Nigeria’s crypto P2P boom: the thrills, the scams, and the smart way out

Imagine sending your hard-earned USDT to a stranger, waiting for naira to hit your account, only to realise you’ve been scammed with a fake payment alert. This isn’t rare fiction in Nigeria’s crypto scene. It’s an everyday reality for thousands trading peer-to-peer.

Yet, despite the risks, P2P has fuelled $59 billion in crypto transactions here from mid-2023 to mid-2024. Nigerians love it for bypassing bank restrictions and grabbing better rates. But is the hustle worth the headache?

A new study by Breet entitled “The State of P2P in Nigeria 2025” sampled over 100 active traders, tested major platforms hands-on and analysed over 20,000 tweets to paint a vivid picture of what P2P trading feels like on the ground. The study focused on real user experiences with platforms like Binance, Bybit, Bitget, Gate.io, and NoOnes.

Researchers posed as sellers, captured screenshots of interfaces and disputes, and gathered candid feedback to gain insight into why P2P dominates but often disappoints.

The ugly side: scams, stress, and frozen funds

The report calls out fraud as the biggest nightmare. For every smooth trade, dozens leave users regretting their decision. Over 70% of surveyed traders admitted to losing money to scams at least once. Fake payment proofs top the list; buyers send doctored screenshots of bank transfers that never arrive. Sellers release crypto too early, and poof, it’s gone.

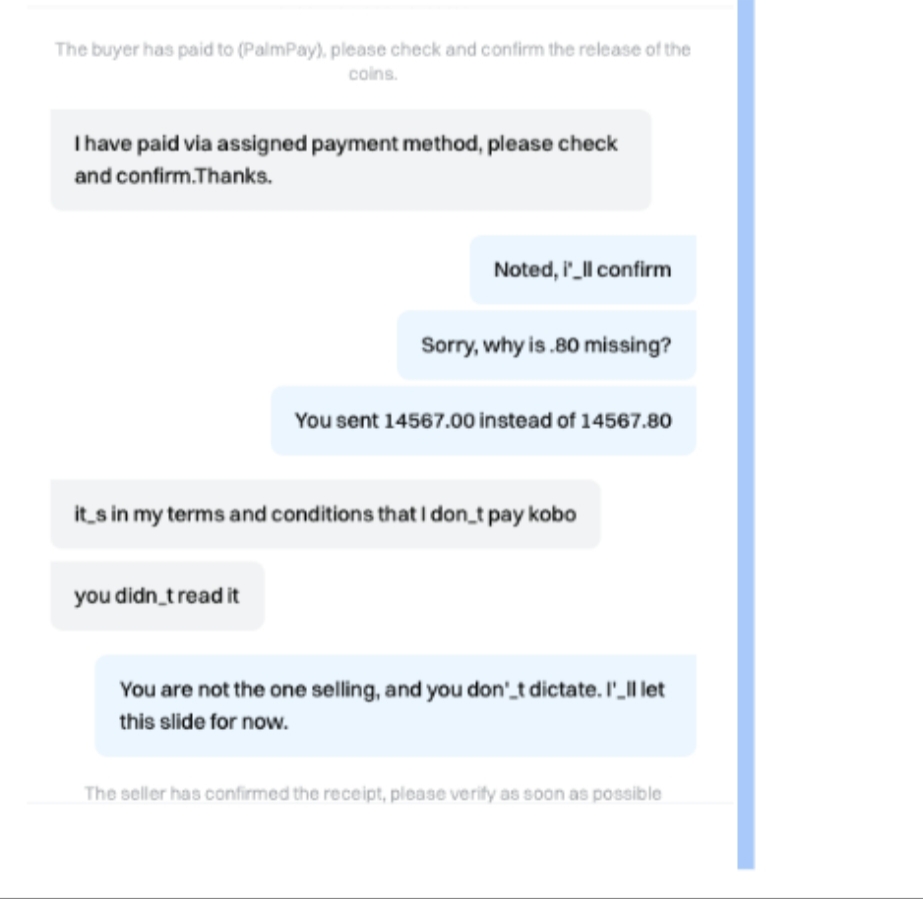

One of the most common challenges is what users call “Kobo chopping”.

A screenshot between one of the traders and a Breet user, arguing over kobo not being paid

A screenshot between one of the traders and a Breet user, arguing over kobo not being paid

This is where traders deduct small amounts from payouts. Over time, these losses add up. They can range from a few naira on small trades to hundreds spread across multiple deals. The issue persists because platforms do not automatically detect these discrepancies. The burden falls on buyers and sellers to notice and contest them.

Fake screenshots of payments have become an epidemic of sorts. In the study, nearly half of the respondents reported receiving bogus proof of transfer. Traders will show a convincing image of a bank transfer that never actually cleared. Once the seller releases their crypto, there is no way to reverse the deal. Weak verification systems and a lack of bank integration amplify this risk.

Ghosting is another frequent complaint. After agreeing to terms and locking crypto in escrow, some buyers disappear. Users recount waiting five to twenty minutes or more while their funds sit in limbo. In informal channels, like WhatsApp groups, this problem can balloon into hours of waiting and unnecessary stress.

The study highlights that many trades are pushed off-platform as soon as they begin. Messages like “add me on WhatsApp” were common across the dataset. Trading off-platform removes critical protections. No escrow. No dispute resolution. No safety net when things go wrong.

Finally, customer support on most marketplaces offers little respite. Users complain of slow response times, unresolved disputes and lack of accountability when a trade goes awry. As the Breet report notes, traders are often left to fend for themselves, even when platforms hold the power to intervene.

The good: Why Nigerians can’t quit P2P

That said, P2P has real wins that keep it king. Flexibility shines brightest. You negotiate rates directly, often beating centralised exchanges by 2-5%. In a country where currency volatility bites, that extra margin matters.

For a start, P2P works anywhere there is a smartphone and data. Traditional banking access in Nigeria is uneven. Roughly one-third of adults remain unbanked, and many more are underbanked. P2P bridges that gap. It allows people to trade crypto without a formal bank account or an international card.

Anonymity appeals too, with no heavy KYC for small trades on some platforms. A variety of payment methods, from bank transfers to mobile money, make it accessible. For freelancers paid in crypto or remitters dodging fees, it’s a lifeline.

There is real flexibility in pricing. Skilled traders can negotiate better rates than those on automated order books. In tight markets, this can lead to meaningful savings. For small-scale traders and casual users, that flexibility is part of the appeal.

P2P also shines in remittances. Traditional channels can charge up to eight or ten per cent and take days to settle. Crypto P2P routes can reduce costs significantly and get value to recipients faster. This has made P2P a preferred route for diaspora payments and cross-border settlement among freelancers and small businesses.

Most platforms offer escrow and dispute resolution features. When things go right, they protect both buyer and seller in a way that direct off-chain transactions cannot. For many users, this layer of trust, even imperfect, is preferable to dealing purely in cash or informal channels.

Finally, P2P has kept crypto alive in Nigeria amid regulatory uncertainty. After the Central Bank of Nigeria’s restrictions on banks serving crypto businesses in 2021, many global exchanges were forced to adapt or retreat. P2P trading provided continuity during that disruption.

What could be better?

The research makes clear that P2P still has structural weaknesses. First, platform technology must improve. Automatic detection of mispaid amounts, better bank verification integrations, and stronger fraud filters would reduce obvious scams.

Escalation processes should be faster. Waiting days for a dispute to be resolved is unreasonable when hundreds of thousands, if not millions, of naira are at stake. A working escalation pathway into live human support within minutes could change the user experience overnight.

The study also suggests a zero-tolerance policy for fake proofs and fraudulent behaviour. Permanent bans and shared blacklists among platforms could discourage bad actors. User education remains crucial. Many traders fall for the same tricks repeatedly simply because they do not recognise the red flags until it’s too late.

Regulatory clarity would also improve confidence across the ecosystem. While P2P will always involve human counterparts, sensible oversight and consumer protections would bolster trust without stifling innovation.

Smarter Alternatives

As Nigeria’s crypto ecosystem matures, alternatives to classic P2P are emerging.

Automated over-the-counter (OTC) solutions are one such option. They buy your crypto directly at competitive rates; no matching needed. Instant settlements, zero scam risk since there’s no counterparty. Breet stands out here, an OTC app focused on Nigeria, paying naira fast without the marketplace hassle.

In the end, P2P powers Nigeria’s crypto love affair, but the risks are real. Weigh the good against the bad, and maybe explore safer paths. Your wallet will thank you.

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

UK Energy Shock Threatens Crucial Bank of England Rate Cuts – Deutsche Bank Warns