With the fee switch activated and weekly buybacks, Resolv is more than just an Ehena imitation.

Author: Castle Labs

Compiled by AididiaoJP, Foresight News

What is Resolv

Resolv is an overcollateralized, interest-earning stablecoin protocol that mints USR and RLP. The USR stablecoin earns interest through delta-neutral strategies; RLP is a liquidity token that earns leveraged returns by assuming the risks inherent in these strategies.

USR and RLP users earn income from the liquidity staking income generated by ETH liquidity staking tokens (LST) and the funding rate obtained from shorting ETH on centralized exchanges.

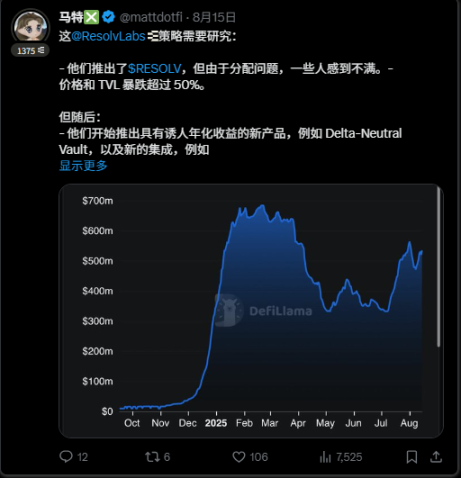

Resolv now has its own governance token, RESOLV, which can be staked to earn rewards. The token’s airdrop was not well received by the market, and many long positions were quickly liquidated, causing the TVL to drop by more than 50% from its all-time high (ATH) within a few months.

Then the Resolv team started announcing new partnerships, strategies, and protocol integrations, as well as fee switches (and token buybacks), and the price and TVL rebounded from recent lows.

Resolv Buyback Program

Last week, the Resolv Foundation launched a program to buy back RESOLV tokens, using revenue from the protocol on a weekly basis.

But where does this revenue come from? The protocol earns 10% from interest paid to the staking pool, as well as incentives from external participants like EtherFi, thanks to their fee switch enabled in July.

To date, the project has generated over $22 million in interest for its depositors, and since the fee switch went live, the protocol has accumulated $226,000 in fees, 75% of which has been used to buy back RESOLV.

Benefits of the Program

Not only are buybacks effective for token price growth because they reduce the circulating supply, but they are also important for what they represent to the community: the protocol is sacrificing some of the revenue that would have been earned by the team in favor of the project’s token.

These repurchased tokens will then be allocated to future initiatives to drive ecosystem development, effectively re-entering the protocol’s economics.

Supporting their tokens for the long term through buybacks is a reliable way to increase trust among community members and plan for the future of the token, effectively retaining more supply in the long term.

Final Thoughts

Redirecting a small portion of proceeds toward staking and buybacks is a necessary step to support a token that has yet to find its purpose, as stakeholders currently have no say in the future of the protocol.

While this move makes sense, I have some concerns about how these buybacks are executed. Weekly buybacks don't always align with market conditions (such as liquidity, volume, and spreads), so they could end up filling pending orders during price increases and provide limited support to prices when needed.

On the other hand, there are ways to improve this, such as developing a strategy that uses market maker (limit) orders to support prices when necessary, such as during cyclical declines, prolonged downturns, or when low liquidity conditions cause prices to fall. Fluid and Raydium have already used this strategy.

You May Also Like

Crypto’s Top 10 AI & Big Data Projects: ICP, Chainlink, and NEAR Lead Development Rankings

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy