Inside the Powerhouse: The 50 Most Profitable Bitcoin Miners, Aug. 9-10, 2025

At today’s bitcoin price and network difficulty, and with electricity costs set at just $0.02 per kilowatt-hour, a select group of mining rigs pull in serious profits—these are the top 50 machines doing it best in August 2025.

Power, Profit, and Precision: Today’s Top 50 BTC Mining Machines

The economics of bitcoin (BTC) mining can shift overnight, but for operators with ultra-low electricity costs, some machines stand out as clear profit leaders. The following ranking captures the most profitable miners this weekend between Aug. 9 to 10, 2025, based on metrics from asicminervalue.com, BTC’s price, the current network difficulty, and an energy rate of $0.02 per kilowatt-hour (kWh). It’s a rare view into how raw hashrate, power draw, and design efficiency combine to turn watts into wealth.

Tier 1 – Elite Class ($40–$30/day)

Towering over all others is Bitmain’s Antminer S21e XP Hydro 3U, a direct liquid-to-chip behemoth delivering 860 terahash per second (TH/s) and pulling in $43.56 a day under these conditions. Its 11,180-watt appetite is substantial, but efficiency keeps it unmatched at the top.

Bitmain’s Antminer S21e XP Hydro 3U

Bitmain’s Antminer S21e XP Hydro 3U

Only one other miner cracks the upper-$20s range—Auradine’s Teraflux AH3880, pushing 600 TH/s at 8,700 watts for $28.98 daily. While the AH3880 doesn’t challenge Bitmain’s flagship in pure output, it cements Auradine’s position as a serious player in the hydro-cooled high-performance category.

Auradine’s Teraflux AH3880

Auradine’s Teraflux AH3880

Tier 2 – Heavy Hitters ($29–$20/day)

Below the elite two is a dense cluster of profit machines dominated by Bitmain, Bitdeer, Canaan, and Microbt. Bitmain’s Antminer S21 XP+ Hydro leads this tier, matching 500 TH/s with $25.81/day, followed closely by Bitdeer’s Sealminer A2 Pro Hydro at $24.87/day for the same hashrate. Bitmain also fields the S21 XP Hydro at 473 TH/s and $24.19/day, while the S19 XP Hydro 3U brings in $24.04 with a slightly higher 512 TH/s rating.

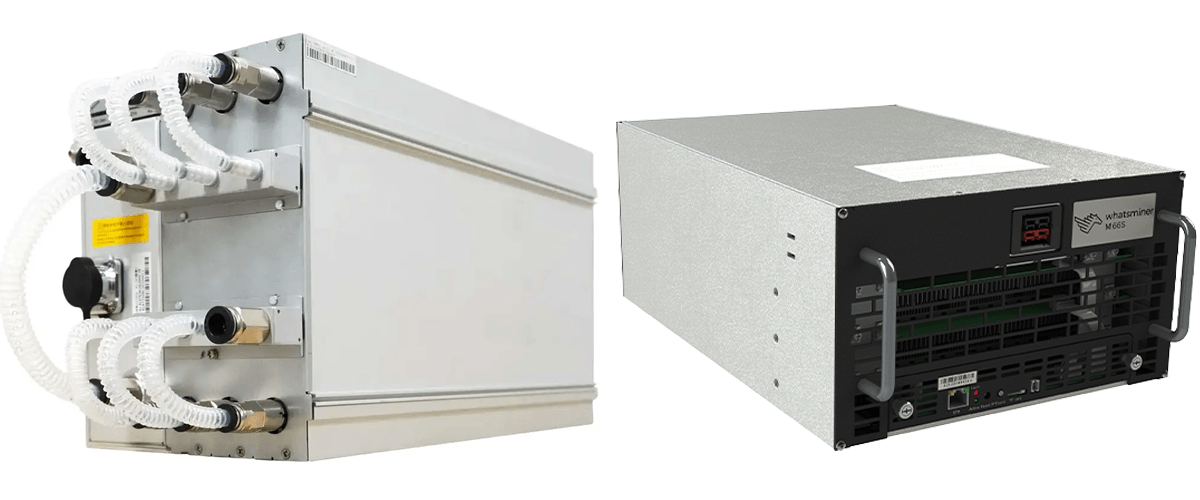

Bitmain’s Antminer S21 XP+ Hydro (pictured left) and Microbt’s Whatsminer M63S++ (pictured right).

Bitmain’s Antminer S21 XP+ Hydro (pictured left) and Microbt’s Whatsminer M63S++ (pictured right).

Canaan’s Avalon A1566HA 2U proves it can run with the big names, delivering 480 TH/s for $23.44/day. Microbt’s Whatsminer M63S++, clocking 464 TH/s, produces $22.94 daily, just ahead of Bitdeer’s Sealminer A2 Hydro at $21.84. Bitmain’s S21e XP Hydro delivers 430 TH/s and $21.78/day, with the Whatsminer M63S+ rounding out the bracket at 424 TH/s and $20.66/day.

Tier 3 – Solid Performers ($19–$15/day)

For operators chasing steady profitability without the power extremes of Tier 1 and 2, Tier 3 offers compelling options. Microbt’s Whatsminer M63S produces 390 TH/s for $18.72/day, and Auradine appears again with the Teraflux AI3680 at 375 TH/s and $18.63/day.

The hydro-cooled Microbt’s Whatsminer M63S (pictured left) and the immersion mining unit Auradine’s Teraflux AI3680 (pictured right).

The hydro-cooled Microbt’s Whatsminer M63S (pictured left) and the immersion mining unit Auradine’s Teraflux AI3680 (pictured right).

