Bitcoin ETFs Suffer $258M Outflow as ETH Bleeds for 4th Straight Day — Is a Major Crash Imminent?

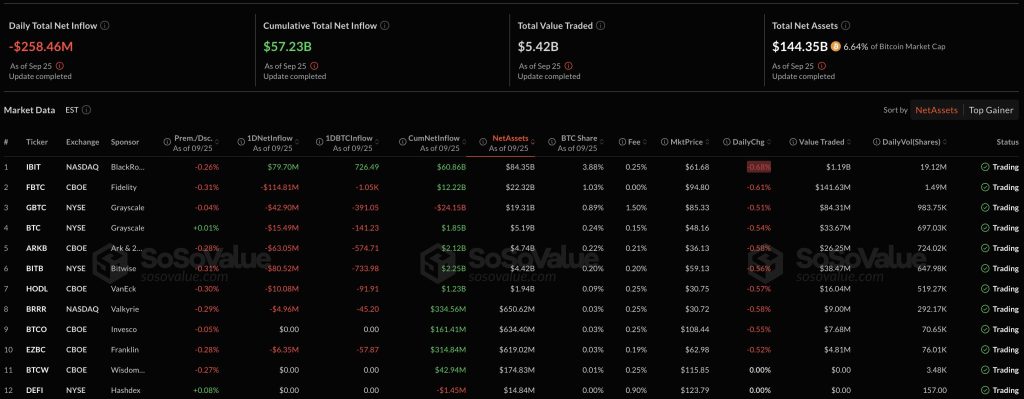

Bitcoin exchange-traded funds (ETFs) recorded another wave of investor redemptions on September 25, with $258.4 million in net outflows, according to SoSoValue.

The withdrawals come just a day after the products staged a strong rebound, showing continued volatility in institutional flows.

Bitcoin ETFs Fall to $144B Amid ETH Losing Over $500 Million in 4 days

BlackRock’s iShares Bitcoin Trust (IBIT) was the only bright spot, attracting $79.7 million in fresh inflows. IBIT remains the market leader, with $84.35 billion in net assets and cumulative inflows of $60.86 billion.

Bitcoin ETFs Inflow Chart September 25 Source: SoSoValue

Bitcoin ETFs Inflow Chart September 25 Source: SoSoValue

However, other major issuers saw heavy withdrawals. Fidelity’s Wise Origin Bitcoin Fund (FBTC) posted the sharpest single-day decline, losing $114.8 million.

Grayscale’s GBTC recorded $42.9 million in outflows, while Ark Invest and 21Shares’ ARKB shed $63.05 million.

Bitwise’s BITB lost $80.5 million, and VanEck’s HODL fell by $10.1 million. Valkyrie’s BRRR also saw smaller redemptions of $4.9 million.

In total, Bitcoin spot ETFs now hold $144.3 billion in assets, representing 6.64% of the cryptocurrency’s market capitalization.

Historical cumulative inflows stand at $57.2 billion, with total trading volume on September 25 reaching $5.42 billion. Ethereum products, meanwhile, extended their losing streak for a fourth consecutive day.

Ethereum spot ETFs reported $251.2 million in net outflows on September 25, bringing cumulative inflows to $13.37 billion and total assets under management to $25.6 billion, or 5.46% of ETH’s market cap.

Fidelity’s FETH again led the declines, with $158.1 million in outflows. Grayscale’s ETHE lost $30.3 million, its ETH fund saw $26.1 million in redemptions, and Bitwise’s ETHW shed $27.6 million.

Smaller withdrawals were also recorded from VanEck’s ETHV, Franklin’s EZET, and 21Shares’ TETH. BlackRock’s ETHA remained flat on the day, reporting no significant flows.

The persistent selling follows a difficult stretch for ETH products, as it records over $500 million in outflows in the last 4 days. On September 24, Ethereum ETFs lost $79.4 million, with Fidelity, BlackRock, and Grayscale leading the declines.

A day earlier, September 23 saw $140.7 million in redemptions, while September 22 marked $76 million in outflows, largely driven by Fidelity’s FETH.

Bitcoin ETFs have also faced sharp swings over the past week. After losing $363 million on September 22 and $244 million on September 23, the products staged a rebound on September 24, posting $241 million in inflows led by BlackRock’s IBIT.

The renewed outflows on September 25 suggest continued investor caution, with trading patterns closely tied to macroeconomic conditions, including the Federal Reserve’s recent rate cut and upcoming U.S. inflation data.

At present, Bitcoin spot ETFs remain the largest driver of institutional activity, but the latest redemptions across both BTC and ETH products highlight the fragility of sentiment in digital asset markets.

Bitcoin and Ethereum Extend Losses Amid Heavy ETF Withdrawals

The ETF outflow comes amidst the general drop in the crypto market. Crypto markets extended losses this week, with exchange-traded fund (ETF) outflows adding pressure to already fragile sentiment.

The global market fell 1.45% in the past 24 hours, pushing its seven-day decline to 6%.

Bitcoin (BTC) dropped 1.7% to $109,329, erasing nearly 6% over the past week. Ethereum (ETH) slid 1.5% to $3,956, deepening its seven-day loss to 12.5% as leveraged liquidations and ETF delays amplified the decline.

The pullback has erased gains from earlier in the month, when Bitcoin briefly logged its second-best September rally in 13 years.

Historically, September has been unkind to crypto, with negative returns in eight of the past 11 years. Analysts attribute the pattern to institutional portfolio rebalancing and fiscal year-end adjustments.

This year’s cycle appears to be following suit, as profit-taking and macro uncertainty weigh on sentiment.

On technical charts, Bitcoin trades below both its 50- and 100-hour moving averages near $113,700, reinforcing bearish momentum.

A descending triangle points to support at $107,300, with further downside possible toward $105,200 and $102,800. Resistance remains at $111,100 and $113,700.

Ethereum’s technical picture is similarly weak. Its relative strength index (RSI) has plunged from 82 earlier this month to 14.5, its most oversold level since June 2025.

Analysts suggest this could trigger a short-term bounce if ETH holds above $3,900. A failure, however, risks a deeper correction toward $3,600 or even the $3,000–$3,300 zone.

You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

Why Everyone Is Talking About Saga, Cosmos, and Mars Protocol