Solana ETFs recover after 21-day losing streak, but SOL price breaks below $140

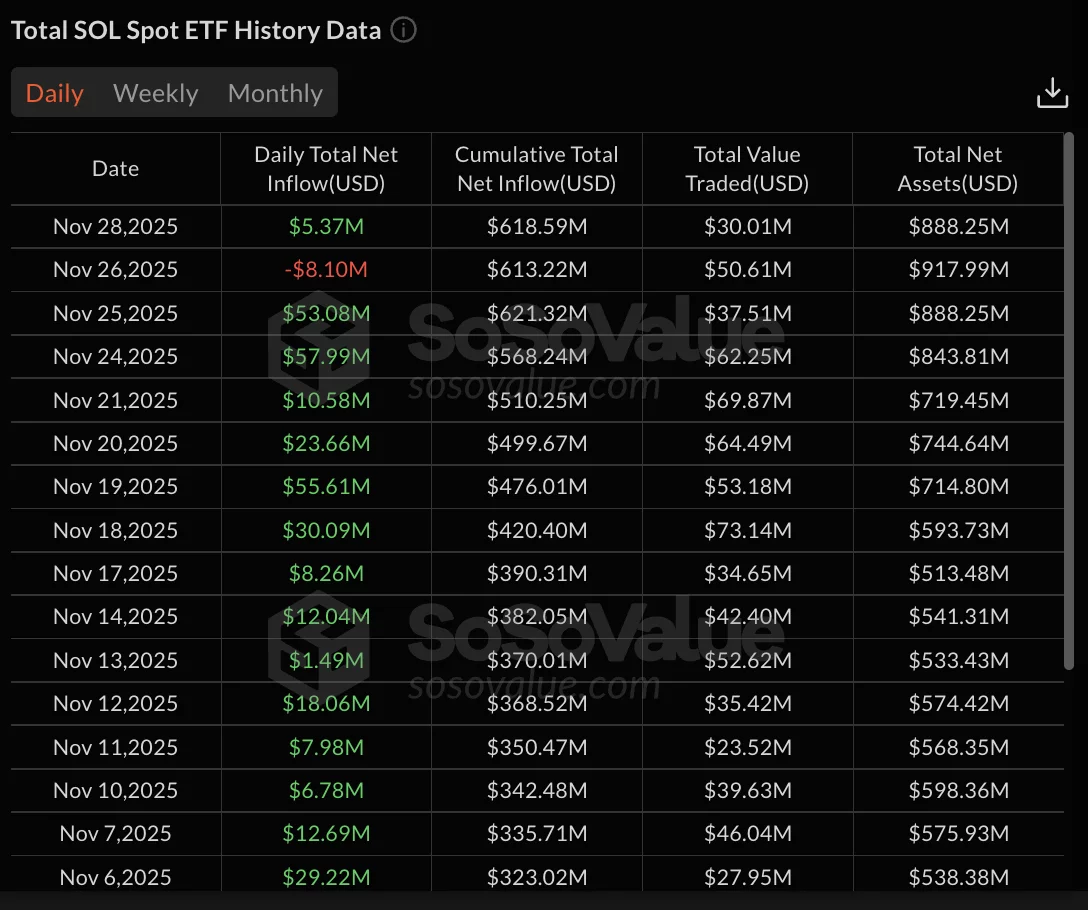

Solana spot ETFs recorded $5.37 million in net inflows on November 28, breaking a 21-day losing streak.

- Solana ETFs saw $5.37M inflows after 21 days of outflows, led by Grayscale and Fidelity.

- SOL price stayed below $140 despite ETF recovery, continuing its 30-day decline.

- Cumulative SOL ETF inflows hit $618.59M.

The recovery comes as Solana’s (SOL) price fell below $140, dropping to $137 amid broader market weakness.

Grayscale’s GSOL led the inflows with $4.33 million, while Fidelity’s FSOL attracted $2.42 million.

21Shares’ TSOL saw $1.38 million in outflows, partially offsetting the gains. Bitwise’s BSOL, VanEck’s VSOL, and Canary’s SOLC posted zero flow activity.

ETF recovery fails to lift Solana above $140

Solana price has dropped 2% over the past 24 hours and 30% over the past 30 days. The token traded as high as $143 in the last 24 hours before falling to its current level. SOL has gained 8% over the past seven days.

The November 28 inflows ended three weeks of consistent ETF outflows. November 26 posted the most recent withdrawal at $8.10 million.

Prior to that, SOL ETFs attracted $53.08 million on November 25 and $57.99 million on November 24.

Cumulative total net inflow across all Solana ETFs reached $618.59 million as of November 28.

Total net assets under management stood at $888.25 million. Total value traded hit $30.01 million on November 28.

Grayscale and Fidelity dominate November flows

Grayscale’s GSOL has accumulated $77.83 million in cumulative net inflows. Bitwise’s BSOL leads all Solana ETFs with $527.79 million in total inflows. Fidelity’s FSOL holds $32.30 million in cumulative assets.

21Shares’ TSOL has seen net outflows of $27.60 million since launch. VanEck’s VSOL and Canary’s SOLC maintain smaller asset bases.

The disconnect between ETF inflows and price action suggests institutional accumulation at lower levels.

While SOL ETFs attracted capital on November 28, the token continued its 30-day decline. SOL failed to reclaim $140 following the inflow recovery.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Subaru Motors Finance Reviews 2026