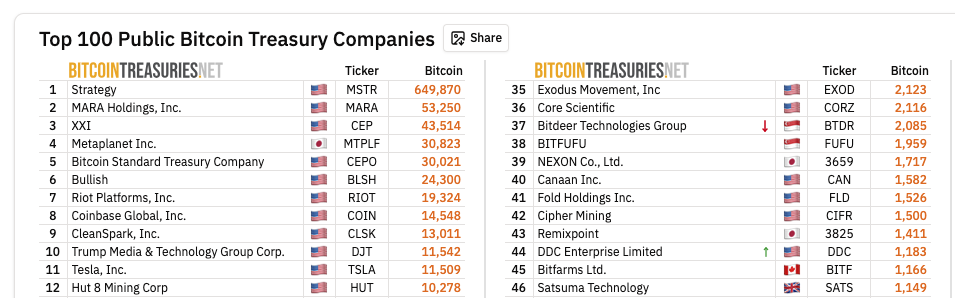

DDC Enterprise Becomes 44th Largest Public Bitcoin Holder After 100 BTC Purchase

DDC Enterprise Limited announced the acquisition of 100 Bitcoin BTC $89 882 24h volatility: 4.2% Market cap: $1.79 T Vol. 24h: $68.61 B , expanding its corporate treasury to 1,183 BTC, according to a statement issued on Thursday. With the purchase executed amid a market dip, the company emphasized its commitment to its long-term bitcoin investing strategy.

In the official press release, DDC reported its average cost per bitcoin at $106,952, while the updated balance translates to 0.039760 BTC per 1,000 DDC shares.

She added that the firm views Bitcoin as a strategic reserve asset and remains focused on building up shareholder value through periodic purchases.

DDC becomes 44th Largest public Bitcoin treasury in the US after 100 BTC purchase on Nov. 26 | Source: Bitcointreasuries.net

DDC also highlighted that its H2 Bitcoin yield to date stands at 122%, reflecting gains from its active treasury management framework. The company continues to participate in the broader corporate Bitcoin treasury movement while maintaining its operations as a global Asian food platform.

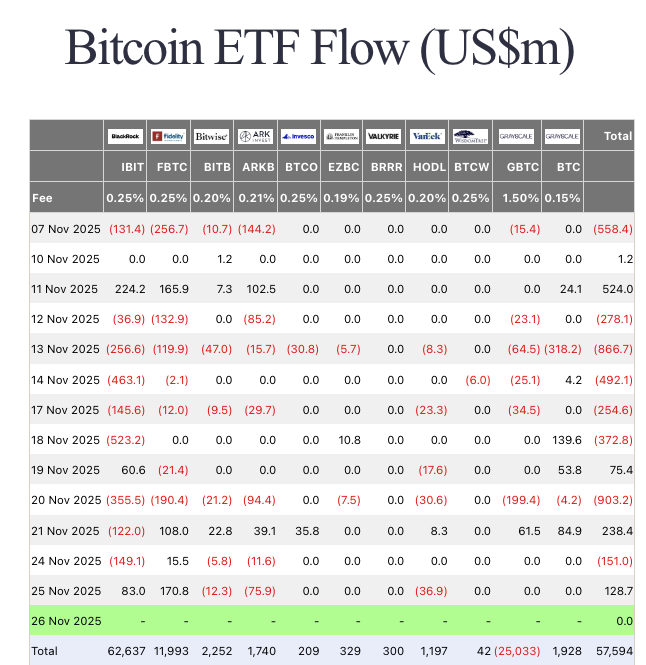

BlackRock Leads Corporate Buying After Trump’s Call to China’s President

Bitcoin’s push toward $90,000 was reinforced by a resurgence in corporate demand following US President Trump’s call with China’s leadership on Nov. 25. The discussion produced eased trade tensions, triggering risk-on sentiment across US tech stocks and adjacent crypto markets.

Blackrock returns to buying mode with $83 million on Nov. 25, ending a 3-day selling spree | Source: FarsideInvestors

US-listed Bitcoin ETFs recorded $128.7 million in total inflows on Nov. 25, as seen in FarsideInvestors data. BlackRock’s IBIT led the pack with $83 million in deposits, marking its first day of positive net flows since Nov. 19.

The improving macro and ETF momentum set the stage for corporate treasurers to re-enter the market. DDC’s 100 BTC purchase on Nov. 26 appears to follow this institutional rotation.

Best Wallet Presale Tops $17.6M as DDC Bitcoin Purchase Sparks Bullish Sentiment

DDC’s latest 100 BTC acquisition reinforced institutional demand, as capital flows rotated aggressively toward early-stage crypto projects.

Best Wallet, an AI-enhanced self-custody ecosystem, has now surpassed $17.6 million in presale commitments. The project integrates secure non-custodial storage, on-chain staking rewards, and multi-chain interoperability for traders seeking security and attractive yield income.

Best Wallet Presale

The BEST token presale remains active, with less than 24 hours to secure allocations at $0.026 before the next pricing tier activates. BEST tokens are available exclusively through the official Best Wallet website.

nextThe post DDC Enterprise Becomes 44th Largest Public Bitcoin Holder After 100 BTC Purchase appeared first on Coinspeaker.

You May Also Like

LTC Cloud Mining aims to make mining simple and accessible

Avalanche and Hyperliquid Lead Crypto Rally Post-Fed Rate Cut