The Whatsminer M66S++ follows at 356 TH/s for $17.60/day. Bitmain’s S21 Hydro pulls 335 TH/s for $16.49/day, while the S21+ Hydro yields $15.85/day from 319 TH/s. The Whatsminer M63 matches the $15.81 mark with 334 TH/s, just ahead of the M66S+, which turns 318 TH/s into $15.50/day.

Tier 4 – Consistent Earners ($14–$10/day)

Here, a mix of cooling styles comes into play. Bitmain’s immersion models lead with the S21 XP Immersion at 300 TH/s and $15.12/day, and the S21 Immersion at 301 TH/s and $14.45/day. Microbt’s M66S delivers 298 TH/s for $14.31/day, while Bitmain’s S21e Hyd pushes 288 TH/s for $14.03/day. The S19 XP+ Hyd appears twice—once at 293 TH/s for $14.00/day and again at 279 TH/s for $13.33/day. The air-cooled S21 XP produces 270 TH/s for $13.61/day, flanked by Microbt’s M66 at 280 TH/s and $13.26/day.

Canaan’s Avalon A1566I, an immersion model, outputs 261 TH/s for $12.69/day, matched by Bitdeer’s Sealminer A2 Pro Air at 255 TH/s. Bitmain’s S19 XP Hyd (257 TH/s, $12.06/day) and S21 Pro (234 TH/s, $11.63/day) keep the flow going, followed by Microbt’s M53S at 260 TH/s for $11.55/day. Bitmain’s S21+ (235 TH/s, $11.51/day) sits alongside Microbt’s M60S++ (226 TH/s, $11.13/day) and Bitdeer’s Sealminer A2 at the same hashrate and $11.07/day.

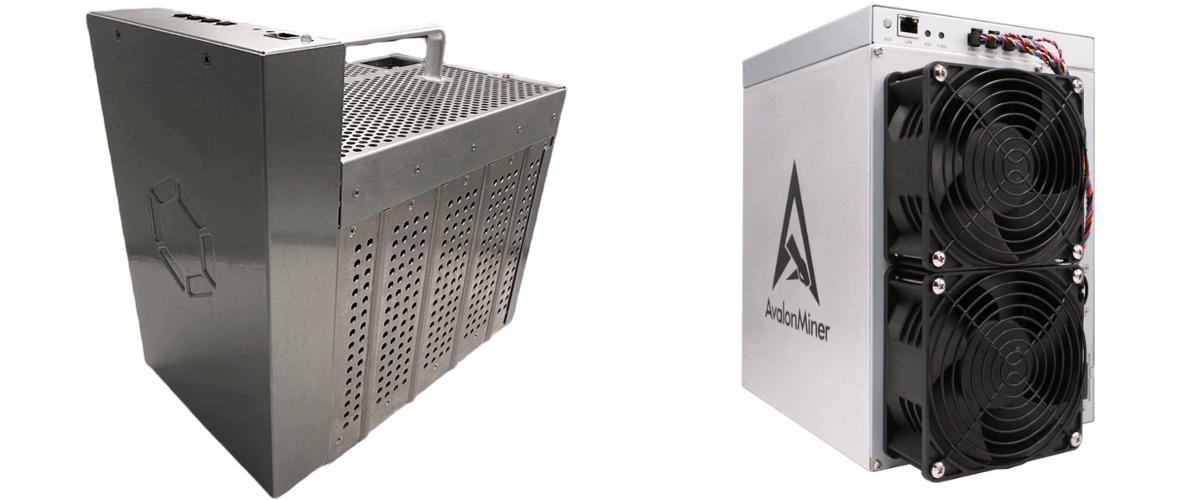

Canaan’s Avalon A1566I immersion miner (pictured left) and Canaan’s air-cooled Avalon A15Pro (pictured right).

Canaan’s Avalon A1566I immersion miner (pictured left) and Canaan’s air-cooled Avalon A15Pro (pictured right).

Bitmain’s S21+ appears again at 225 TH/s for $11.02/day, with the hydro-cooled T19 Pro Hydro delivering 235 TH/s for $10.89/day. Auradine closes this tier with the Teraflux AT2880 at 222 TH/s and $10.78/day, followed by Canaan’s Avalon A15Pro-218T at 218 TH/s for $10.64/day, Bitmain’s S21+ (216 TH/s, $10.58/day), and Microbt’s M60S+ at 212 TH/s for $10.33/day.

Tier 5 – Foundation Level ($9–$4/day)

While these machines earn less per day, they still maintain strong efficiency profiles at $0.02/kWh. Microbt’s M33S++produces 242 TH/s for $10.28/day, while Canaan’s Avalon A15XP-206T outputs 206 TH/s for $9.96/day. The hydro-cooled M53 from Microbt earns $9.88/day at 230 TH/s, and Bitmain’s S21 clocks 200 TH/s for $9.70/day.

Microbt’s M56S follows with 212 TH/s at $9.40/day, just above Canaan’s Avalon A15-194T at 194 TH/s and $9.29/day. Bitmain’s T21 produces 190 TH/s for $9.08/day, with Microbt’s M60S at 186 TH/s and $8.93/day. Canaan’s Avalon A1566 adds 185 TH/s for $8.88/day, and closing out the top 50 is Bitmain’s S19 Pro+ Hyd, delivering 198 TH/s for $8.65/day.

Across these tiers, Bitmain claims 23 of the top 50 spots, Microbt holds 15, Canaan secures 6, Bitdeer captures 4, and Auradine makes 2 high-impact appearances. Hydro-cooled rigs dominate the upper tiers, but air and immersion models still play critical roles for miners optimizing capital and operational strategies. With efficiency gains and new releases always on the horizon, the current leaders set a high bar for profitability in 2025’s mining landscape.

You May Also Like

Siren Token Sheds 16.4% After 54% Retreat From All-Time High

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State