Hyperliquid (HYPE) Price: Token Surges 20% as Prediction Markets Get Green Light

TLDR

- Hyperliquid’s HyperCore team announced support for HIP-4 proposal to add prediction markets to the platform

- HYPE token price jumped 19.5% to $37.14 following the announcement on Monday

- New feature will allow traders to bet on political elections, sports, and other markets without leverage or liquidations

- Prediction markets feature is currently in testing on testnet and will use Hyperliquid’s USDH stablecoin

- Hyperliquid remains the largest decentralized perpetual futures crypto platform

Hyperliquid announced Monday that its core infrastructure team will support the HIP-4 proposal. This decision sent the HYPE token up 19.5% to $37.14.

Hyperliquid (HYPE) Price

Hyperliquid (HYPE) Price

The proposal aims to bring prediction markets to the platform. Users would be able to bet on political elections, sports outcomes, and other events.

HyperCore, which powers Hyperliquid’s layer-1 network, said the move responds to extensive user demand. The team sees potential for prediction markets and options-like instruments on the platform.

The new feature would work differently from typical derivatives trading. Users could place bets with capped payouts that settle within fixed ranges.

These contracts would operate without leverage, liquidations, or margin calls. This structure makes them similar to betting slips with predetermined maximum returns.

Hyperliquid currently holds the position as the largest decentralized perpetual futures crypto platform. The prediction markets addition would combine two popular crypto use cases.

Both onchain perpetual futures and blockchain prediction markets regularly see hundreds of millions in daily trading volume. The integration could attract users from both sectors.

The team clarified that outcomes trading remains a work in progress. Testing is taking place on the testnet environment before any mainnet launch.

Technical Details and Market Position

When launched, the prediction markets will use Hyperliquid’s native stablecoin USDH for canonical markets. This keeps betting denominated in a stable asset.

The price rally adds to HYPE’s strong recent performance. The token has gained 46.9% over the past month while broader crypto markets pulled back.

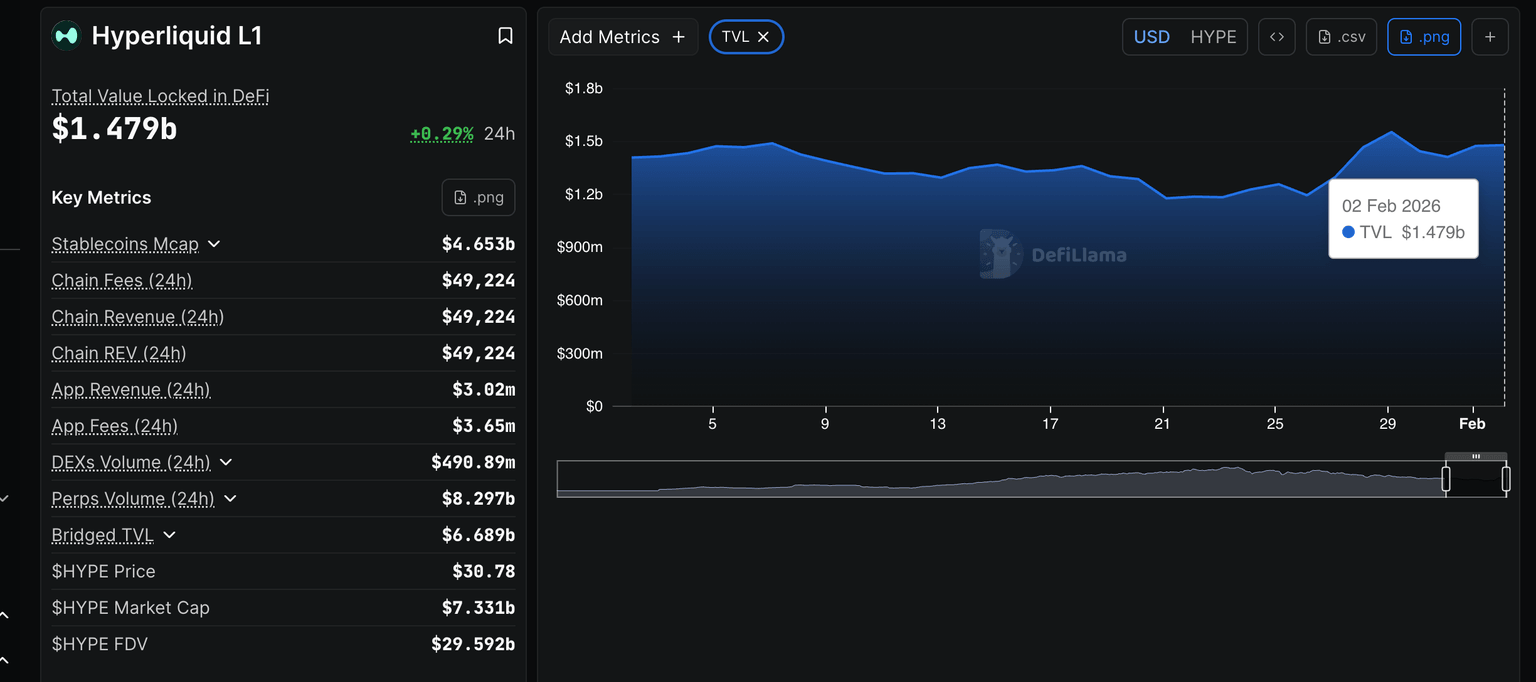

Source: DefiLlama

Source: DefiLlama

Hyperliquid’s DeFi Total Value Locked increased to $1.5 billion on Monday from $1.41 billion on Saturday. This metric tracks the total value of coins held in smart contracts on the chain.

The platform’s futures Open Interest stands at $1.43 billion. This figure measures the total value of outstanding futures contracts on the exchange.

Perpetual futures trading volumes across the crypto sector remain above $200 billion weekly. These volumes are three to four times higher than January 2025 levels.

The sector hit a peak of $341.7 billion in weekly volume between November 3 and November 9. Trading activity has cooled since then but remains elevated.

HYPE trades above the 50-day Exponential Moving Average at $27.58. The 100-day EMA sits at $30.45, providing additional support.

The token faces resistance at the 200-day EMA of $32.68. Breaking above this level could push prices toward $35.01.

The HIP-4 proposal represents Hyperliquid’s expansion into new market segments. The platform aims to offer more trading options beyond perpetual futures contracts.

The post Hyperliquid (HYPE) Price: Token Surges 20% as Prediction Markets Get Green Light appeared first on CoinCentral.

You May Also Like

What Would Happen If Amazon Were To Incorporate XRP Into Its Services?

UK Looks to US to Adopt More Crypto-Friendly Approach