Is Canton Network Price Rally Coming with Rise In Adoption?

The post Is Canton Network Price Rally Coming with Rise In Adoption? appeared first on Coinpedia Fintech News

The Canton Network price continues to draw attention as institutional finance and crypto are converging around real-world utility. Now, as CC crypto is witnessing massive rise in its onchain adoption, large-scale collateral activity, and even sees renewed technical strength, its turns Canton Network’s position as a serious infrastructure layer for regulated financial markets more vividly.

Canton Network’s Institutional Design Comes Into Focus

The Canton Network crypto ecosystem is designed as a purpose-built institutional finance platform that blends privacy, compliance, and scalability within a public yet permissioned framework.

As discussions across traditional finance and blockchain intensify, RWA’s are displaying their edge with most potential for growth and projects surrounding these narratives could tend to grow faster, and here Canton Network is a clear example.

Notably, public commentary from major financial and blockchain infrastructure players has also strengthened Canton Network’s credibility as a settlement-grade blockchain.

Onchain Collateral and Always-On Markets

Moreover, in a recent post on X, the network mentioned a core inefficiency in global finance, where they highlighted that trillions of dollars in collateral remained idle due to operational friction.

By enabling real-time onchain collateral mobility, Canton Network seeks to address delivery failures, excess postings, and high trade operating costs that still dominate offchain systems.

In practice, Canton Network enables instant delivery-versus-payment settlement, allowing collateral to be financed, reused, and optimized intraday.

As a result, capital previously locked overnight can remain productive. This shift supports intraday repo markets, after-hours collateral mobility, and continuous precision rather than batch-based uncertainty.

Use cases such as repo markets, high-quality liquid assets, tokenized funds, and digital money for settlement are already forming the backbone of this always-on architecture.

Consequently, Canton Network price forecast discussions are increasingly tied to usage metrics rather than speculative narratives alone.

Ecosystem Growth and Onchain Metrics

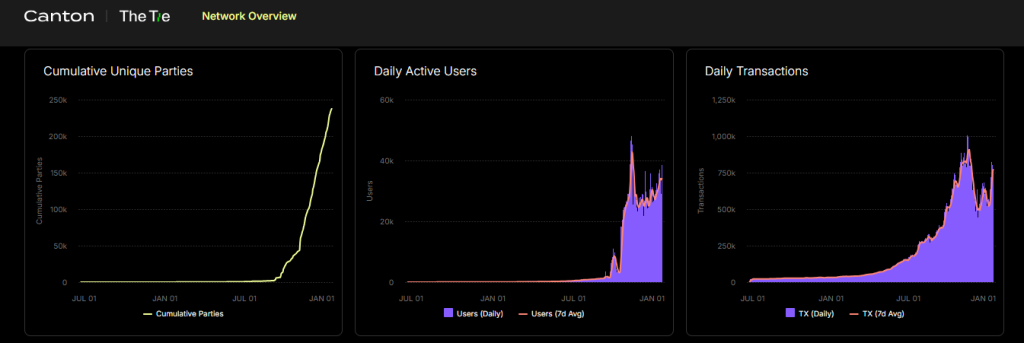

According to official data, the Canton ecosystem has surpassed $6 trillion in onchain value, including roughly $4 trillion in monthly repo activity and more than $300 billion in daily repo volume. The validator network has expanded to over 600 validators, supported by 30 super validators, reinforcing operational resilience.

Adoption metrics further support this trend. Cumulative unique participants have climbed past 237,000, while daily active users hover near 38,000. Daily transactions exceeding 700,000 illustrate consistent usage growth, contributing to broader confidence in Canton Network price USD performance.

Canton Network Price Chart Signals Decision Point

From a technical perspective, the Canton Network price chart reveals a developing cup-and-handle structure on the daily timeframe. Price action is approaching the pattern’s upper boundary, while the recent rebound from the $0.11 support zone signals renewed demand.

At the time of writing, Canton Network price today trades near $0.1289, following a notable intraday recovery.

In addition, an ascending channel remains intact, reinforcing a constructive bias as long as key support holds. If momentum continues, discussions around a short-term Canton Network price prediction toward the $0.20 area may gain traction.

However, failure to hold structural support would invalidate the setup and shift sentiment accordingly.

You May Also Like

How handysaufraten.de Helps Consumers Navigate the Tech Financing Boom

Palantir hits 15% weekly gain as Iran conflict intensifies despite Putin’s call for ceasefire