3 Reasons Robert Kiyosaki Is Still Buying Bitcoin While Most Investors Are Selling

TLDR

- Robert Kiyosaki bought one more Bitcoin at $67,000, calling the dip a buying opportunity.

- He cited two reasons: expected U.S. debt-driven money printing and Bitcoin’s approaching 21 million coin supply cap.

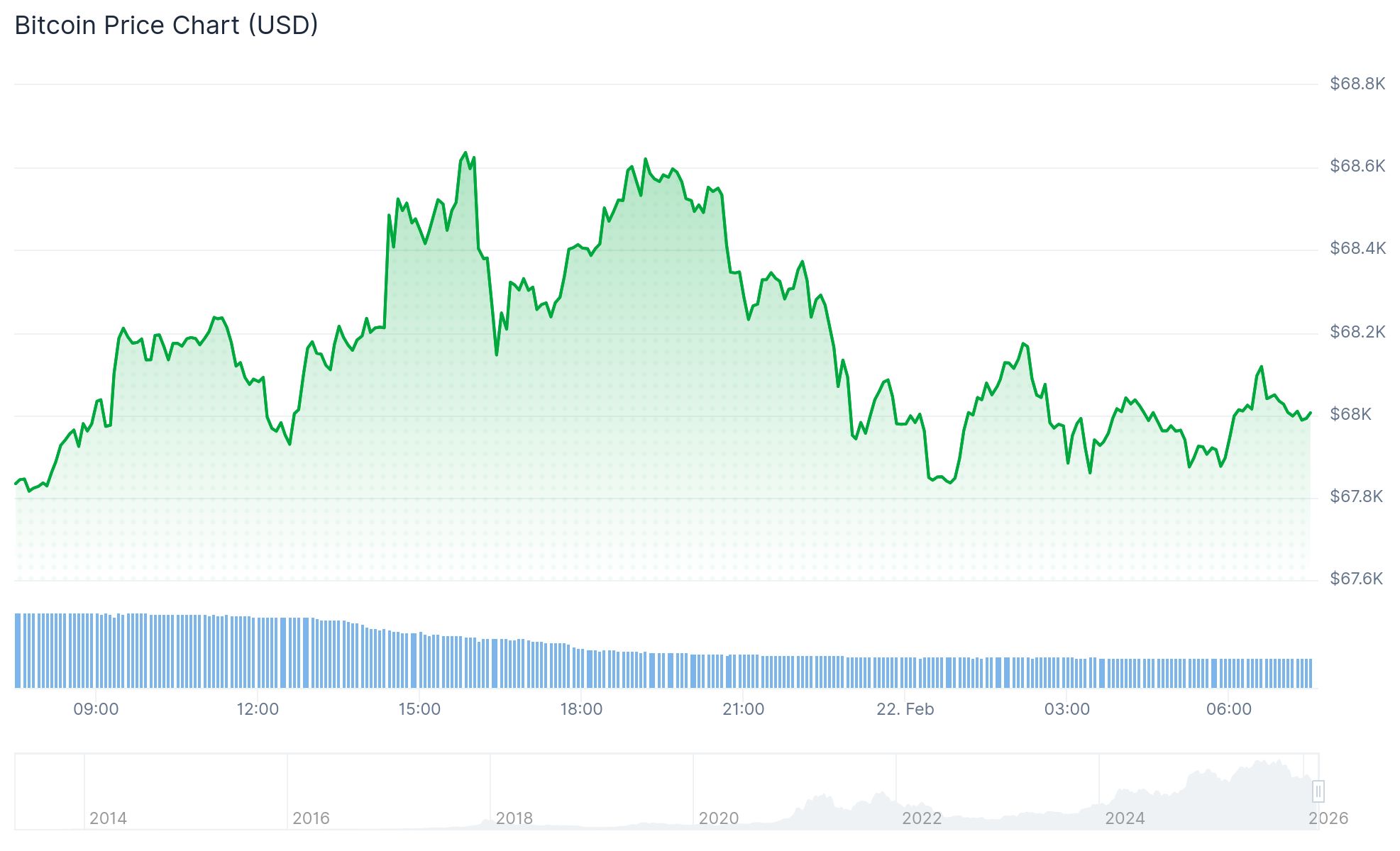

- Bitcoin is down ~46% from its all-time high of $126,080 but hovers near $68,000.

- Kiyosaki also holds Ethereum, gold, and silver as hedges against dollar weakness.

- He has previously predicted Bitcoin could reach $250,000 by 2026 and $1 million within a decade.

Robert Kiyosaki, author of Rich Dad Poor Dad, announced on Saturday that he bought one full Bitcoin for $67,000. He made the purchase even while describing Bitcoin as “crashing.”

He shared the move on X, outlining two reasons for the buy. First, he believes U.S. debt will eventually force the Federal Reserve to print large amounts of new money. Second, he pointed to Bitcoin’s approaching supply limit of 21 million coins.

He called the Federal Reserve “The Marxist Fed” and described any future money creation as “fake dollars.” This fits his long-held view that traditional financial institutions erode real wealth.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin is currently trading near $68,000. That is down roughly 46% from its all-time high of $126,080. However, the total crypto market cap remains above $2 trillion.

U.S. ETFs tied to Bitcoin are still actively trading. Major financial institutions remain involved in the crypto market. Analysts do not describe current conditions as a panic sell-off.

U.S. federal debt now sits above $34 trillion. Interest costs are rising and fiscal deficits remain high. Kiyosaki argues this pattern historically leads to monetary expansion, not austerity.

Why Bitcoin Over Gold?

Kiyosaki has favored gold and silver for years. He views Bitcoin as a digital version of those stores of value.

The key difference he cites is supply. Gold supply grows slowly each year through mining. Bitcoin’s supply is fixed at 21 million coins by its code and cannot be changed.

During the 2020 pandemic stimulus cycle, Bitcoin rose from below $4,000 to above $60,000 in under a year. When the Fed tightened policy in 2022, Bitcoin fell sharply to the mid-$10,000 range.

Kiyosaki also holds Ethereum and says he does not make decisions based on short-term price moves. He combines crypto holdings with physical gold and silver as part of one broader strategy.

Kiyosaki’s Price Targets

He has previously said Bitcoin could reach $250,000 by 2026. He has also set targets of $27,000 for gold and $100 for silver.

His longer-term Bitcoin target is $1 million, tied to a timeline of several years to a decade. He links that outlook to continued erosion of the dollar’s purchasing power.

In Saturday’s post, he also claimed Bitcoin would surpass gold once the 21 million coin milestone is reached. The current supply is close to that cap, with the final coins expected to be mined around the year 2140 under the current issuance schedule.

Kiyosaki’s current Bitcoin holdings include purchases made at multiple price levels over recent years.

The post 3 Reasons Robert Kiyosaki Is Still Buying Bitcoin While Most Investors Are Selling appeared first on CoinCentral.

You May Also Like

Morpho (MORPHO) Price Prediction 2026–2030: Can MORPHO Hit $3 Soon?

Shiba Inu Price Analysis: Can SHIB Recover by 2027?