After weeks of silence, memecoins are starting to move again. Capital is quietly finding its way back. In fact, it can be argued that the memecoin market has been seeing a clear shift in momentum over the last 30 days.

Market capitalization fell steadily through mid-December, sliding from above $42 billion to nearly $36 billion.

However, sentiment flipped in early January. Capital rushed back in. As a result, market cap surged sharply from around $38 billion to a peak near $48 billion, before cooling to $44.69 billion.

At the same time, the volume expanded aggressively. Trading activity climbed by 17.42% to $4.75 billion, confirming that the move was driven by participation, not thin liquidity.

Source: X

Importantly, the acceleration coincided with Solana [SOL] memecoins leading flows – Indicative of renewed risk appetite within the Solana ecosystem.

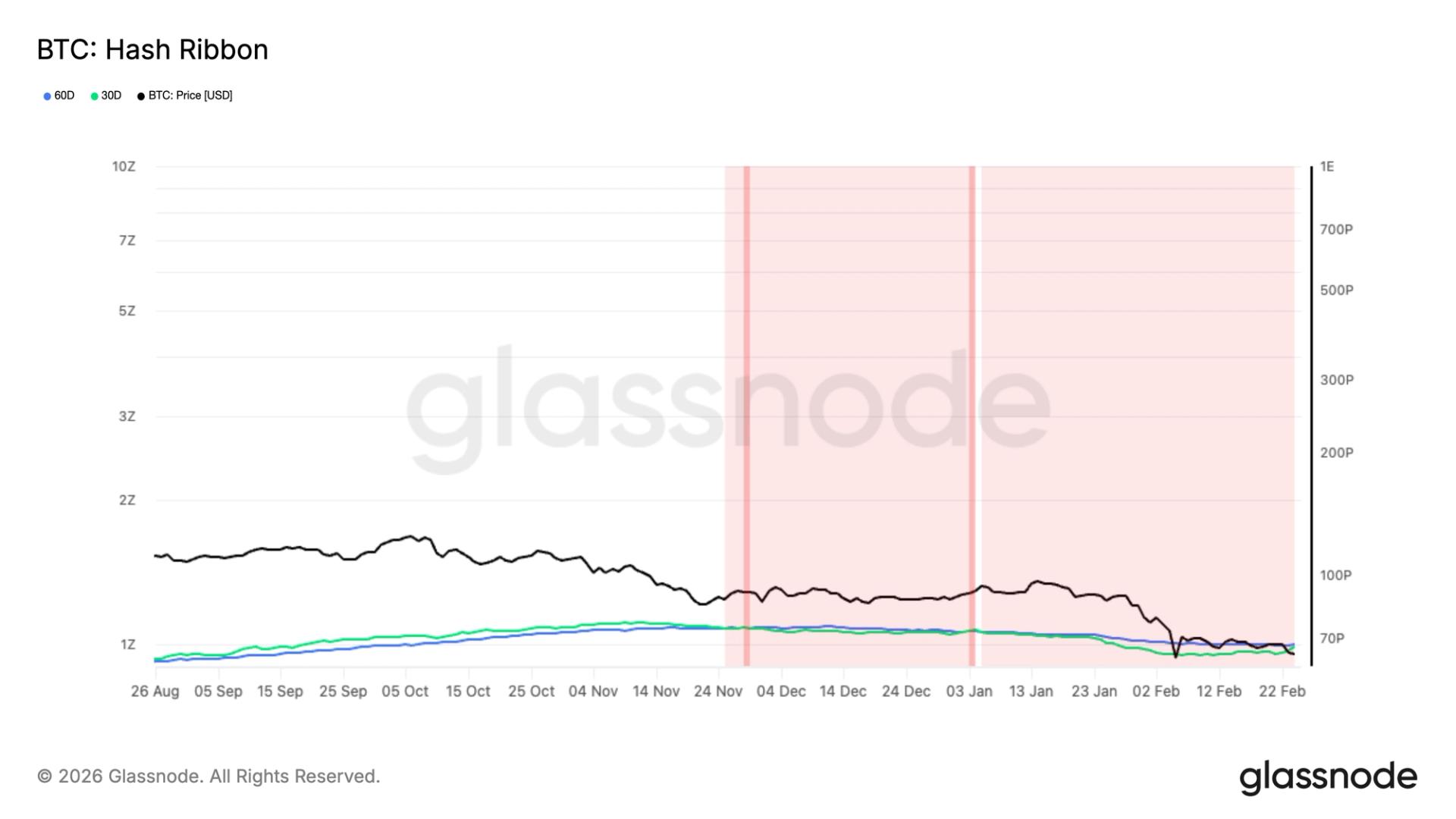

The aforementioned rebound suggested that speculative capital might be rotating back into high-beta assets. Moreover, holding Bitcoin [BTC] above $90,000 has been lending a supportive macro backdrop too.

Together, these factors have been contributing to a hike in confidence across crypto markets, with memecoins acting as an early risk-on indicators rather than isolated hype.

Top memecoins gain, smaller tokens chase momentum

CoinMarketCap data revealed gains concentrated among the market’s largest memecoins, reinforcing the sector’s broader rebound. Bonk [BONK] seemed to be leading this move, at press time. It jumped by 27.78% over seven days while recording $131 million in daily volume.

Such a pairing alludes to conviction, not thin liquidity pumps. In this particular case, traders showed up and stayed active.

For its part, Shiba Inu [SHIB] climbed by 15.31% over the same period. Its $5.1 billion market cap lent weight to the move. Capital rotated in steadily too, pointing to accumulation rather than short-term speculation.

Source: CoinMarketCap

Meanwhile, Pepe [PEPE] gained by 17.10%, supported by a heavy $621 million in daily volume. That level of activity seemed to confirm strong trader engagement.

Elsewhere, memecoin momentum spilled into smaller names. Dogwifhat [WIF] rose by 28.86%, Fartcoin [FARTCOIN] surged by 38.64%, and Pudgy Penguins [PENGU] added 19.84% to its value.

Their rallies came on the back of a broader market rebound too. Bitcoin [BTC] stayed above $90,000, lifting risk appetite and fueling flows into high-beta assets. After 2025’s slump, retail investors have returned, driven by post-holiday optimism, tax-loss effects, social media hype, and Solana’s low-fee ecosystem.

However, their lower market caps also imply higher volatility. To put it simply, while top memecoins have been exhibiting conviction-led strength, mid-tier tokens have been seeing short-lived hype driven by momentum chasing.

Final Thoughts

-

Top memecoins led a conviction-driven rebound, supported by strong trader activity and rising volumes.

-

Smaller tokens spiked on the back of short-term momentum, highlighting volatility and speculative flows in the market.

Source: https://ambcrypto.com/bonk-shib-pepe-and-more-are-memecoins-really-back-in-business/