Bitcoin Hyper Defies Market Slump, Viral Crypto Presale Nears $26M

Quick Facts:

Bitcoin Hyper’s upcoming Layer-2 solution upgrades the slow and clunky Bitcoin blockchain for Web3, unlocking a wide range of use cases across DeFi, NFTs, and real-world tokens – to name just a few.

Bitcoin Hyper’s upcoming Layer-2 solution upgrades the slow and clunky Bitcoin blockchain for Web3, unlocking a wide range of use cases across DeFi, NFTs, and real-world tokens – to name just a few. While Bitcoin is widely regarded as digital gold, Bitcoin Hyper extends that idea, turning it from a store of value into a thriving ecosystem for creative new decentralized applications.

While Bitcoin is widely regarded as digital gold, Bitcoin Hyper extends that idea, turning it from a store of value into a thriving ecosystem for creative new decentralized applications. Currently, early backers can grab Bitcoin Hyper’s native crypto by joining the viral presale that has already smashed through $25.6M.

Currently, early backers can grab Bitcoin Hyper’s native crypto by joining the viral presale that has already smashed through $25.6M.

Bitcoin has rightfully earned the title ‘digital gold’.

Today, it’s a reliable store of wealth, as demonstrated by its 174,410,533% lifetime growth. Now compare that to gold’s, and you’ll understand why the term fails to capture Bitcoin’s potential.

This is because Bitcoin doesn’t just preserve value like gold. It generates value, thanks to the underlying blockchain technology that continues to disrupt industries. AI and real-world tokenisation, in particular, are predicted to take crypto to new heights.

However, this Web3 expansion has nothing much to do with the Bitcoin network.

Sure, Bitcoin remains the crypto king with a massive market cap of $2.14T. But its underlying blockchain constrains its speed and functionality.While Bitcoin was introduced to the world as a peer-to-peer digital cash network, it’s still far away from accomplishing that dream.

Can you imagine paying for coffee with $BTC?

With its speed sometimes as low as 2.8 transactions per second, $BTC transactions are simply not designed for everyday payments.

Bitcoin’s market cap comes as a surprise when you compare the blockchain’s speed to traditional payment networks like Visa, which is capable of handling around 65K transactions per second.

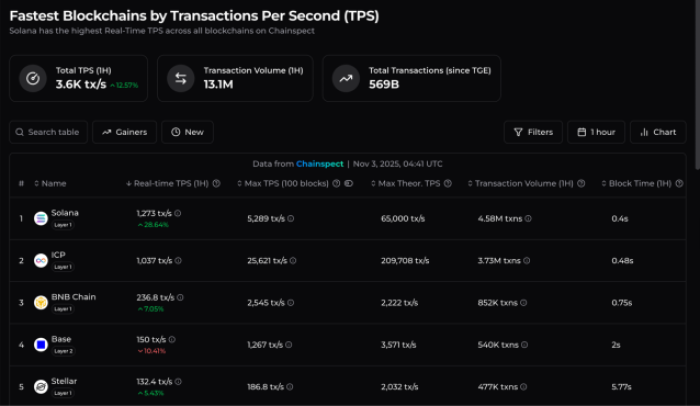

In fact, there is a long list of blockchains that rank higher than Bitcoin in speed.

Solana, in particular, is well-known for its fast network – theoretically capable of 65K transactions per second. More importantly, its developer-friendly blockchain is a hot hub for creative new Web3 projects.

What sets Bitcoin apart from gold is its technological foundation. Interestingly, however, that foundation is built on other blockchains. Bitcoin’s network constraints prevent it from exploring new crypto frontiers like DeFi, NFTs, gaming and real-world tokenization.

This gap explains why institutions are diversifying their reserves into altcoins like Ethereum, XRP, Solana, and BNB, which offer both speed and programmability.

It’s about time Bitcoin overcame these bottlenecks and turned the long-held dream of hitting $1M into a tangible possibility. And that’s where Bitcoin Hyper is stepping up to the plate, placing it among the best crypto presales of the year.How Bitcoin Hyper Unlocks Bitcoin’s Full Potential

Bitcoin Hyper ($HYPER) is developing a Layer-2 solution that could finally address Bitcoin’s lack of speed and programmability – all while maintaining its proven security framework.

At the heart of the solution is a non-custodial Canonical Bridge, which helps issue a wrapped version of Bitcoin on the Layer-2 network, which can then be used across the broader Web3 ecosystem.

More importantly, it could finally bring DeFi, NFTs, micropayments, and real-world assets to the Bitcoin blockchain at near-zero transaction costs. This is made possible by the Solana Virtual Machine, which makes the network compatible with smart contracts.

In other words, Bitcoin could soon evolve into a Web3 hub, without relying on the reputation of other blockchains to drive its growth or expand its market cap.

As companies increasingly accumulate Bitcoin as a strategic reserve asset and crypto regulations become friendlier, the importance of a project like Bitcoin Hyper can’t be stressed enough.

Given this promising backdrop, our Bitcoin Hyper price prediction sees the native crypto $HYPER potentially outperforming Bitcoin in terms of annual ROI. Being much younger and having a smaller market cap, it could have considerably more room for returns.

Read our guide to buying Bitcoin Hyper for step-by-step instructions on joining one of the best crypto presales this season.$25.6M Raised: Why You Shouldn’t Miss the Presale Window

Bitcoin Hyper is now hosting the presale of $HYPER tokens, where early backers can grab it for fixed, discounted prices.

Since the token is used for transactions, staking incentives, and governance, its long-term growth is tied to both network adoption and Bitcoin’s journey ahead.For the same reason, the token is expected to take off once it hits exchanges, especially if the launch aligns with the next crypto super cycle.

While 30% of the token supply is set aside for product development, 20% is reserved for marketing. And product development is progressing steadily, instilling confidence in its future.

Whales have already begun accumulating the token for low prices in the presale, with some transactions worth $379K and $274K.

But there isn’t much time left to buy the token at its current price of $0.013215 and unlock a 46% staking APY.

The price is set to increase in just one day.

Join the $HYPER presale now.

But as always, do your own research before investing in crypto. This is not financial advice.

Authored by Bogdan Patru, Bitcoinist – https://bitcoinist.com/bitcoin-hyper-nears-26m-best-crypto-presale

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Crucial Fed Rate Cut: October Probability Surges to 94%