Memecoins Under Pressure as Liquidations Cross $500M: PEPE, PENGU, SHIB Traders at Risk?

Crypto markets faced intense turbulence on Dec. 5 as liquidations surged above $500 million, reigniting concerns about recurring weekend volatility and increasingly fragile market depth.

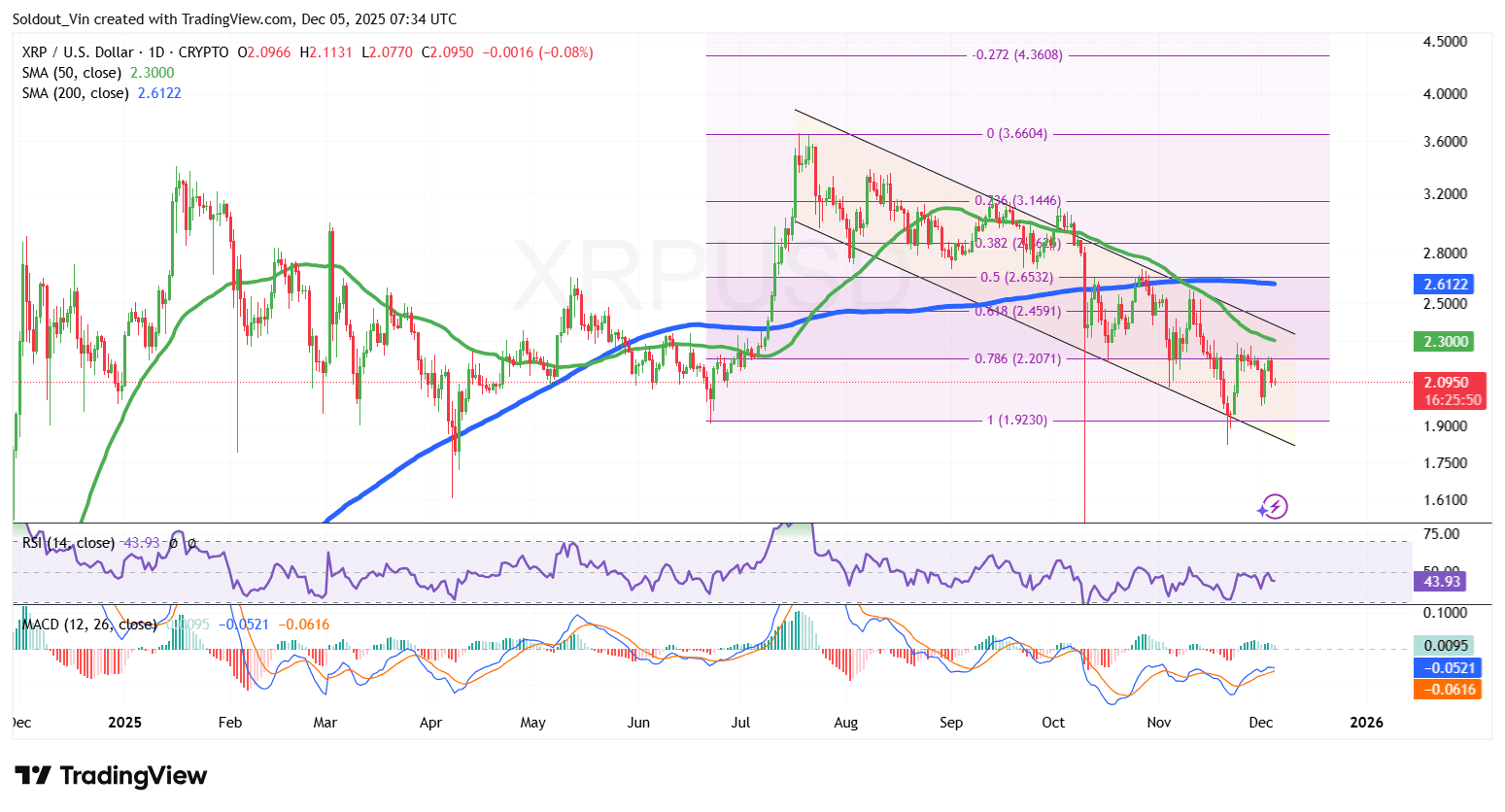

According to Coinglass’ real-time data, a total of $499.27 million in positions was wiped out over 24 hours, with $419.19 million in longs and $80.08 million in shorts liquidated, with more than 142,000 traders affected.

