BCH and WLFI Explode by Double Digits, BTC Price Calms at $84K: Weekend Watch

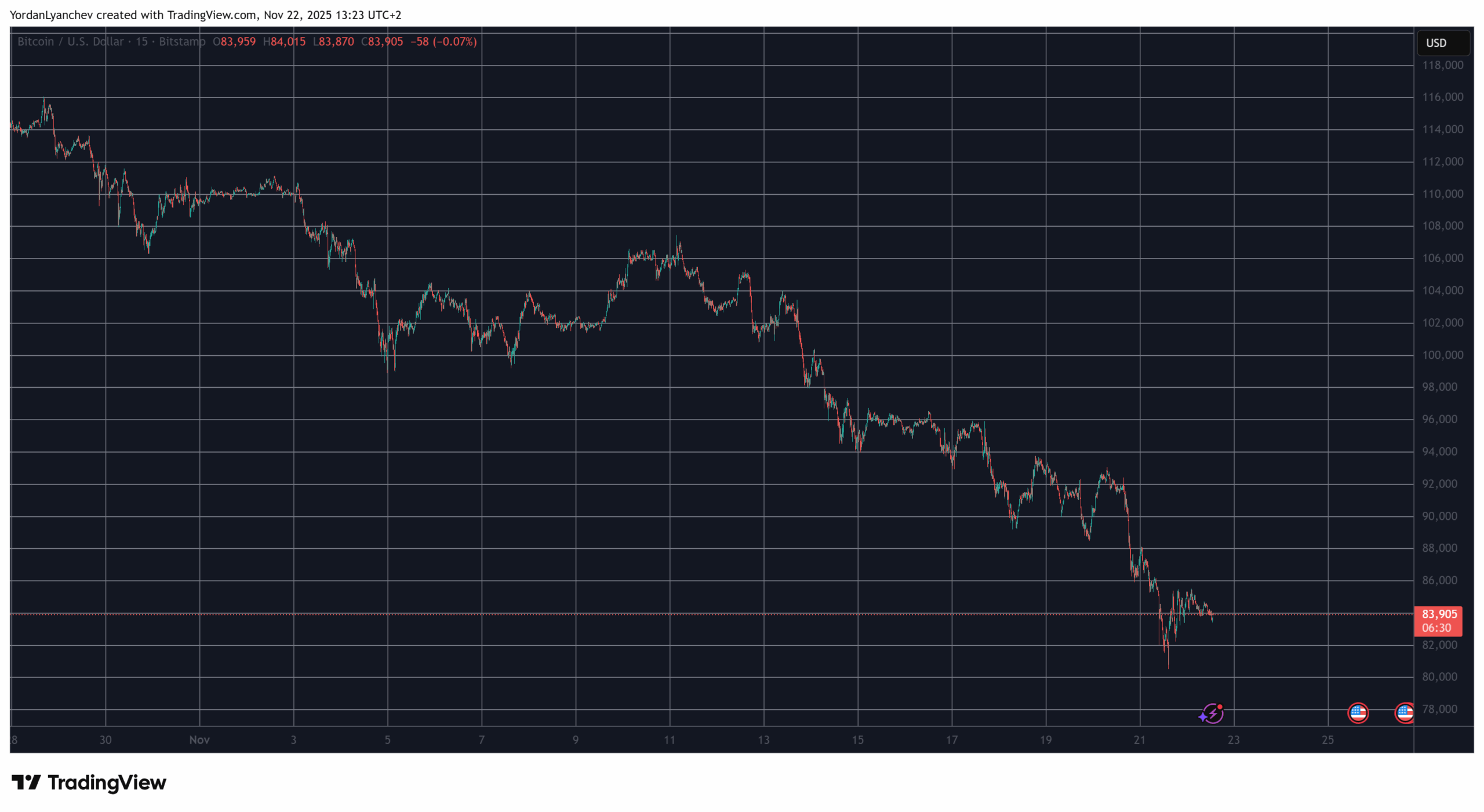

Bitcoin’s nosedive continued on Friday as the asset plunged to a new seven-month low beneath $81,000 before it staged a minor recovery to the current $84,000.

There are some big movers from the larger-cap alts, including WLFI and BCH, which have rocketed by double digits, and ZEC, which has headed in the opposite direction.

BTC Starts to Recover?

What a week it has been for the primary cryptocurrency. After the massive price dump from the previous one, when it dropped from $107,000 to $94,000, the asset entered the current at around $95,000. However, the bears quickly retook control and initiated several consecutive leg downs.

The culmination took place on Friday when bitcoin slumped below $81,000 for the first time since April. This came amid certain OG whales offloading and the growing outflows of the spot Bitcoin ETFs. Moreover, it liquidated over 400,000 traders at one point, including some high-profile names, such as Andrew Tate.

Some relief followed suit after this mindblowing correction, and bitcoin bounced to $85,000 later that day after the president of the New York Fed branch hinted that the central bank might actually lower the rates soon.

However, this rally was short-lived, and BTC pushed south to just under $84,000 as of press time. Its market cap is well below $1.7 trillion, while its dominance over the alts is beneath 57% on CG.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

ZEC Down, WLFI and BCH Up

Most larger-cap alts followed BTC on the way south by charting multi-month lows. Now, though, they are slightly in the green but only on a daily scale. ETH, XRP, BNB, and SOL are with minor gains, while TRX, DOGE, HYPE, and ADA are with insignificant losses.

A lot more volatile moves come from BCH, WLFI, and ZEC. The first two have skyrocketed by double digits since yesterday to $545 and $0.14, respectively. The recent high-flyer ZEC, on the other hand, has plunged by 18% to $522.

The total crypto market cap has erased more than $300 billion since Thursday and is down to $2.950 trillion on CG.

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

The post BCH and WLFI Explode by Double Digits, BTC Price Calms at $84K: Weekend Watch appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis