BTC Recalibrates After Fed Cut as AI Correlation Deepens, Says Nansen

Crypto markets are stabilizing after the Federal Reserve’s latest rate cut, with traders reassessing how a more data-dependent policy path may influence liquidity conditions heading into early 2026.

According to a new note from on-chain analytics firm Nansen, the combination of revised forward guidance, fresh liquidity tools, and shifting cross-asset dynamics has created a more complex environment for digital assets.

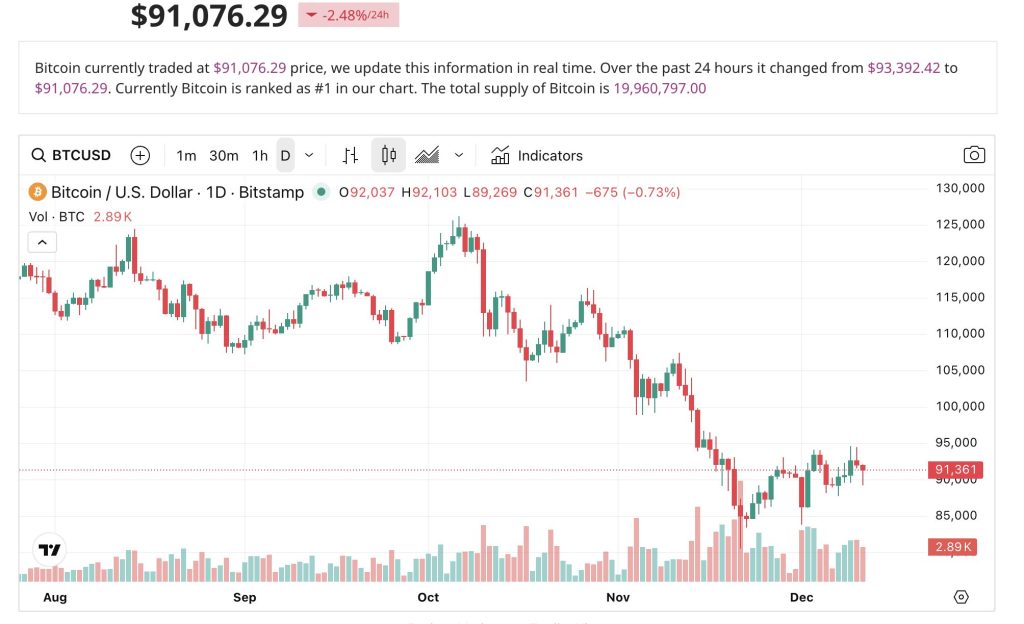

Earlier today, Bitcoin briefly rallied above $92,000 before retreating, mirroring broader volatility across risk markets following the Federal Open Market Committee (FOMC) meeting.

Aurelie Barthere, Principal Research Analyst at Nansen, said markets were braced for a rate cut paired with hawkish messaging but instead received a cut accompanied by “uncertain, data-dependent” guidance. The Fed’s introduction of T-bill purchases and removal of the cap on the standing repo facility added to the perception of a potential liquidity boost in the first quarter of 2026.

AI Stocks Drive BTC’s Latest Pullback

Bitcoin’s post-FOMC dip occurred alongside sharp moves in large U.S. AI names following Oracle’s earnings release. Barthere notes that while the AI sector continues to post strong earnings and capex growth, valuations have climbed to levels that are increasingly difficult to justify as 2026 approaches.

She added that BTC has shown rising correlation with AI-themed equities—a relationship she expects to persist. “I expect that relationship to continue until we see a more meaningful sell-off that fully ‘cleans’ valuations in the sector,” she said. As long as AI stocks react sharply to earnings surprises or guidance revisions, BTC is likely to echo those swings.

Key Resistance at $91K as Positioning Stays Stretched

From a technical and market-structure perspective, Barthere emphasized $91,000 as the dominant resistance level for BTC. Sustained trading above that mark for several weeks would be needed to confirm a renewed uptrend.

However, the derivatives markets are showing stretched positioning with open interest in both futures and options at record highs. Elevated leverage increases the risk of abrupt moves if sentiment shifts or liquidity thins.

Heading into year-end, traders are holding considerable downside protection. Options imply a 48% probability that BTC reclaims $91,000, and futures funding rates remain only mildly positive, suggesting leveraged longs are not aggressively dominating.

2026 Outlook: Bullish Options, Risk of Disappointment

Looking further ahead, Nansen notes that options markets are structurally bullish for 2026, reflecting expectations for improved liquidity, macro stability, and continued institutional inflows.

However, Barthere cautioned that such positioning could prove vulnerable if economic data or earnings trends fail to meet optimistic assumptions. With markets recalibrating, traders will be watching how liquidity dynamics evolve and whether BTC can break cleanly above resistance to regain upward momentum.

In September, Nansen announced the launch of Nansen AI, a mobile agent designed to transform how investors and traders interact with blockchain data.

You May Also Like

‘Slam dunk’ case? The brutal killing of a female cop and her son

Adoption Leads Traders to Snorter Token