Crypto market liquidation hit $500 million, Dec 5, 2025 | Source: Coinglass

The largest single liquidation was recorded on Hyperliquid’s BTC-USD market, where a position worth $8.5 million was forcibly closed. These figures highlight a continued pattern of large-scale crypto leverage exits increasingly occurring during periods of thinner liquidity, particularly between US session closures and weekend trading cycles.

Recurring Friday Liquidations Signal Structural Weakness

With public companies in the US now holding 1,061,940 BTC (~$94 billion), institutional capital is now deeply intertwined with crypto markets. The $500 million capitulation on Dec 5, follows a series of major Friday liquidation events that shook the market in recent months.

On Oct. 10, 2025, nearly $20 billion in leveraged crypto positions was erased within a day after President Trump announced sweeping 100% tariffs on Chinese technology imports, triggering fears of a renewed trade war.

A similar pattern emerged on Nov. 14, when traders closed nearly $1.4 billion positions in 24 hours sending Bitcoin BTC $89 368 24h volatility: 3.2% Market cap: $1.78 T Vol. 24h: $49.81 B price spiraling below $100,000. That sell-off was driven by profit-taking, rising concerns over interest-rate policy.

That dynamic has reappeared this week, as traders wound down $500 million leverage exposure heading into another low-liquidity weekend. The low market-depth and sentiment-sensitive memecoin sector absorbed the heaviest damage.

