Ondo Finance Partners With State Street and Galaxy to Launch SWEEP Tokenized Liquidity Fund on Solana

- Ondo will anchor the new SWEEP tokenized liquidity fund on Solana with capital from its OUSG Treasury product.

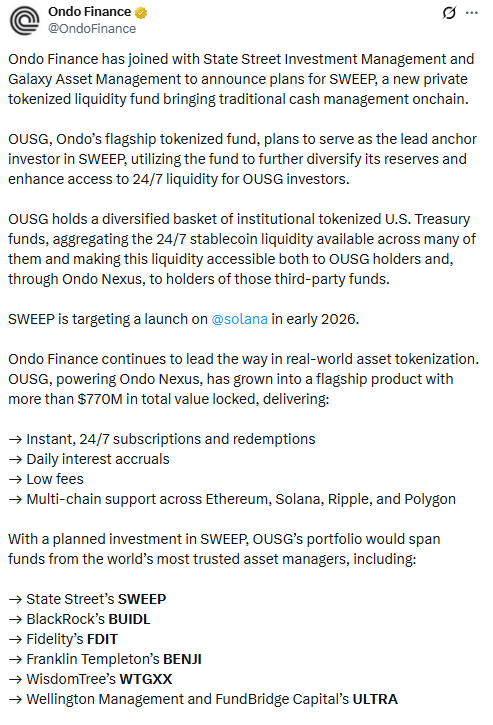

- OUSG’s portfolio will span tokenized funds from State Street, BlackRock, Fidelity, Franklin Templeton, WisdomTree and Wellington/FundBridge.

Ondo Finance has partnered with State Street Investment Management and Galaxy Asset Management to launch SWEEP, a private tokenized liquidity fund planned for the Solana blockchain in early 2026. The fund aims to bring traditional cash management strategies onchain while using Solana’s infrastructure for fast settlement.

According to Ondo, SWEEP will operate as an institutional liquidity product, giving qualified investors tokenized exposure to underlying cash-equivalent assets. The structure places State Street in the role of asset manager, with Galaxy involved on the digital asset and infrastructure side.

Ondo SWEEP Tokenized Liquidity Fund. Source: Ondo Finance on X

Ondo SWEEP Tokenized Liquidity Fund. Source: Ondo Finance on X

Ondo said its existing tokenized U.S. Treasuries product, OUSG, plans to act as the lead anchor investor in SWEEP once the fund launches. By allocating part of its reserves into SWEEP, OUSG intends to diversify its holdings and add another source of round-the-clock liquidity for OUSG investors.

Ondo to Anchor SWEEP and Broaden Tokenized Treasury Access

OUSG holds a basket of institutional tokenized U.S. Treasury funds, as outlined in our recent blog post. and aggregates the 24/7 stablecoin liquidity available across those vehicles. Ondo then makes that pooled liquidity accessible both to OUSG holders and, through its Nexus infrastructure, to investors in the third-party funds themselves.

The firm reports that OUSG now has more than 770 million dollars in total value locked. It offers instant subscriptions and redemptions at any time, daily interest accrual, comparatively low fees, and multi-chain access across Ethereum, Solana, Ripple, and Polygon. These features are designed to keep the product aligned with stablecoin-style liquidity while remaining backed by tokenized Treasuries.

With the planned SWEEP allocation, OUSG’s portfolio would extend across funds run by several major asset managers. Ondo lists State Street’s SWEEP alongside BlackRock’s BUIDL, Fidelity’s FDIT, Franklin Templeton’s BENJI, WisdomTree’s WTGXX, and ULTRA, a product from Wellington Management and FundBridge Capital.

Together, these tokenized funds form the core universe that OUSG uses for its onchain cash and Treasury strategy.

Ondo said it plans to keep working with State Street, Galaxy, and other institutions that are building tokenized products and infrastructure, as it positions OUSG and Nexus as components of a broader onchain financial stack.

]]>You May Also Like

Community Banks, Crypto Industry ‘Are Allies’ In CLARITY Act Clash: Exec

$350K Bitcoin Prediction by Robert Kiyosaki as Ethereum Remains Strong Despite Bearish Pressure and $HYPER Pumps