BlackRock’s IBIT Bitcoin ETF Becomes Top 20 Fund After Assets Hit $90.7 Billion

BlackRock’s iShares Bitcoin Trust (IBIT) has entered the top 20 list of the biggest ETFs (exchange-traded funds) for the first time, with its assets reaching $90.7 billion.

According to an X post by Bloomberg ETF analyst Eric Balchunas, IBIT is now ranked below the Vanguard Dividend Appreciation ETF (VIG US) with its $98 billion in assets, and above the Technology Select Sector SPDR Fund (XLK US) with its assets standing at $90.6 billion.

That’s after BlackRock’s spot Bitcoin ETF recorded its biggest net daily inflows since Aug. 14.

Analyst Says IBIT Could Enter Top 10 Around December 2026

Asked when or if IBIT could enter the top ten list, Balchunas said the milestone ”may not take long.”

“It took in $40b last 12mo and went up 85%,” Balchunas wrote, estimating it could enter the top 10 around Christmas next year.

Spot Bitcoin ETFs Continue Inflow Streak, Pull In Over $1.5 Billion In 3 Days

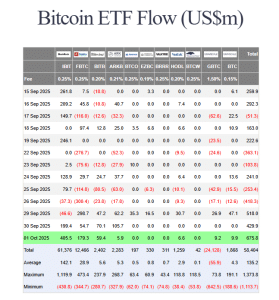

IBIT’s entry into the top 20 comes amid a multi-day inflow streak for US spot Bitcoin ETFs. In the latest trading session, the products pulled in another $675.8 million, data from Farside Investors shows. This was the ETFs’ highest net daily inflows since Aug. 14.

US spot Bitcoin ETF flows (Source: Farside Investors)

BlackRock’s IBIT led the charge in the latest trading session, with investors pouring in $405.5 million into the fund. The next-biggest net daily inflows were posted by Fidelity’s FBTC, which saw $179.3 million inflows on the day.

Other funds that recorded net daily inflows in the latest trading session were Bitwise’s BITB, ARK Invest’s ARKB, VanEck’s HODL, as well as both of Grayscale’s funds.

Meanwhile, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR and WisdomTree’s BTCW recorded no new flows on the day.

With yesterday’s inflows, the US spot Bitcoin ETFs extended their positive flow streak to three days as well. During this period, the products have pulled in more than $1.5 billion

BlackRock’s IBIT remains the spot Bitcoin ETF of choice, and leads in terms of cumulative net inflows. Investors have poured $61.376 billion into the fund since its launch last year.

In a Sept. 30 X post, Balchunas commented on the funds’ performance thus far, noting that the spot Bitcoin ETFs took in $7.8 billion in the third quarter this year.

The Bloomberg analyst added that the funds have also pulled in $21.5 billion year-to-date, and $57 billion since inception. However, some investors are still disappointed with how the products are performing.

Balchunas went on to criticize those investors who he says “live in childish fantasy” and are disappointed that the funds are not seeing “$1T of inflows every day.”

Nasdaq Submits Filing To List BlackRock’s Bitcoin Premium Income ETF

As IBIT continues to perform, Nasdaq has recently filed with the US Securities and Exchange Commission (SEC) to list and trade the asset management giant’s iShares Bitcoin Premium Income ETF.

BlackRock’s new fund includes a covered call mechanism that will generate consistent yield through Bitcoin exposure.

While IBIT tracks the spot price of Bitcoin, the Premium Income ETF adds an options overlay to extract extra income. The trust will invest mainly in BTC, IBIT shares, and cash reserves, according to the filing.

The SEC has already recognized that the filing complied with the general listing criteria. As such, the public comment period on the proposed rule change has been initiated.

Blachunas described the new fund as a “sequel” to IBIT, and said the product is not meant to diversify into other cryptos, but is instead intended to offer more options for investment within the Bitcoin ecosystem.

The new product filing comes after Bloomberg reported that IBIT recently surpassed Coinbase’s Deribit platform to become the largest venue for Bitcoin options trading. Open interest in options tied to IBIT reached nearly $38 billion, while options tied to Deribit only reached $32 billion.

You May Also Like

Schwartz Says He Knows of No Epstein Links to XRP or Ripple, Warns of ‘Giant Iceberg’

Why This Week’s Jobs Report and Earnings Matter More Than Usual