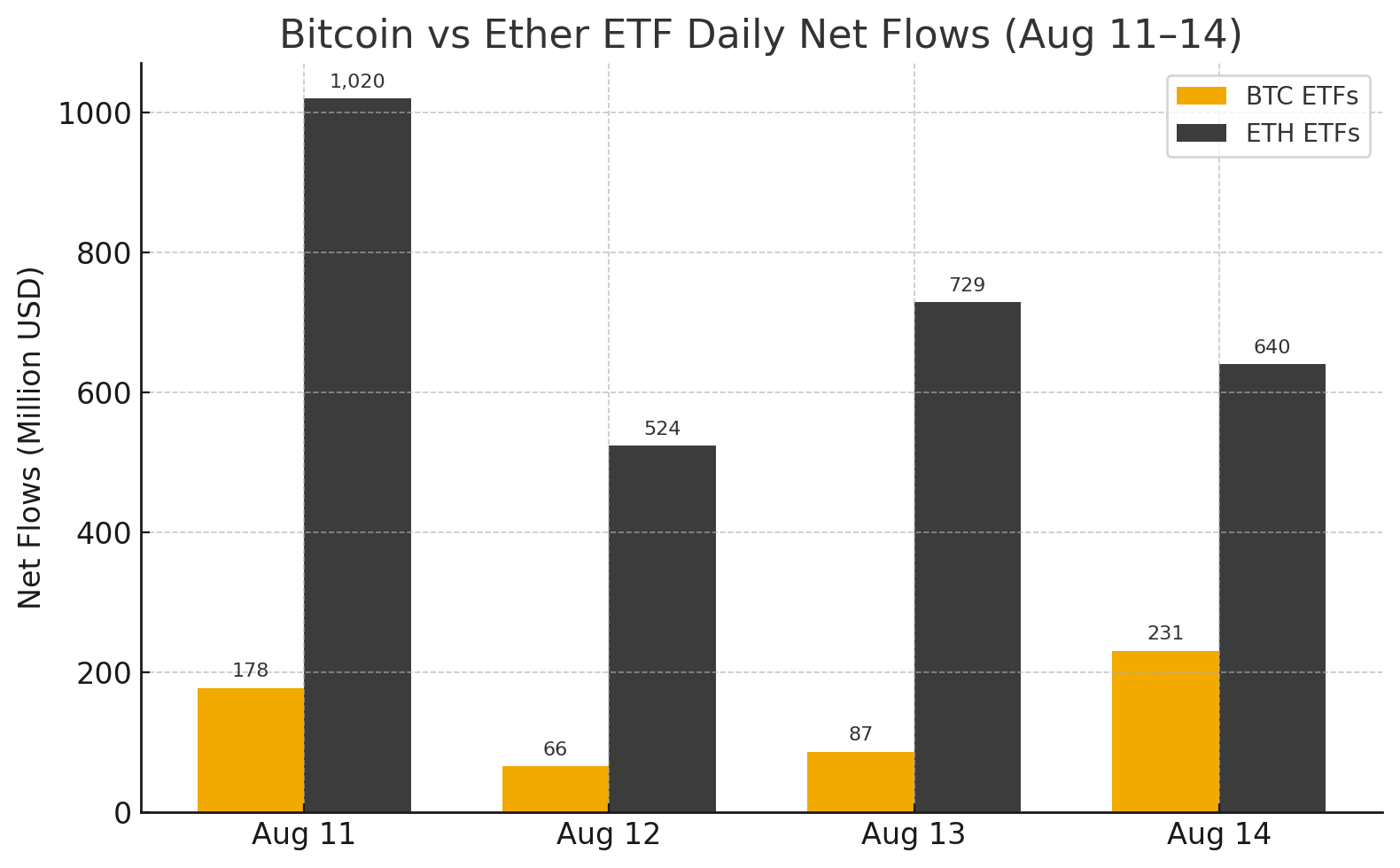

$640 Million Flows Into Ether ETFs as Bitcoin ETFs Notch 7th Day of Gains

Ether exchange-traded funds (ETFs) scored another $640 million in inflows, marking their eighth consecutive day in the green, while bitcoin ETFs logged a seventh straight day of gains with $231 million despite sharp outflows in several major funds. Record-breaking trading volumes underscored the market’s feverish pace.

Ether ETFs Extend Streak to 8 Days With Bitcoin ETFs Overcoming Heavy Outflows to Stay Green

Crypto ETF momentum is refusing to cool. Thursday, August 14, saw ether ETFs bank another $639.61 million, extending their inflow streak to eight consecutive sessions, while bitcoin ETFs eked out $230.93 million to stretch their own run to seven days, despite heavy selling pressure in key products.

Ether ETFs continued their domination. Blackrock’s ETHA led with $519.68 million, followed by Fidelity’s FETH at $56.94 million. Grayscale’s Ether Mini Trust added $60.73 million, and Invesco’s QETH closed the list with $2.26 million. For the third day in a row, not a single ether ETF saw outflows. Turnover was a massive $4.22 billion, keeping net assets steady at $29.22 billion.

On the bitcoin side, Blackrock’s IBIT was the star, pulling in a staggering $523.74 million. Grayscale’s Bitcoin Mini Trust chipped in $7.32 million, but gains were challenged by sizable exits. Ark 21shares’ ARKB shed $149.92 million, Fidelity’s FBTC lost $113.47 million, and Bitwise’s BITB saw $30.87 million leave. Vaneck’s HODL also recorded a $5.85 million exit.

Even so, IBIT’s haul was strong enough to keep the day in the green. Trading activity hit a fresh record at $6.20 billion, though total net assets dipped to $153.43 billion.

Eight straight days of ETH inflows, record-high volumes, and BTC resilience in the face of selling, the ETF race is heating up fast.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

‘Slam dunk’ case? The brutal killing of a female cop and her son