Ethereum Future Runs On Stablecoins And Tokenized Assets — Here’s What To Know

The narrative surrounding Ethereum’s future has fundamentally shifted, and is rapidly solidifying its role as the global, compliant settlement layer for traditional finance (TradFi). This strategic transformation is inextricably linked to the dominance of Stablecoins and the explosive growth of Tokenized Real-World Assets (RWAs).

Network Effects Of Stablecoins And RWA On Ethereum

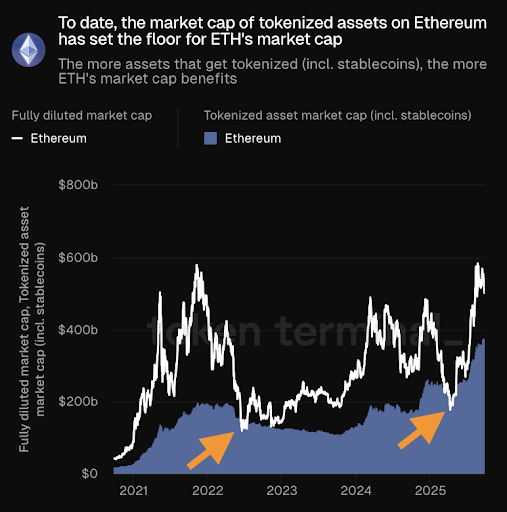

In a recent post on X, the Token Terminal highlighted a key insight focusing on why Stablecoins and RWAs matter for the Ethereum market cap. To date, Stablecoins and RWAs are crucial for ETH, as the market capitalization of tokenized assets on ETH acts as the floor for ETH’s market cap.

The reasoning is that as more assets are tokenized on the ETH blockchain, including the massive market of stablecoins and the growing sector of RWAs, the total value locked and secured by the network increases, and the more Ethereum’s market cap benefits.

A Host and Producer of The Edge_Pod, known as DeFi_Dad, has reflected on how rewarding it feels to finally see stablecoins cementing credibility for Ethereum and the decentralized finance (DeFi).

For years, explaining crypto in real life carried negative associations, which were often tied to price speculation or hype. Meanwhile, the narrative has shifted, and stablecoins have provided a clear, relatable entry point, with investors focused on investing in digital money applications using Stablecoins.

However, the expert pointed out that the stablecoins are now so mainstream in the media that even government officials and traditional media are taking them seriously. Unlike Bitcoin, which many people only associate with volatile price action, stablecoins provide practical utility and a way to earn 5–10% yields on-chain.

According to DeFi_Dad, most of it is built on ETH and stablecoins, which are like Fundstrat and the ChatGPT moment for crypto, a breakthrough product that clicks instantly for the masses. From there, stablecoins would become the stepping stone into DeFi yield and broader digital asset exposure.

A Stronger Foundation For Future Development

Amid the Ethereum advancements, the new Go-Pulse v3.3.0 has officially been released, a major rebase that is going to make the ETH network even faster and more robust. Richard Heart mentioned that the update from the old Go-Ethereum (GETH) v1.13.13 has gone all the way up to the new v1.16.3, which would deliver substantial performance and efficiency improvements.

Heart credited ETH’s role in the process, noting that the Ethereum mainnet serves as the ultimate testing ground. By proving stability on the ETH, PulseChain is the first to integrate and is the most reliable and optimized software enhancements into its own ecosystem.

You May Also Like

👨🏿🚀TechCabal Daily – Folded by a paper cut

MTN Plans Starlink Launch in Zambia