1.20” lines up almost directly with the 0.702 Fib (~$1.215), while his “maybe wick to $1” comment points toward a deeper flush into the space between $1.00 and the 0.618 Fib (~$0.915).

What makes that zone more than just a horizontal level on his layout is the trendline confluence. The green, rising trendline he’s drawn from the 2020–2022 base is shown catching price into early March (his vertical marker sits around Mon 02 Mar ’26), with the trendline effectively rising into the same $1.00–$1.20 neighborhood.

In other words, his implied “March bottom” isn’t just a date call, it’s a confluence call: trendline support rising into the 0.702 retracement area, with room for a volatility wick closer to the 0.618 if the market tries to force capitulation.

Above spot, the chart also shows the upside Fib extensions he’s using as reference points: 0.786 ($1.612), 0.888 ($2.274), and the prior swing reference around 1.0 ($3.317), with higher extensions marked at 1.236 ($7.349), 1.272 ($8.297), 1.414 ($13.389), and 1.618 ($26.630).

At press time, XRP traded at $1.3888.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Kalshi debuts ecosystem hub with Solana and Base