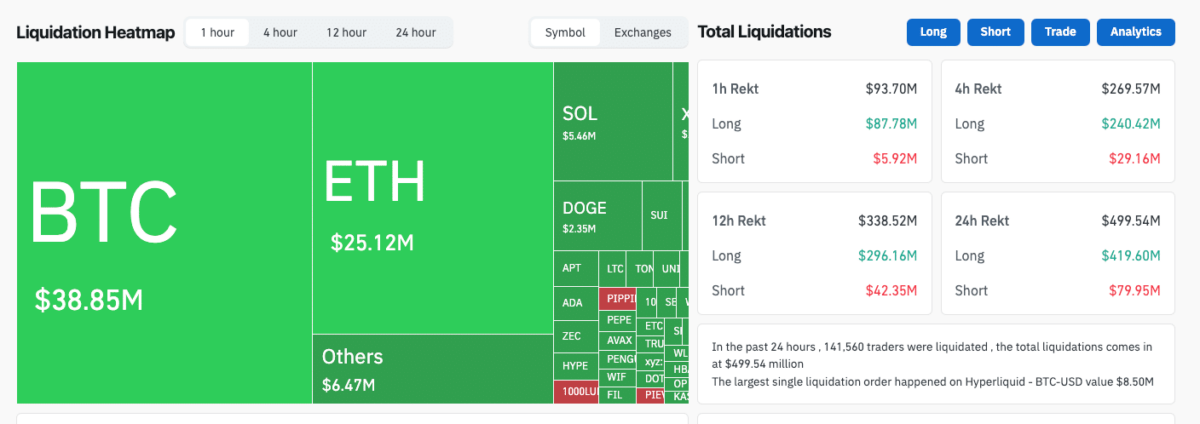

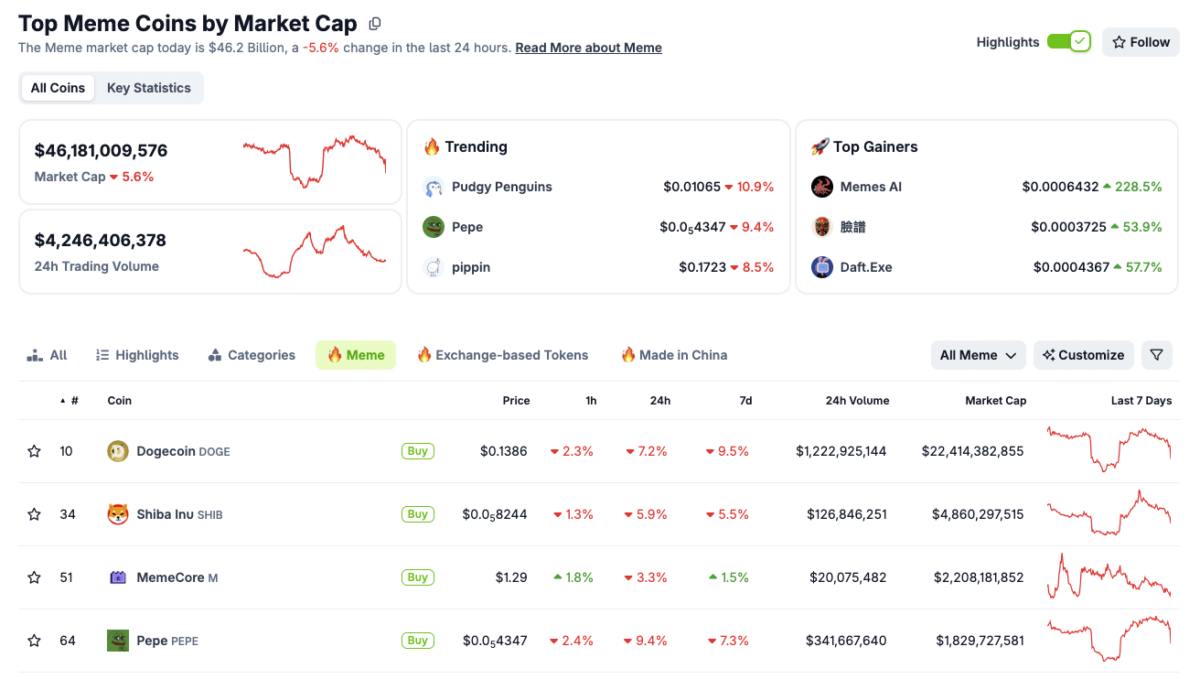

According to CoinGecko, the aggregate memecoin market capitalization fell 5.6%, to $46.18 billion. Trading volumes stood at $4.24 billion over 24 hours, reflecting the scramble to exit positions.

Cumulative Memecoin Sector Marketcap Plunges 5.6% on Dec 5, 2025 | Source: Coingecko

Solana-native Pudgy Penguins saw the highest spike in search interest as traders rushed to trim exposure to memecoins. PEPE PEPE $0.000004 24h volatility: 8.3% Market cap: $1.84 B Vol. 24h: $326.04 M , and Pipin joined Pudgy Penguins as the top three trending tokens during the sell-off. The memecoins posted steep intraday declines of 10.5%, 9.4%, and 8.5%, respectively.

Even larger, more established memecoins suffered losses, with Dogecoin DOGE $0.14 24h volatility: 6.3% Market cap: $22.37 B Vol. 24h: $1.17 B price shedding 7.2%, while Shiba Inu SHIB $0.000008 24h volatility: 5.0% Market cap: $4.88 B Vol. 24h: $125.51 M dropped 5.9% at the time of reporting.

Thinning market liquidity heightens the risks of further downside volatility over the weekend.

SUBBD Presale Nears $1.5M Cap as Traders Exit Memecoins

Tense sentiment surrounding memecoin could drive investor focus towards early-stage projects like SUBBD.

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and brands to build fan communities.

SUBBD Presale

The SUBBD presale has now surpassed $1.4 million of its $1.5 million fundraising target, with tokens currently priced at $0.057 each. With less than 24 hours before the next price tier, interested participants can visit the official SUBBD presale website to unlock early-entrant rewards.

nextThe post Memecoins Under Pressure as Liquidations Cross $500M: PEPE, PENGU, SHIB Traders at Risk? appeared first on Coinspeaker.

You May Also Like

Top Crypto to Invest in as Shiba Inu (SHIB) Weakens in 2025

Filecoin Breakout Alert: Analysts Eye Explosive Jump Toward $15 and $30