$21 Million Vanishes After Hyperliquid Wallet Hack

The post $21 Million Vanishes After Hyperliquid Wallet Hack appeared first on Coinpedia Fintech News

In another shocking on-chain exploit, blockchain security firm PeckShieldAlert has revealed that an address linked to the Hyperliquid platform suffered a massive loss of around $21 million in crypto assets.

The incident reportedly occurred after the attacker managed to compromise the wallet’s private key, allowing full access to the victim’s fund

Hyperliquid’s Victim wallet Lost $21 Million

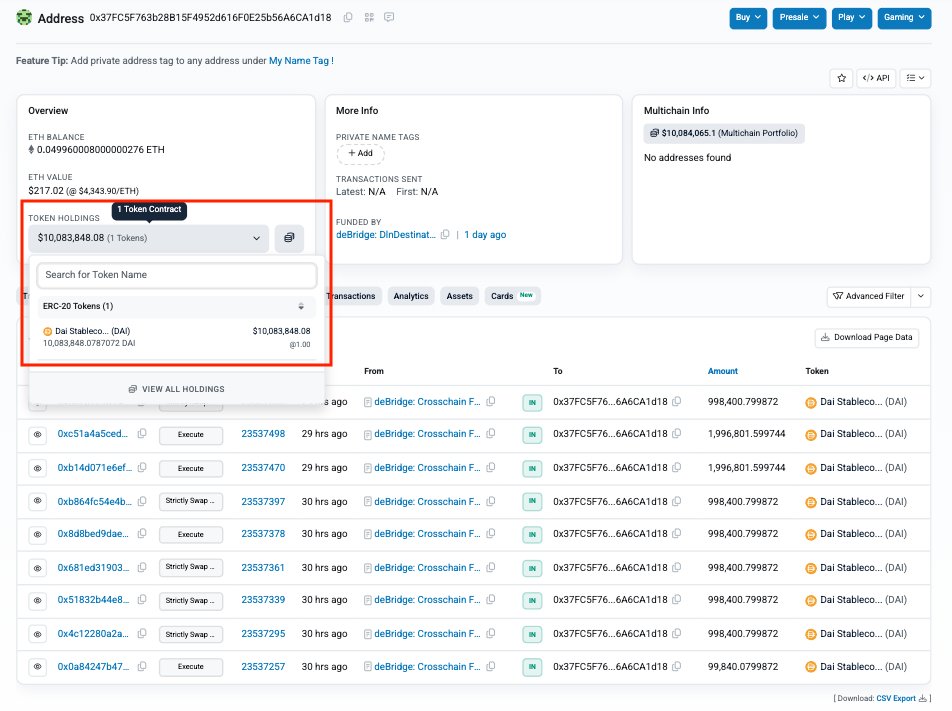

According to PeckShield’s on-chain data the hacker transferred 17.5 million DAI and 3.11 million SYRUPUSDP from the victim’s wallet. Soon after stealing the money, the hacker quickly bridged the assets across chains, making it harder to trace them.

However, the parts of the funds are now sitting in different Ethereum wallets, and investigators believe they may soon be swapped or laundered further.

PeckShield also shared a screenshots which show several wallet addresses connected to the incident, each reflecting traces of the stolen tokens being transferred, swapped, and distributed, a pattern commonly seen in laundering attempts after major crypto heists

How the Hacker Got In

What stands out about this hack is the precision of the attack. Unlike smart contract bugs or exchange exploits, this attack happened because of a private key leak. That means the attacker got direct access to the wallet’s login credentials. Such leaks often occur due to phishing links, malware, or unsafe key storage.

Security experts have long warned that high-value accounts should always use cold wallets or multi-signature protection to prevent such incidents.

As investigations continue, PeckShield has urged all traders and project teams to stay alert, avoid clicking on suspicious links, and store private keys offline.

You May Also Like

Why Everyone Is Talking About Saga, Cosmos, and Mars Protocol

Disney Pockets $2.2 Billion For Filming Outside America