Bitcoin Fear and Greed Index Plunges to 9-Month Low: Ultimate Buy The Dip Signal?

It’s safe to say that the overall narrative in the cryptocurrency markets has changed significantly in just over a month, and this is evident from the popular Fear and Greed Index.

The question now asked by several analysts is whether this is the moment where people can build generational wealth if they act properly.

Deep in Fear Territory

It was just over a month ago. The so-called ‘Uptober’ had just started, and bitcoin’s price was on the rise as it tapped a fresh all-time high of over $126,000. Everything seemed to be going well in BTC land.

However, this rally was short-lived, and the cryptocurrency started a prolonged correction that culminated in early November with the first dip below $100,000 since July. The landscape worsened on November 14 when the asset plunged below that level again, and all the way down to $94,000. This became its lowest price tag in six months.

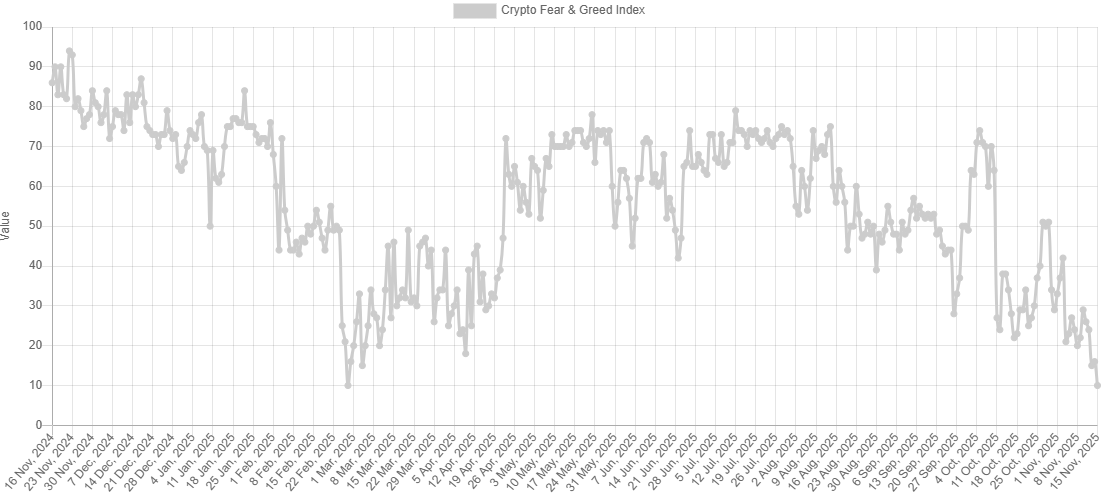

In retrospect, the Fear and Greed Index shows an interesting story. It jumped to ‘extreme greed’ territory in early October, which is typically followed by a correction. After all, remember the immortal words of Warren Buffett – be fearful when others are greedy (and vice versa).

The subsequent leg down changed the market sentiment, and the Index has plunged to 10 – the lowest level (meaning the deepest ‘extreme fear’ state) since late February. So, will there be a rebound if history is any indication?

Bitcoin Fear and Greed Index. Source: Alternative.me

Bitcoin Fear and Greed Index. Source: Alternative.me

Generational Wealth in the Making?

Given BTC’s performance following a sharp change in the Index, many now speculate whether this massive decline from 50 to 10 in the span of just a few weeks will provide a proper buying opportunity.

For example, BTC dropped below $80,000 in late February/early March when the metric reached similar levels. In a few weeks, it rebounded briefly to $88,000, and in a couple of months, bitcoin was back within a six-digit price territory.

Satoshi Flipper weighed in on the matter, predicting that investors can build “generational wealth” if they leave emotions at the door and capitalize on this momentum.

The post Bitcoin Fear and Greed Index Plunges to 9-Month Low: Ultimate Buy The Dip Signal? appeared first on CryptoPotato.

You May Also Like

Solana Price Stalls as Validator and Address Counts Collapse

Radar Detector Apps: Tech that Takes the Boredom Out of Road Trips