XRP Price Eyes a Comeback as Open Interest Falls to 2024 Levels

Key Insights:

- XRP price prediction indicates XRP is eyeing a comeback, as it is down by almost 60% just 6 months after attaining a historic top.

- Rapid crash wiped out its appeal in the derivatives market with open interest cooling to multi-month lows.

- Less volatility, more appeal? XRP whales may be ready to jump back in despite extreme FUD.

XRP has become somewhat of a rockstar in the crypto market for multiple reasons. Its issuer took on the SEC and won after a lengthy legal battle. Moreover, Ripple has been working towards becoming a critical part of the global financial system.

Those factors have cultivated an extremely bullish XRP price prediction, but the last few months have been anything but bullish. The cryptocurrency has lost almost 60% of its value since its July 2021 peak.

Unfavorable market conditions have maintained their grip on the crypto market this week. This may translate into more XRP price slippage. However, it is worth noting that the XRP price was already oversold at press time, hence, potential recovery could be on the cards.

XRP Price | Source: TradingView

XRP Price | Source: TradingView

XRP price just extended its bearish trend, and was on track to hit its 5th consecutive week in the red. The cryptocurrency was down by almost 15% in the last 24 hours at its $1.28 press time price tag, and over 64% from its July top.

Open Interest Cools to More Than 12-month Lows as XRP Price Retreats

While XRP price action reveals the level of value erosion over the last few months, it has also had a major impact on XRP derivatives. According to CoinGlass, XRP open interest is now down to $2.57 billion. That’s its lowest level in the last 12 months.

XRP Open Interest | Source: CoinGlass

XRP Open Interest | Source: CoinGlass

The XRP open interest is now hovering at levels seen in early 2025 and late 2024. Funding rates have also cooled significantly. It reflects the uncertainty in the market, which usually reflects periods of low demand.

But what does this all mean for XRP price action? The lower levels of open interest may be ideal for a bullish relief. This is because higher open interest translates to elevated volatility, usually characterized by liquidation events. In other words, XRP price may face less volatility when open interest is low.

XRP Price Prediction: Is a Bullish Recovery on the Cards?

It is hard not to wonder whether a bullish relief may take place soon, considering the heavily discounted crypto prices. XRP just retested a key price support level below $1.30.

It has so far tanked to levels last seen during the 10 October crash. This has analysts wondering whether it will bounce back from the same zone.

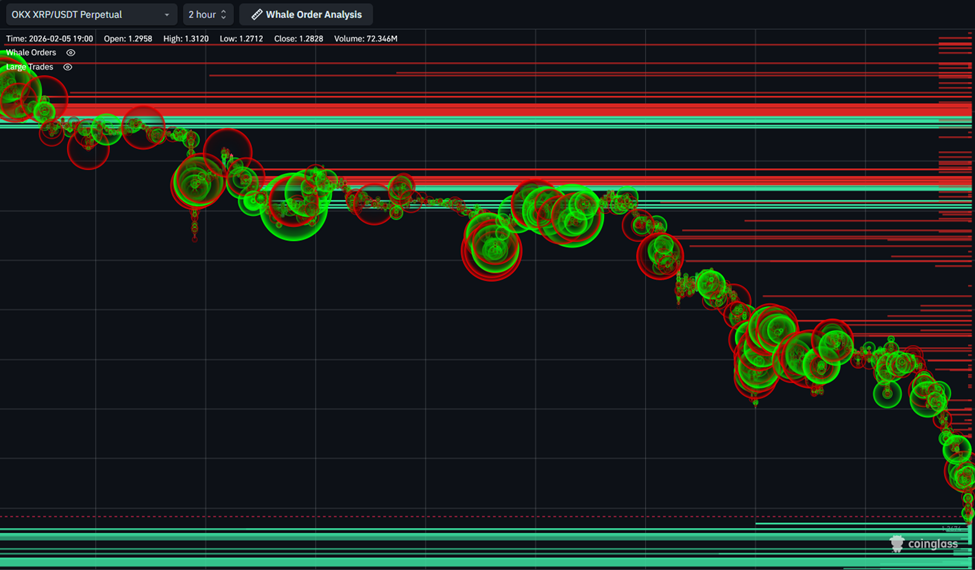

Interestingly, recent on-chain data revealed that spot demand from whales may be about to make a comeback. This is because whale order books revealed plenty of buy orders placed below the $0.25 price level.

Whale Buy Orders | Source: CoinGlass

Whale Buy Orders | Source: CoinGlass

Large order flow data previously revealed that some whales have been buying at discounted prices on the way down. The overall spot market reflects the price, meaning it has mostly been leaning in favor of net outflows.

For context, XRP has so far not had a single day of positive flows in the spot market in the first 5 days of the month. Moreover, the extensive capitulation across the market suggests that prices may fall even lower.

In conclusion, investors should now keep an eye out for key levels currently underpinned by whale buy orders. If XRP price fails to find support near $1.24, the next major support zone could be near $1.05.

The post XRP Price Eyes a Comeback as Open Interest Falls to 2024 Levels appeared first on The Coin Republic.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

Nubank plans stablecoin integration for credit card transactions

Nubank Vice-Chairman Roberto Campos Neto said the bank will test stablecoin credit card payments, as adoption of stablecoins accelerates across Latin America. Nubank, Latin America’s largest digital bank, is reportedly planning to integrate dollar-pegged stablecoins and credit cards for payments.The move was disclosed by the bank’s vice-chairman and former governor of Brazil’s central bank, Roberto Campos Neto. Speaking at the Meridian 2025 event on Wednesday, he highlighted the importance of blockchain technology in connecting digital assets with the traditional banking system. According to local media reports, Campos Neto said Nubank intends to begin testing stablecoin payments with its credit cards as part of a broader effort to link digital assets with banking services.Read more