How ETH and SOL Traders Are Flipping Gains Into Ozak AI Early

The post How ETH and SOL Traders Are Flipping Gains Into Ozak AI Early appeared first on Coinpedia Fintech News

Ozak AI is quickly becoming a top rotation target as traders who’ve profited from Ethereum and Solana look to amplify their gains by moving into early-stage plays with higher upside potential. This mirrors classic bull cycle patterns, where capital flows from large caps into breakout narratives before retail catches on.

Unlike hype-only tokens, Ozak AI is built on real AI infrastructure, integrating 700,000+ AI nodes through partnerships with Perceptron Network and SINT, powering predictive intelligence and agent-driven systems. With growing presale momentum and a narrative at the heart of the next major trend, Ozak AI is positioning itself as one of the smartest early rotation opportunities of 2025.

Ozak AI Is Becoming the Destination for Early Rotations

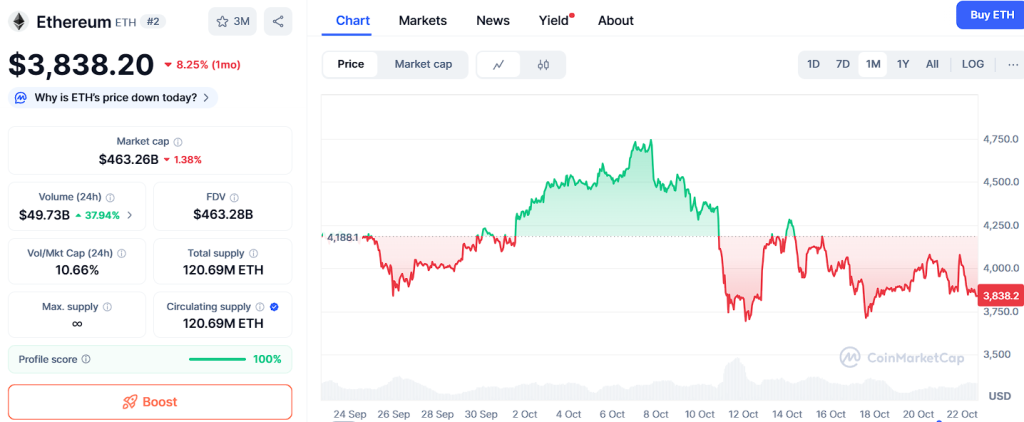

As the market heats up, traders who’ve profited from Ethereum and Solana are strategically rotating their gains into early-stage projects with the potential for much larger upside. ETH is currently trading around $3,838, with support levels at $3,500, $3,200, and $2,950, and resistance levels at $4,200, $4,800, and $5,300.

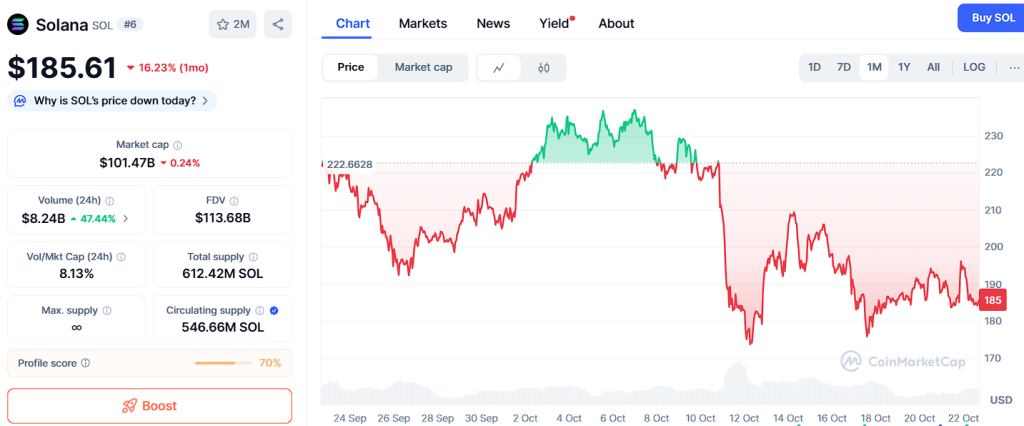

SOL, meanwhile, trades near $185, supported by $160, $145, and $120, with resistance at $210, $250, and $300. These price structures show that both assets remain strong—but seasoned traders know that the biggest multiples in a bull cycle often come not from holding large caps but from flipping profits into high-upside early plays like Ozak AI.

Youtube embed:

Next 500X AI Altcoin.

Why ETH and SOL Profits Are Flowing Into Ozak AI

ETH and SOL have delivered impressive returns this cycle, creating substantial liquidity among active traders. Instead of chasing late-stage rallies, many are front-running the next narrative by reallocating capital into Ozak AI’s presale. Priced at $0.0012 in its 6th OZ presale stage, with over $4 million raised and more than 960 million tokens sold, Ozak AI offers a rare low-barrier, high-upside entry point.

This is a familiar playbook: in 2021, traders flipped gains from ETH into meme tokens like Shiba Inu; in 2020, profits from large caps fueled DeFi’s explosive rally. In 2025, that rotation appears to be moving into the AI + blockchain narrative, with Ozak AI emerging as a key early-stage target.

Ozak AI’s AI Infrastructure Is What Sets It Apart

Unlike hype-driven presales, Ozak AI is backed by real AI technology. Through partnerships with Perceptron Network and SINT, it connects to over 700,000 AI nodes, enabling predictive analytics, real-time signal processing, and agent-driven intelligence. This powerful infrastructure positions Ozak AI as more than just another speculative token—it’s a core technology layer designed to shape how AI interacts with blockchain ecosystems.

For ETH and SOL traders, this makes it an attractive rotation target: they can take profits from mature plays and deploy into a token that combines strong narrative momentum with tangible utility.

Early Rotations Often Define the Biggest Winners

Whales and experienced traders are usually the first to spot emerging narratives, positioning early before retail FOMO drives prices higher. Just as early Ethereum flips led to 2020’s DeFi boom and meme rotations defined 2021, 2025 is setting up for AI-powered tokens to take the spotlight. Ozak AI’s presale momentum and infrastructure advantages make it one of the clearest plays in this rotation.

These early rotations can be pivotal. Those who get in during the presale often capture the steepest part of a token’s growth curve once exchange listings, liquidity, and retail volume kick in.

Ozak AI Could Be the Next Big Flip of the Cycle

Ethereum and Solana have been phenomenal profit engines this cycle, but traders looking for multipliers beyond large caps are increasingly turning to Ozak AI. With its real AI infrastructure, low entry price, and rapidly growing presale demand, it’s becoming the go-to rotation play for early movers.

If the AI + blockchain narrative accelerates as expected, flipping ETH and SOL gains into Ozak AI early could be one of the smartest strategic moves of 2025.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

‘Areas to Watch BTC Are…’ Top Analyst Reveals Where Recovery Might Happen

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon