XRP Market Structure Resembles That Of February 2022, Glassnode Warns

Glassnode says XRP is slipping back into a cost-basis configuration last seen in February 2022, with newer buyers accumulating at levels that leave a prior cohort “top” increasingly underwater, an on-chain setup that can shape sell pressure around key price zones.

In a note shared Monday via X, the analytics firm pointed to a rotation in realized prices by age band. “The current market structure for XRP closely resembles February 2022,” Glassnode wrote. It added that “psychological pressure on top buyers builds over time,” framing the current tape as one where patience is being tested rather than rewarded.

What This Means For XRP Price

The firm’s core observation is that wallets active in the short-term window, roughly the 1-week to 1-month cohort, are accumulating below the cost basis of holders in the 6-month to 12-month band. In practice, that means newer demand is stepping in at prices that are cheaper than what a meaningful slice of mid-term holders paid.

That relationship matters because cohorts tend to behave differently when price revisits their cost basis. When spot trades below a cohort’s realized price, that cohort is, on average, underwater. If the market rallies back toward that level, some of that supply can become eager to de-risk into breakeven, creating overhead liquidity that can cap upside until it is absorbed.

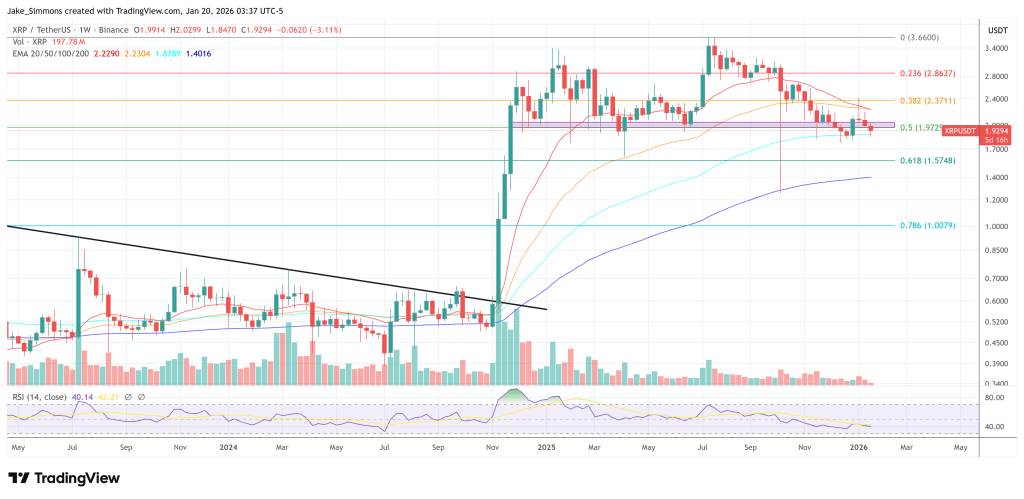

Glassnode’s “Realized Price by Age” chart (7-day moving average) visualizes this dynamic by plotting cohort realized prices against spot. The standout feature is the gap between shorter-term and 6–12 month cost bases during the most recent consolidation, echoing the firm’s February 2022 comparison.

With XRP price again trading slightly below the $2 mark, a post by Glassnode from Nov. 24 2025 also comes back into focus. Glassnode quoted this old X post in which it singled out $2 as the level where this cohort stress has been most visible in flows. “The $2.0 level remains a major psychological zone for Ripple holders,” the firm said. “Since early 2025, each retest of $2 saw $0.5B–$1.2B per week in losses,” a reminder that many holders have been exiting at a loss as price revisits that handle.

Those realized loss estimates are a key qualifier: they suggest that $2 is not just a chart level, but a behavior level, where spending decisions change and where capitulation (or forced de-risking) can cluster.

Notably, in February 2022, XRP put in a sharp round-trip: after slipping to about $0.6034 on Feb. 2, it ripped higher to the month’s peak near $0.8758 on Feb. 8, then rolled over into the back half of the month as macro risk accelerated. Then, XRP was back around $0.70 by Feb. 23–24 (roughly 20% off the Feb. 8 high), before bouncing into month-end near $0.7856 on Feb. 28.

The late-month downdraft coincided with the Russia–Ukraine escalation and the Feb. 24 invasion, which hit risk assets broadly and pushed major crypto lower intraday, consistent with the risk-off impulse seen across the entire crypto market.

At press time, XRP traded at $1.9294.

You May Also Like

Here’s How Consumers May Benefit From Lower Interest Rates

Discover Mono Protocol: The $2M-Backed Project Built to Simplify Development, Launch Faster, and Monetize Every Transaction