Bitcoin Pullback Puts Strategy At Nearly $1 Billion in Paper Losses

TLDR

- Strategy holds 712,647 BTC at an average cost of $76,037 per coin.

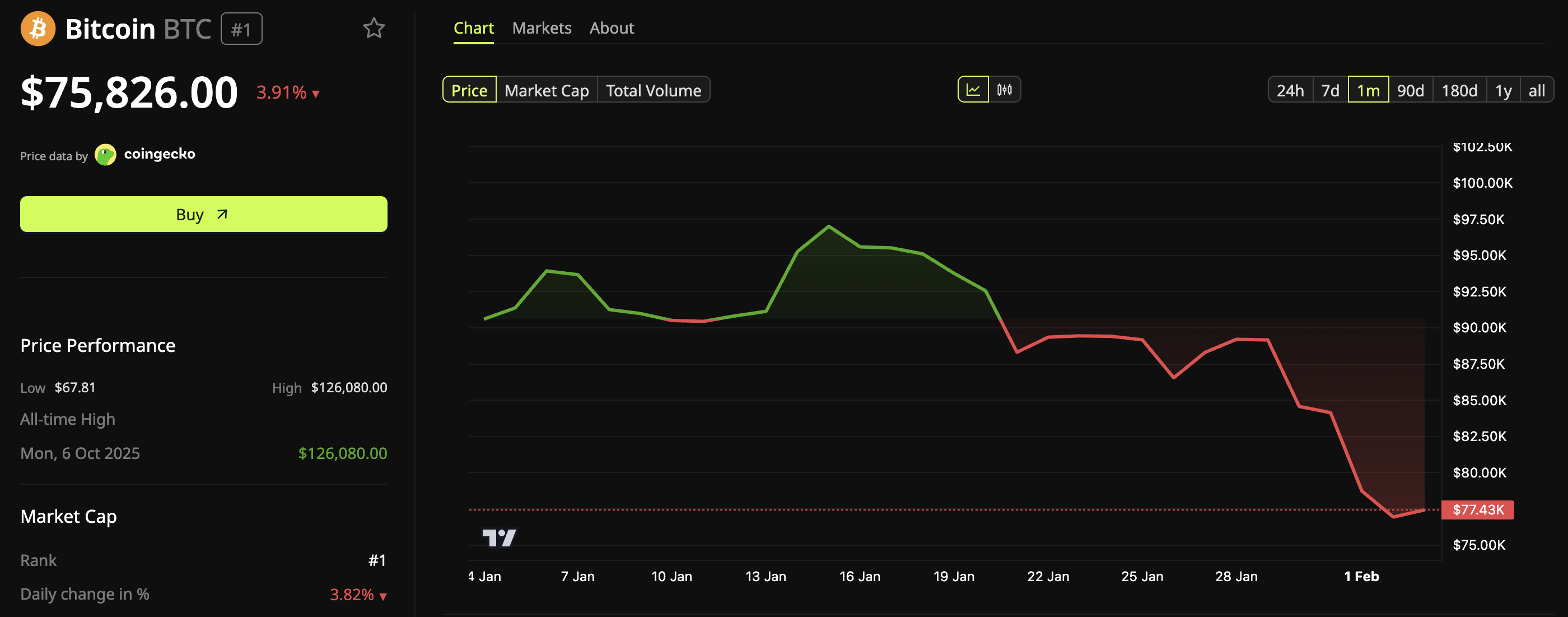

- Bitcoin briefly dropped to $74,544 on Binance on February 1, 2026.

- Strategy’s losses briefly reached nearly $1 billion during the price dip.

- Bitcoin is now trading below its ETF Realized Price and 200-week average.

Bitcoin’s brief decline below $75,000 on February 1 led to large paper losses for Strategy, the company formerly known as MicroStrategy. During the early hours of trading in Asia, the asset touched $74,544 on Binance before recovering slightly.

At its lowest point, the company’s Bitcoin position showed a paper loss of nearly $1 billion. According to BeInCrypto Markets, Bitcoin was trading at $75,826 at the time of publishing, which reduced Strategy’s unrealized losses to about $150 million.

Strategy, led by Executive Chairman Michael Saylor, has continued accumulating Bitcoin. The company now holds 712,647 BTC at an average cost of $76,037 per coin.

Corporate Bitcoin Treasuries See Broad Unrealized Losses

Strategy is not the only company facing losses from the recent Bitcoin pullback. Several other corporate holders have also been affected. According to BitcoinTreasuries data, Metaplanet’s holdings are down by over 30%, while Strive and GD Culture Group show losses of 28.97% and 35.59%, respectively.

Despite the losses, Strategy remains committed to Bitcoin. The company may make its fifth purchase of the year this week. On January 20, it made its largest acquisition to date, buying 22,305 BTC.

To help fund its purchases, Strategy raised the dividend on its Series A Perpetual Stretch Preferred Stock (STRC) to 11.25% starting February. The company has already acquired over 27,000 BTC using proceeds from STRC sales.

Bitcoin Trading Below ETF Cost and Long-Term Support Levels

Bitcoin is currently trading below the ETF Realized Price. This means that most spot ETF investors are now holding their assets at a loss. According to CryptoQuant, this could test investor patience if prices remain low for an extended period.

Technical indicators also point to more downside. Analyst PlanB mentioned that Bitcoin’s 200-week moving average is near $58,000, while the realized price of all coins has dropped to around $55,000.

Bitcoin has previously retraced to these levels in past cycles. The RSI (Relative Strength Index) has also dropped below 50, showing reduced momentum in the market.

Analysts Warn of Further Decline Toward $55,000

As market sentiment weakens, some analysts see the potential for further declines. They suggest Bitcoin could fall to the $58,000–$55,000 range if current conditions persist.

PlanB noted, “However bull has been weak (no red) so bear might be shallow,” suggesting the drop may be limited. But the risk remains, and a deeper fall could increase paper losses across major Bitcoin-holding firms.

The coming weeks may be important for both corporate holders and institutional investors as they assess whether to continue accumulating or hold back.

The post Bitcoin Pullback Puts Strategy At Nearly $1 Billion in Paper Losses appeared first on CoinCentral.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment