Bitcoin Cash Price Prediction 2026, 2027 – 2030: Will BCH Hit $1000?

The post Bitcoin Cash Price Prediction 2026, 2027 – 2030: Will BCH Hit $1000? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of Bitcoin Cash is $ 593.74587735

- Price predictions for 2025 range from $300 to $710, with strong support at $300.

- By 2030, BCH could reach highs of $2,675, driven by increased adoption and transaction activity.

With Bitcoin smashing through the $100K barrier, all eyes are now on Bitcoin Cash (BCH) as traders wonder—will BCH price follow with a banana move of its own? Beyond hype, Bitcoin Cash is proving its value in the real world. Ranked 4th on Crypwerk’s global adoption list, BCH is gaining traction for its speed, low fees, and merchant-friendly design.

If you’re searching for answers to “Will Bitcoin Cash go up further?” — you’re not alone. In this Bitcoin Cash price prediction 2026–2030, we dive into the technicals and adoption trends shaping the next big BCH Price Prediction.

Table of Contents

- Story Highlights

- CoinPedia’s Bitcoin Cash Price Prediction

- BCH Price Action History Driven by Smart Money Transaction Volume (2017-2025)

- Near-Term Outlook

- BCH Price Prediction 2025 (Q1 to Q4)

- Bitcoin Cash Price Target December 2025

- BCH Price Prediction 2026 (Q1)

- Bitcoin Cash Price Targets 2026 – 2030

- Market Analysis

- FAQs

Bitcoin Cash Price Today

| Cryptocurrency | Bitcoin Cash |

| Token | BCH |

| Price | $593.7459 |

| Market Cap | $ 11,856,975,288.85 |

| 24h Volume | $ 333,367,875.7621 |

| Circulating Supply | 19,969,781.25 |

| Total Supply | 19,969,781.25 |

| All-Time High | $ 4,355.6201 on 20 December 2017 |

| All-Time Low | $ 75.0753 on 15 December 2018 |

CoinPedia’s Bitcoin Cash Price Prediction

Coinpedia’s analysis suggests that Bitcoin Cash could potentially emerge as a more affordable version of Bitcoin.

If Bitcoin Cash gains some hype in the coming months, then the BCH price can reach $701 in 2025. On the flip side, the BCH price can drop to $507 during that year.

We expect the BCH price to create a new 2025 high of $701 during the upcoming altcoin season.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $507 | $605 | $701 |

BCH Price Action History Driven by Smart Money Transaction Volume (2017-2025)

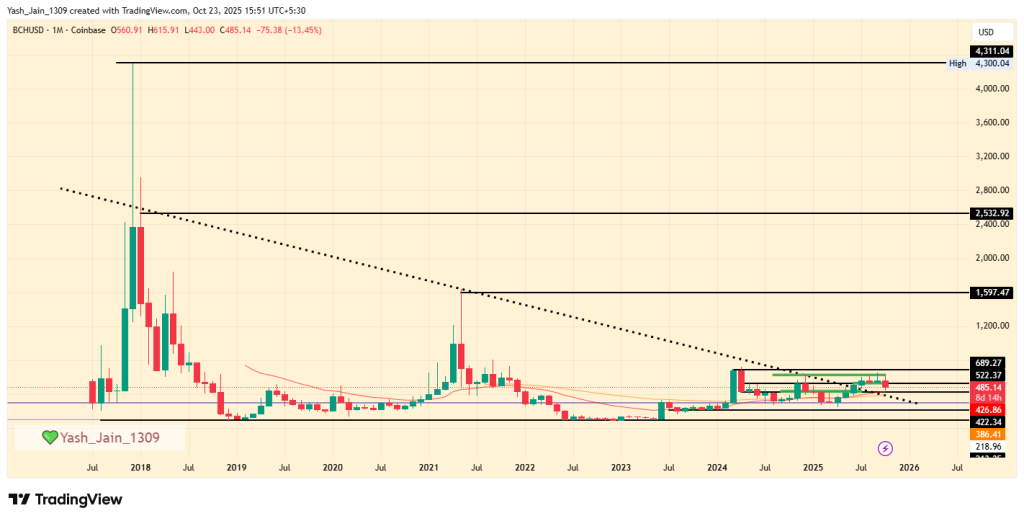

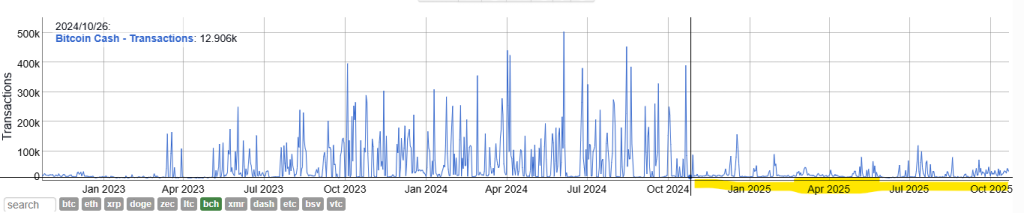

The history of BCH price USD movements shows a strong correlation with daily transaction volume, highlighting the presence of “smart money” participation.

In the run-up of late 2017, the Bitcoin cash price increased over 1100% (from $350 to $4,300) despite daily transactions remaining under 110,000. but, the subsequent 2018 crash from the $4,300 ATH to $400 saw daily transactions skyrocket to 2 million, confirming a massive, swift sell-off by large holders.

Similarly the smart money activity was seen in 2021 also when transactions increased from daily average but unlike 2017’s rise, the opposite behavior characterized the 2021 recovery. As the price climbed from $450 to $1,597 between February and April, transaction volume held consistently high, fluctuating between 300,000 and 400,000 per day.

However, this time this buying enthusiasm was followed by a prolonged, 24-month slow bear market from May 2021 to May 2023. During this severe sell-off, transactions plunged from 300,000 to below 15,000 daily, capping BCH recovery attempts and driving the price below $150.

Therefater, since June 2023, the market has seen a notable shift. Daily transactions began increasing abruptly, oscillating between 100,000 and 400,000 through October 2024, mirroring the price recovery attempt toward 689. This fluctuation confirms that large market players are responsible for high-volume swings in transactions, and their absence results in flat activity.

Near-Term Outlook

Currently (November 2024 onwards), daily transactions have consistently remained under 100,000, suggesting that smart money is neither actively buying nor selling. The price recovery to above 600 in Q3 2025 is built primarily on retail-based transactions.

However, given this historical pattern, there are high odds that significant buying could be seen soon. When large players return, high-magnitude fluctuations in the transaction chart will signal their entry, confirming genuine demand.

If this smart money buying materializes, mirroring the large daily transaction spikes previously seen in Q1 and Q4 2024, the resulting rally will feature large Marubozu-style candles.

Should this momentum return in Q4 of 2025, BCH price action could initiate a strong recovery, starting with a $ 689 target. This would be followed by $ 1,200 and $ 1,597 by year-end. This trajectory is expected to continue even into the first half of 2026, potentially reaching $ 2,532 and even retesting the prior all-time high of $ 4,300.

Also, if momentum remains half baked and doesn’t move aggressively then a slow rally would conclude the year at $1000 area.

In bearish scenario: Should the major buying activity fail to materialize, BCH is expected to simply consolidate around the $ 450 level for the remainder of 2025.

BCH Price Prediction 2025 (Q1 to Q4)

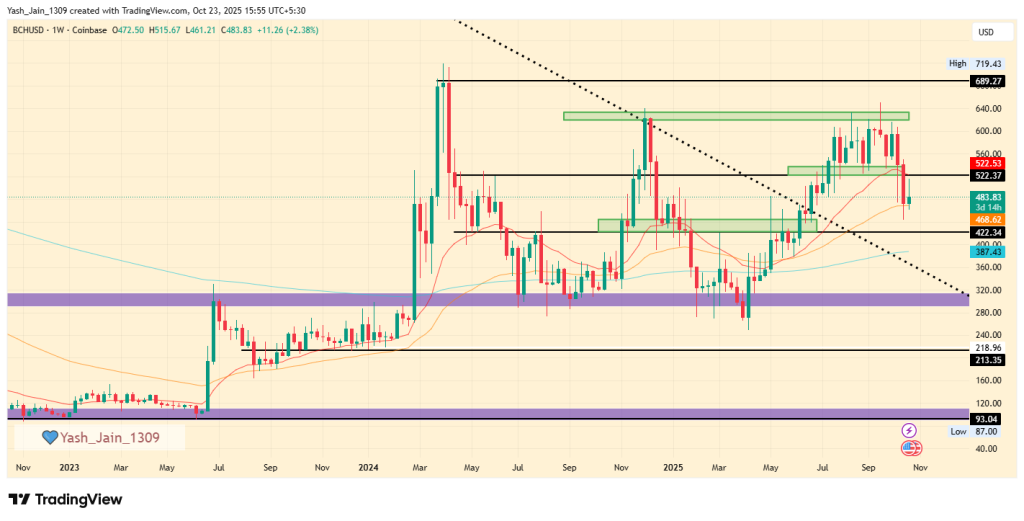

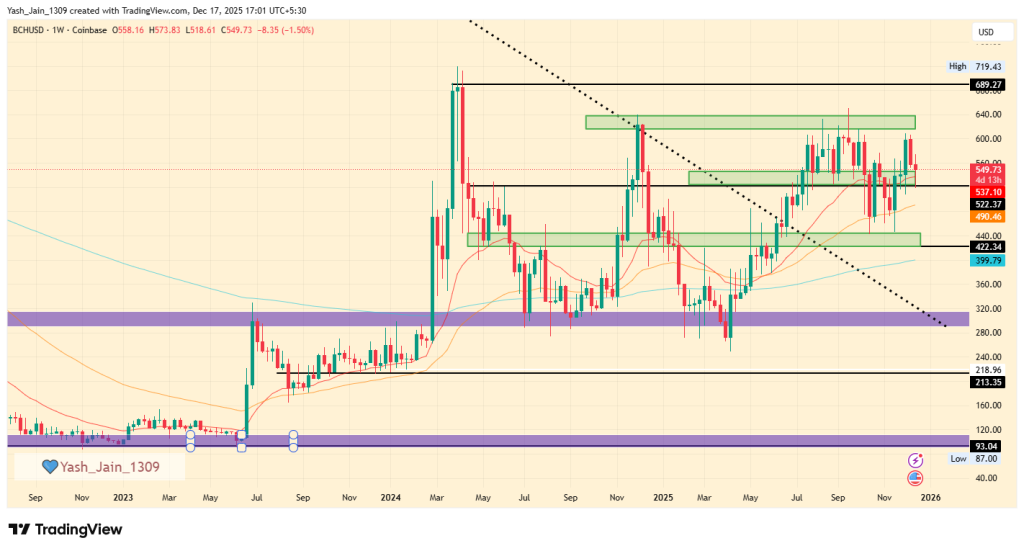

Bitcoin Cash price (BCH) saw a downturn in the first quarter of 2025, following profit-taking activities at the close of December 2024, where it reached the upper boundary of a descending triangle at approximately $640.

However, the second quarter brought a renewed wave of enthusiasm as bullish investors rallied, driving prices up from a critical support level of $300 after some stop-loss orders were shaken out. By the third quarter, BCH impressively rebounded to $645, marking a significant breakout from a multi-year descending triangle.

