China Hits Back at Trump’s Tariffs with Rare Earth Restrictions — Wipes Over $500M from Crypto Market

China has tightened export controls on rare earth magnets, escalating tensions with Washington and triggering widespread turbulence across global markets, including a $7 billion sell-off in cryptocurrencies.

The move, seen as direct retaliation against President Donald Trump’s newly announced 100% tariffs on Chinese goods, has reignited fears of a full-scale trade war between the world’s two largest economies.

Following the announcement, over 1.66 million traders were wiped out in 24 hours, resulting in $19.33 billion in liquidated positions. Bitcoin and Ethereum alone accounted for nearly $10 billion of those losses, making it one of the year’s most severe deleveraging events.

Additionally, the Crypto Fear & Greed Index plunged from a “Greed” level of 64 on Friday to 27 (“Fear”) on Saturday, its lowest in six months.

Rare Earth Exports Fall 31% as Beijing Tightens Controls

The latest measures expand Beijing’s existing restrictions to five additional rare earth elements, including holmium and erbium, requiring export approval for any product containing more than 0.1% of Chinese-sourced rare earths.

These materials are essential to industries ranging from electric vehicles and wind turbines to advanced defense systems.

With China controlling more than 90% of global rare earth processing capacity, the new policy has raised concerns over potential supply chain disruptions and mounting production costs worldwide.

Sources familiar with the matter said Chinese magnet manufacturers have been facing tighter scrutiny on export license applications since September. Approval processes have lengthened, with applications increasingly returned for additional documentation.

Though still within the Commerce Ministry’s 45-day window, the review process now resembles that of April, when export delays caused magnet shortages and temporary shutdowns at several automotive plants.

Data released Monday showed China’s rare earth exports plunged 31% in September, suggesting that the slowdown had already begun before the latest round of restrictions.

Beijing’s Ministry of Commerce has defended the controls, calling them “legitimate actions” intended to refine China’s export management system.

“China has consistently and resolutely safeguarded its own national security,” a spokesperson said, adding that the measures align with international standards.

President Trump, however, responded on Friday with a social media post promising a 100% tariff on all Chinese imports, accusing Beijing of “extraordinarily aggressive” export tactics. He also warned of possible U.S. export bans on critical software beginning November 1.

The exchange rattled markets and cast doubt on a potential meeting between Trump and Chinese President Xi Jinping later this month.

China fired back on Tuesday, vowing to “fight to the end” if the U.S. escalates. “The United States cannot simultaneously seek dialogue while threatening new restrictive measures,” China’s commerce ministry said in a statement.

Trump appeared to soften his stance on Sunday, posting that “it will all be fine,” calling Xi “highly respected,” and saying the U.S. wanted to “help, not hurt” China.

Crypto Market Sinks $7B as China Tightens Rare Earth Controls

The timing of Beijing’s move has also raised concerns within the crypto mining sector. Rare earths are vital for GPU and ASIC chip manufacturing, meaning tighter Chinese export reviews could increase hardware costs and potentially impact mining difficulty and network hash rates in the short term.

The Federal Reserve’s next moves could further sway sentiment. Fed Chair Jerome Powell is set to speak Tuesday at the NABE Annual Meeting in Philadelphia, where investors expect clarity on rate-cut prospects.

Analysts say any hawkish tone could deepen the market downturn, while signs of policy easing may stabilize risk assets

Despite the brief conciliatory tone, markets remained volatile. Wall Street suffered losses, with U.S. tech stocks falling over 2%, while global commodities rallied as investors shifted to safe havens. Gold surged to a record $4,200 per ounce, and silver climbed to $51.70.

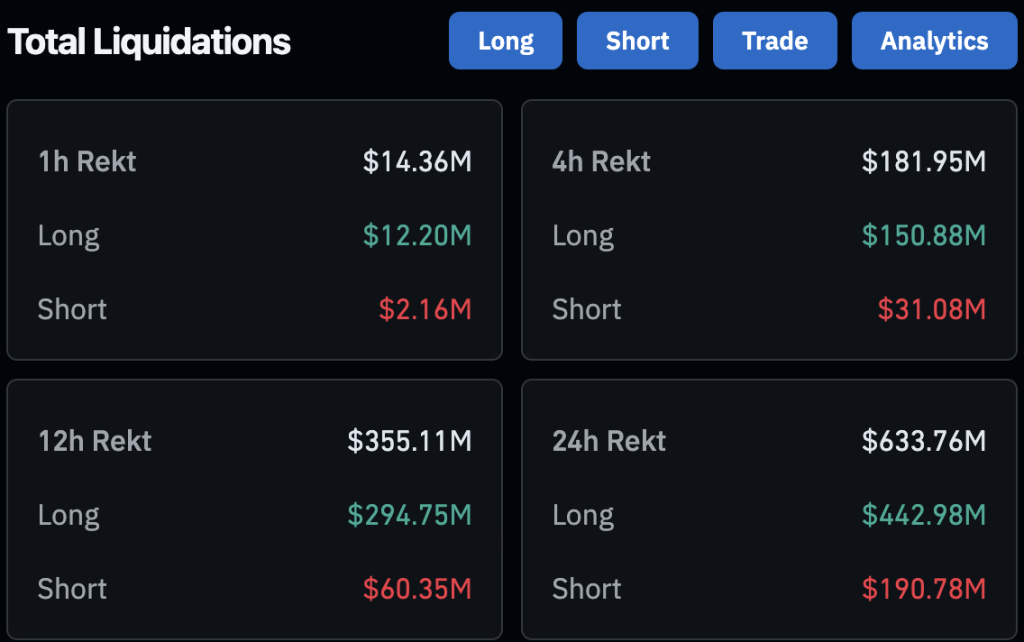

The crypto market bore the sharpest impact. Over $500M in leveraged positions were liquidated within hours of China’s announcement, as traders rushed to de-risk amid the mounting geopolitical uncertainty.

Source: Coinglass

Source: Coinglass

Bitcoin plunged 3.1% to around $113,600 before briefly dipping below $111,700. Ethereum fell 5.1%, trading below $4,000 for the first time in weeks.

XRP and Dogecoin each crashed by more than 30%, marking one of the steepest single-day declines this year.

The broader crypto market capitalization dropped 3.2% to $3.8 trillion.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

The Future of MarTech: Key Trends Shaping Marketing Technology Through 2030