Bitcoin and Gold Hit New Highs as “Dollar Debasement” Searches Reach Historic Peak

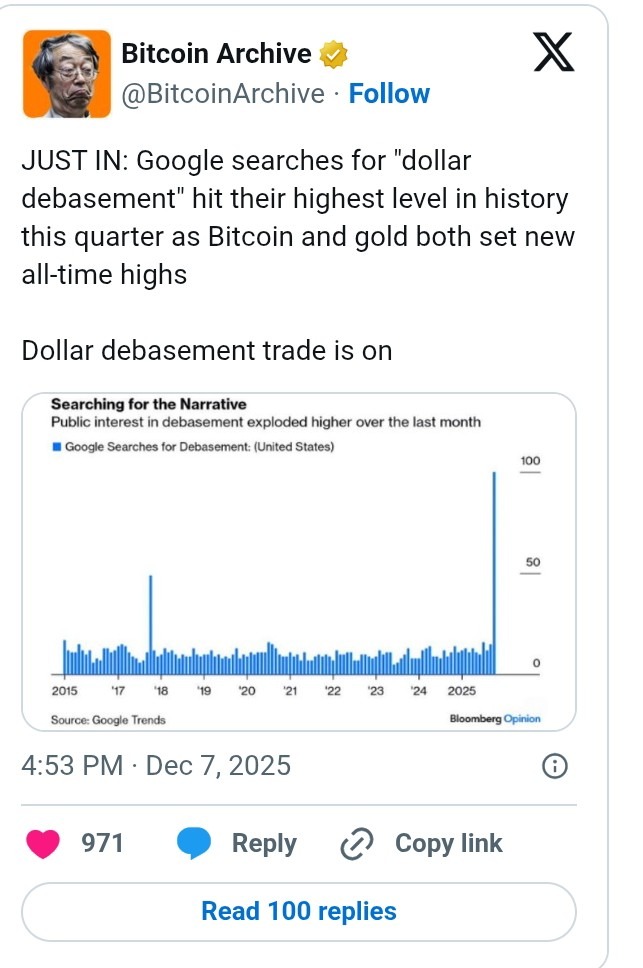

- Google searches for US dollar debasement have reached a historic level, with Bitcoin (BTC) and gold surging higher.

- Robert Kiyosaki is predicting that there could be a “big crash”; hence, it is important to invest in gold, silver, Ethereum (ETH), and BTC.

Google searches for the US dollar debasement have hit their highest level in history, as widely circulating Google Trends data show a massive explosion last month. The last time searches for this keyword skyrocketed was in 2012.

Source: Bitcoin Archive on X

Source: Bitcoin Archive on X

The latest interest, according to reports, has to do with investors exploring strategies to reduce their exposure to the weakening currency. Some reports have even disclosed that the dollar has lost about 96% of its value since 1913.

Amidst this backdrop, Bitcoin (BTC) has surged above $92k again, while gold has risen to $4,225. Experts like Rich Dad Poor Dad author Robert Kiyosaki have advised that people invest in BTC, gold, Ethereum (ETH), and silver to escape from the “biggest crash in history” that he believes will soon hit markets worldwide.

Weakening US Dollar and Rising Interest in Bitcoin (BTC)

EBC Financial Group has also weighed in on the consistent decline of the USD’s purchasing power, disclosing that several structural and privacy-driving challenges are affecting its strength. According to the report, one of these challenges is the US national debt, which was around $37.3 trillion in August 2025.

Additionally, the Congressional Budget Office has projected $3.4 trillion in cumulative deficit over the next decade. To make matters worse, countries like Russia, China, and other BRICS members continue to accumulate gold while expanding local currency trade arrangements.

Already, institutions have lined up to increase their investments in Bitcoin and gold. As detailed in our earlier discussion, Harvard University has, for instance, increased its Bitcoin holdings to almost half a million.

Deutsche Bank has also disclosed that Bitcoin and gold could be adopted by central banks as reserve assets by 2030, as noted in our earlier post. Before this, the bank labeled BTC as “digital gold” and reserve asset, as also mentioned in our previous coverage.

Having considered all these, an early Bitcoin advocate and technology investor, Mike Alfred, has predicted that Bitcoin could hit $315,000 in the long term.

Source: Mike Alfred on X ]]>

Source: Mike Alfred on X ]]>You May Also Like

Monero Balances Privacy, DOT Expands Chains, and BullZilla Presale Emerges in the Race for What Is the Next 100x Meme Coin

ChangeNOW B2B: A Practical Infrastructure Overview For Crypto-Ready Businesses