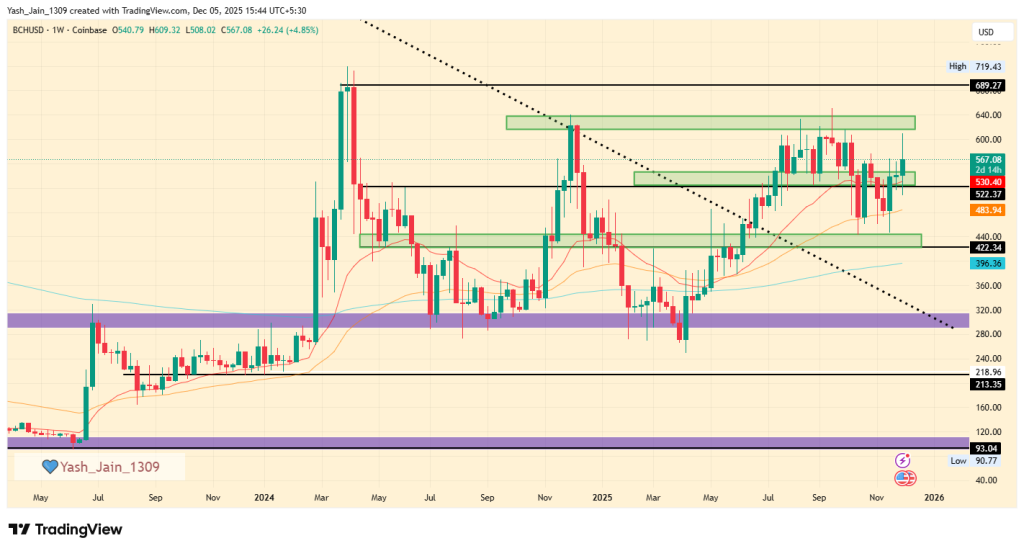

Entering the fourth quarter of 2025, the price did experience a retracement, falling from $645 to $445. This level aligns with the support provided by the 50-week exponential moving average, suggesting that this pullback may be a set-up for another rally. Encouragingly, the likelihood of a market uptick in December 2025 appears to be increasing.

To enhance the bullish outlook, it is essential for BCH price USD to maintain a weekly closing price above the $620–$640 range. Achieving this threshold would facilitate a near-term retest of $689. If BCH successfully sustains above this mark, it would signify a “Change of Character (ChoCh)” on the monthly chart, indicating a pivotal long-term trend shift and opening the door to higher targets ahead.

Conversely, if the breakout fails and BCH dips below critical support at $422, we may witness a rapid downturn. The $300 level is expected to act as a robust defense against further declines; however, a breach here would undermine the current bullish sentiment entirely.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $300 | $605 | $1200 |

Bitcoin Cash Price Target December 2025

Since September 18th, Bitcoin Cash (BCH) has significantly declined, reaching the 50-week exponential moving average (WEMA) and consolidating for several weeks. By mid-December, it confidently trades above the 20-day EMA band.

The BCH price is poised for a decisive move that can transform the $620 resistance into a stepping stone, propelling it to $689 in the short term.

However, should it drop below $540, we could see a continuation of the sell-off down to the key support level at $422. If that level fails, $300 will serve as a strong defense.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| Bitcoin Cash Price December 2025 | 422 | 522 | 689 |

BCH Price Prediction 2026 (Q1)

December 2025 is increasingly being viewed as a crucial stepping stone rather than just a month of rally. Q1 2026 is set to be the most attractive period when the rally will truly kick off based on high odds.

To strengthen the bullish outlook, it’s needed for BCH/USD to maintain a weekly closing price above the $620–$640 range. Surpassing this threshold will pave the way for a near-term retest of $689.

If BCH can hold above this level, it will signify a “Change of Character (ChoCh)” on the monthly chart, marking a significant long-term trend shift and unlocking potential for higher targets ahead.

On the other hand, if the breakout falters and BCH price drops below critical support at $422, we could see a swift decline. The $300 level is expected to serve as a strong line of defense against further declines; however, breaking this level would completely undermine the current bullish sentiment. The market is set for significant movements, and maintaining momentum is vital.

| Year | Potential Low | Potential Average | Potential High |

| 2026 (conservative) | $300 | $605 | $1200 |

Bitcoin Cash Price Targets 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 595 | 790 | 985 |

| 2027 | 680 | 925 | 1,160 |

| 2028 | 795 | 1,135 | 1,475 |

| 2029 | 1,025 | 1,480 | 1,955 |

| 2030 | 1,350 | 2,010 | 2,675 |

This table, based on historical movements, shows BCH price to reach $2675 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential BCH price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Market Analysis

| Firm Name | 2025 | 02026 | 2030 |

| Changelly | $361 | $664 | $3731 |

| priceprediction.net | $572 | $865 | $3830 |

| DigitalCoinPrice | $821 | $932 | $2912 |

*The targets mentioned above are the average targets set by the respective firms.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

According to our Bitcoin Cash price prediction, BCH’s price could hit the maximum trade value of $1,160 by 2027.

Bitcoin Cash is a hard fork of Bitcoin, that aims at a decentralized peer-to-peer electronic cash system. Without relying on any central governing authority.

Bitcoin Cash is an underrated investment with a high chance of performing in 2025.

Bitcoin Cash focuses on resolving two of the major limitations of Bitcoin, which are scalability and transaction fees.

BCH

BINANCE

You May Also Like

X uncovers crypto bribery ring linked to hacker group

SAP Proposes Dividend of €2.50 per Share