Bitcoin Miners Become the Unexpected Winners of the AI Revolution

As artificial intelligence reshapes global infrastructure demand, mining companies are quietly turning into the unlikely suppliers of choice for the world’s fastest-growing tech sector. A new report from Bernstein Research argues that miners’ access to pre-secured energy is giving them a rare advantage – one that could make them essential players in the next phase of the digital economy.

From Energy Burden to Strategic Resource

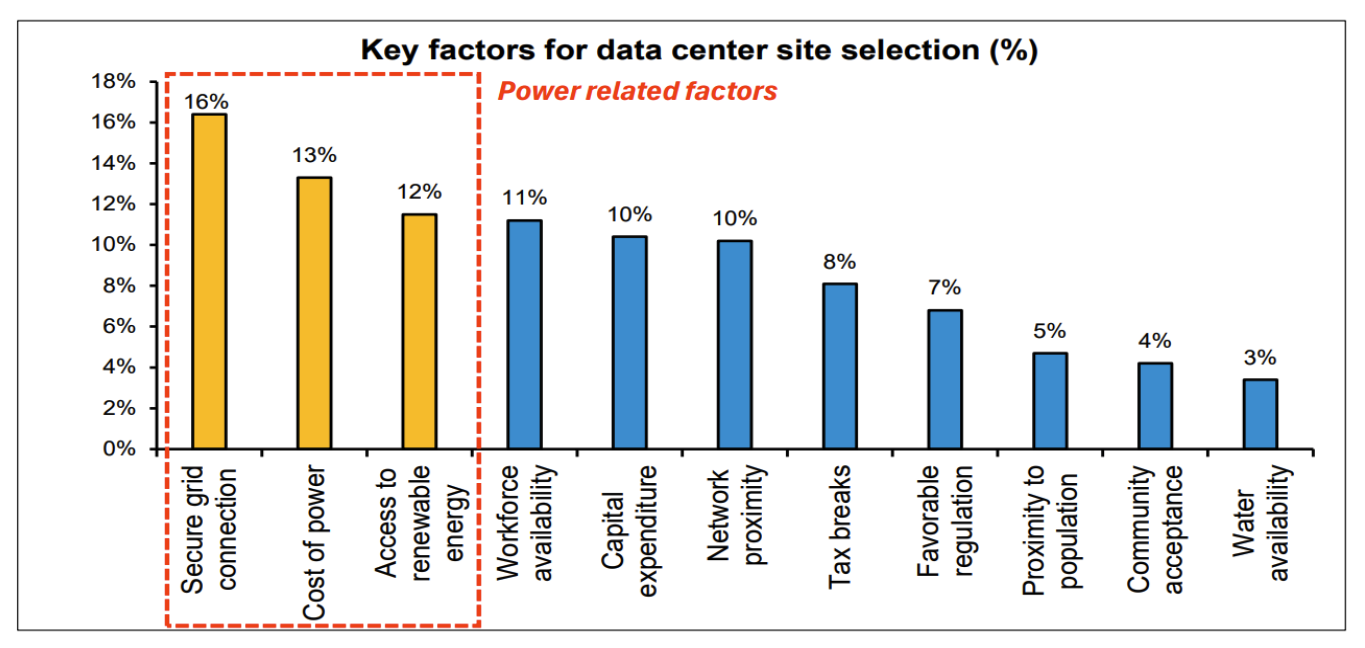

While AI firms struggle with grid congestion and multi-year interconnection delays, Bitcoin miners already sit on 14 gigawatts of power capacity spread across the U.S. and other regions. Much of it is located near underutilized renewable sources – a feature that’s now priceless in a country where connecting a new data center can take years.

“Power access has become one of the scarcest commodities in the U.S.,” Bernstein analysts led by Gautam Chhugani wrote. Their conclusion is simple: AI companies no longer have the luxury of waiting, and miners can deliver instant capacity.

That shift has turned miners from high-energy pariahs into strategic partners for the cloud computing world.

IREN: From Bitcoin to Blackwell

No company embodies that transition more than IREN. Once known purely as a Bitcoin miner, IREN is now building an AI empire powered by its existing energy infrastructure.

The firm controls roughly 3 gigawatts of active and planned power sites in North America and has started deploying over 23,000 NVIDIA GPUs, including the next-generation Blackwell chips designed for AI workloads.

Bernstein predicts IREN’s data center operations could surpass $500 million in annualized revenue by early 2026, driven by two flagship developments – a 50-megawatt liquid-cooled facility and a 2-gigawatt complex in Sweetwater, Texas.

Investors seem to agree. IREN’s shares have soared over 500% this year, including a 123% surge in the past month, bringing it within striking distance of Bernstein’s $75 price target.

A Rare Second Life for Bitcoin Infrastructure

The story here isn’t just about one company. It’s about an entire industry discovering a new identity. After years of being defined by Bitcoin’s volatility, miners are now reinventing themselves as the backbone of AI computing – repurposing existing facilities, cooling systems, and power contracts for machine learning workloads instead of mining blocks.

Bernstein’s researchers call this the “energy bridge” between crypto and AI. The miners’ early land grabs for electricity – once seen as reckless – are now paying off.

As one analyst put it: “Greenfield data centers take years. Miners can deliver in months.”

A Paradigm Shift

The transformation is redefining the conversation around energy use in technology. What began as a race for hash rate is turning into a race for compute power – and the same infrastructure that once sustained the Bitcoin network may soon fuel the AI revolution.

If Bernstein’s forecast proves right, the miners who powered crypto’s past might end up powering the future of artificial intelligence.

Source

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Miners Become the Unexpected Winners of the AI Revolution appeared first on Coindoo.

You May Also Like

The rise of the AI orchestrators

Breaking: CME Group Unveils Solana and XRP Options